At more than one thousand pages, the new tax reform package has plenty of both carrots and sticks for US taxpayers. Both the short- and long-term effects of the new legislation on economic growth in the US are uncertain at this point, but changes in the tax code will undoubtedly confer both benefits and penalties on certain segments of the US economy. Until the tax accountants ferret out every new wrinkle, let’s examine the most likely impacts that the new law will have on the investment landscape in the coming years.

At more than one thousand pages, the new tax reform package has plenty of both carrots and sticks for US taxpayers. Both the short- and long-term effects of the new legislation on economic growth in the US are uncertain at this point, but changes in the tax code will undoubtedly confer both benefits and penalties on certain segments of the US economy. Until the tax accountants ferret out every new wrinkle, let’s examine the most likely impacts that the new law will have on the investment landscape in the coming years.

A Nice Boost to GDP

Our base case is that the new legislation will provide an immediate boost to US GDP in 2018 and 2019. Much of the stimulus from the new law is front-loaded: about 62% is expected in the first four years. According to JP Morgan, individual tax cuts are expected to approximate $100 billion in 2018 and $200 billion in 2019, as the effects of the change in the Alternative Minimum Tax (AMT) for individuals is realized. On a US economy of $20 trillion (and assuming about 60% of these savings are spent), we could expect a boost in US GDP of 0.3% in 2018 and 0.5% in 2019, all else equal. The reduction in the corporate tax rate from 35% to 21% should add another lift to growth, but the precise impact is uncertain since it is highly dependent on what businesses do with the savings. Should they choose to invest it in new capital equipment or raise the wages of employees, the benefits will be more meaningful to economic growth. If instead they increase share buybacks or raise dividends, the benefits will be less broad-based.

In total, the changes in the code could lift US GDP to 3% or more in 2018 and 2019. In an economy that is already experiencing solid growth, the Fed will be moving more aggressively to contain the risk of higher inflation. We expect 3 or 4 rate hikes in 2018 as the Fed moves to raise short-term interest rates to a level more consistent with history.

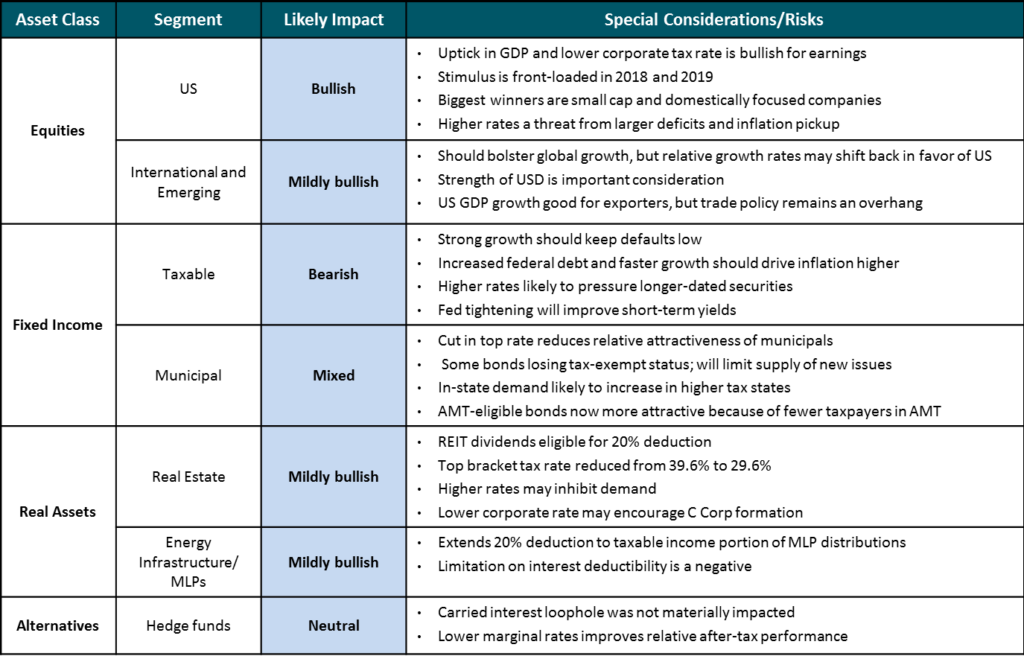

With this economic boost as a backdrop, here is a high-level summary of the likely impact of the new legislation on a diversified investment portfolio:

Equities: Looking Good for Now

Thankfully, one of the items that did not make it into the final bill was the proposal to force investors to use the first-in, first-out (FIFO) method for identifying stock sales. In an environment of rising stock prices, that approach would result in a higher tax liability for investors than being able to select the tax lot to be sold. In addition, it would have greatly inhibited the ability to harvest tax losses in taxable accounts, thus eliminating a very popular tax deferral strategy for investors.

While the impact of tax reform on specific industries is beyond the scope of this article, the new legislation will benefit certain segments more than others. Small cap stocks are likely to be relative winners, since most of their earnings are domestically derived. Sectors with the highest tax burdens (healthcare, retailers, oil and gas, and transportation stocks) are also likely to receive the biggest boost to earnings. Large tech stocks are likely to be among the losers, as a significant portion of their earnings are generated overseas, and therefore not subject to US tax.

A risk to equity prices is the prospect of higher interest rates and inflation as a result of short-term overheating of the economy. The expected addition of $1.5 trillion to the Federal debt burden is likely to put additional upward pressure on interest rates. Higher rates increase the cost of financing for individuals and businesses, and increase the attractiveness of fixed income securities relative to stocks. We view the prospect of higher interest rates as the primary risk to equity prices in 2018 and 2019.

Higher Rates: Bearish for Bonds

The prospect of higher rates is a negative for fixed income, as higher rates are inversely correlated with bond prices. But the impact on various segments of the fixed income markets will vary greatly.

The new tax law will have a direct effect on the municipal bond market in a number of ways, both positive and negative. A lower top marginal tax rate of 37% will reduce the relative attractiveness of tax-exempt bonds versus taxable bonds. The tax-exempt status of so-called “advance refunding bonds” is being eliminated. Averaging about 14% of tax-exempt issuance, municipalities issue these bonds to retire higher cost debt that is to mature in the future. The prospect of their elimination caused a flurry of new issuance in late 2017, and is likely to reduce the supply of new municipals in 2018, which should support higher prices.

Changes to the AMT rules are likely to result in far fewer taxpayers exposed to this alternative method of calculating tax. As a result, people that have avoided AMT-eligible bonds may now find them more attractive, increasing their popularity.

The new $10,000 limitation on the deduction for state and local income taxes is likely to send investors in high tax states looking for additional ways to reduce their tax bill. As a result, we expect higher demand for in-state municipals (that are generally both federal and state tax-exempt) among investors in high tax states such as Connecticut, New Jersey, New York, and California. As a result, lower demand for bonds issued by lower tax states may result in higher yields for these bonds.

Real Assets: A Mixed Bag

The impact of the new tax reform legislation is less clear for owners of real assets such as real estate, infrastructure, and energy master limited partnerships (MLPs). The new pass-through deductions are among the most intricate and complicated parts of the entire legislation, and should be carefully examined to understand the impact on specific investments.

Investors in real estate investment trusts (REITs) will likely enjoy a smaller tax bill on dividends from the new legislation. The plan allows investors to deduct 20% of the income received from their REIT holdings. Coupled with the reduction in the top marginal rate from 39.6% to 37%, a high tax bracket investor would see a reduction in their tax rate on REIT dividends to 29.6%. At the margin, this could increase demand for REITs, since top bracket investors who earn rental income outside of REITs would still be subject to a rate of 37%. At the same time, large investors may choose to own their real estate through a corporation, thereby availing themselves of the new lower 21% corporate rate.

Aside from the tax benefits, investors may be hesitant to commit new funds to REITs because of the prospect of higher future interest rates. Because of their highly leveraged structure, real estate is quite sensitive to changes in interest rates.

MLP investors already receive generous tax benefits under current law. Most of the distributions received by MLP unitholders are considered return of capital and are not taxed at the time of distribution. Instead, the capital portion of the distribution lowers the cost basis of the owner’s investment, allowing them to defer the tax liability until the units are sold. The new tax law extends the 20% deduction on pass-through entities to the taxable income portion of the MLP distribution, providing a greater benefit to unitholders, and increasing the relative attractiveness of these investments. As one of 2017’s weakest performers despite the rise in oil prices, we believe the outlook for MLPs in 2018 is bright.

Alternatives: A Mild Positive

The new tax law does little to alter the attractiveness of alternatives such as hedge funds. The much-discussed carried interest loophole, which allows hedge fund and private equity managers to apply capital gains treatment to their performance incentives, remains largely intact. Hedge fund managers thrive on volatility, so an environment ushered in by more uncertainty from the tax code could be a modest positive. Lower marginal tax rates will reduce the relative penalty for holding tax-inefficient vehicles such as hedge funds in taxable accounts, but the difference is not large enough to change investor behavior.

Bottom Line

We believe the new Tax Reform Act will be a net positive for investors in the coming year, as the reduction in individual and corporate tax rates is likely to accelerate economic growth, increase consumer spending, and boost corporate earnings. Longer term, reducing taxes without offsetting cuts in federal spending could raise the deficit, and lead to higher levels of interest rates and inflation.

Learn more about Bruce D. Simon.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited.

The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available.

Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering.

The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.