“What have you had in your entire life that I didn’t give you?” – Logan Roy

HBO’s hit drama series, Succession, and its cast dominated this awards season, taking home six Emmys, four Golden Globes, three Critics Choice Awards, and a litany of nominations. Many of these trophies will grace the homes of Kieran Culkin (Roman Roy), Sarah Snook (Shiv Roy), and Matthew Macfayden (Tom Wambsgans). I recently wrote about the estate liquidity challenges that the fictitious Roy family likely would have faced following the death of patriarch Logan Roy. While an elegant solution is available to resolve this dilemma, we have always been strong proponents of resolving problems before they occur. Rather than simply delay payment of the estate tax, what if the family was able to reduce the size of the tax bill altogether while Logan was still alive?

All estate plans, regardless of complexity, leave assets for the benefit of any of three possible recipients: (1) People (family, friends, etc.), (2) entities (typically charitable organizations), and (3) tax authorities. While not the case for all people, many prioritize transferring wealth to their loved ones or favored charities, while minimizing applicable taxes. Given Logan’s apparent contempt for politicians and government influence, I expect he would have liked to pay as little tax as possible.

Although Logan was not known for his generosity, some of his estate could be allocated to a charity like Waystar Royco’s private foundation, Roy Endowment Creative New York (RECNY). Such a bequest would provide a welcome deduction against estate taxes. Beyond an outright donation from the estate, additional liquidity could be obtained during Logan’s lifetime by way of a gift of Waystar stock to a Charitable Remainder Trust (“CRT”). During the trust’s term (typically the grantor’s lifetime), an annuity payment is made to the grantor (in this case, Logan). At the end of the term, any remaining assets would transfer to a charity (or charities) Logan designated. Upon donating the Waystar stock to the CRT, he would receive a deduction against income taxes for the present value of the remainder interest. Once in the CRT, the stock could be sold by the Trust where little, if any, applicable capital gains taxes would flow through to Logan’s income tax return over multiple years via the annuity payments. The inverse of this strategy is the Charitable Lead Trust (“CLT”), which provides similar benefits for charity and tax-efficiency, with the added benefit of wealth transfer to future generations. In both instances, these assets would be excluded from his taxable estate.

For Logan’s loved ones, we would have pursued various methods of transferring assets out of Logan’s taxable estate to trusts for their benefit. As his lifetime exemption had likely been exhausted, strategies to leverage gifts with little-to-no associated gift tax would take center stage. For instance, we would likely consider a series of Grantor Retained Annuity Trusts (“GRATs”) that would effectively transfer the appreciation on those assets to his family, while creating a negligible taxable gift. Similarly, Logan could have gifted minority interests or created Qualified Personal Residence Trusts (QPRTs) for some of the palatial estates he owned. We would just need to hope the term of the GRATs or QPRTs ended before that fateful trip to see Lukas Matsson on Connor’s wedding day, otherwise the strategies are rendered ineffective.

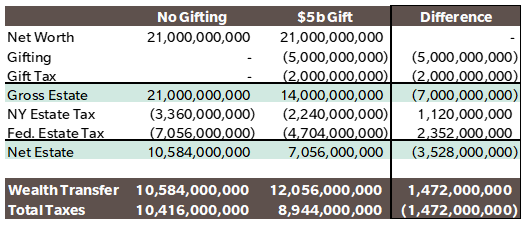

Absent these time-dependent strategies, there is still tremendous value in making taxable gifts. This would have been particularly true for Logan as the State of New York does not have a gift tax. Any assets transferred out of his taxable estate during his lifetime would escape estate tax, without incurring gift tax at the state level. [The key, however, is that Logan would have needed to live at least 3 years after he made such gifts to avoid NY estate taxes.] In addition, estate tax is “tax-inclusive,” whereas gift tax is “tax-exclusive.” In other words, the gift tax is only assessed on the assets transferred, not on the amount used to pay the tax. To illustrate this point, let’s consider the example below, whereby Logan made $5 billion in gifts during his lifetime. Though Logan would have to source $2 billion to pay Federal gift taxes, making lifetime gifts ultimately reduces his total tax bill by nearly $1.5 billion! This does not even factor in the further estate tax savings that come from moving the future appreciation of that $5 billion outside of his estate. While these figures may seem stratospheric, remove a comma and three zeroes, and the principle still applies.

All told, it is always difficult to lose a loved one, even if they were as cantankerous as Logan. The added complexities of stewarding an enterprise through a transition and sourcing liquidity to pay a large estate tax are largely preventable with the foresight, planning, and execution that comes with surrounding yourself with skilled advisors. Alleviating this burden allows the family to focus on grieving (even if some of them “pre-grieved”), which is a gift itself. As often as I wanted to shout through the television to point Logan in a different direction, I think we all know exactly what he would tell me to do …

Learn more about David J. Ferraro, Jr., CFP®, MBA here.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

This article from Ballentine Partners is intended for educational purposes only. Nothing herein should be construed as investment advice or a solicitation to invest in any security. Ballentine Partners is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. A copy of Ballentine Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.ballentinepartners.com.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.