Market Recap

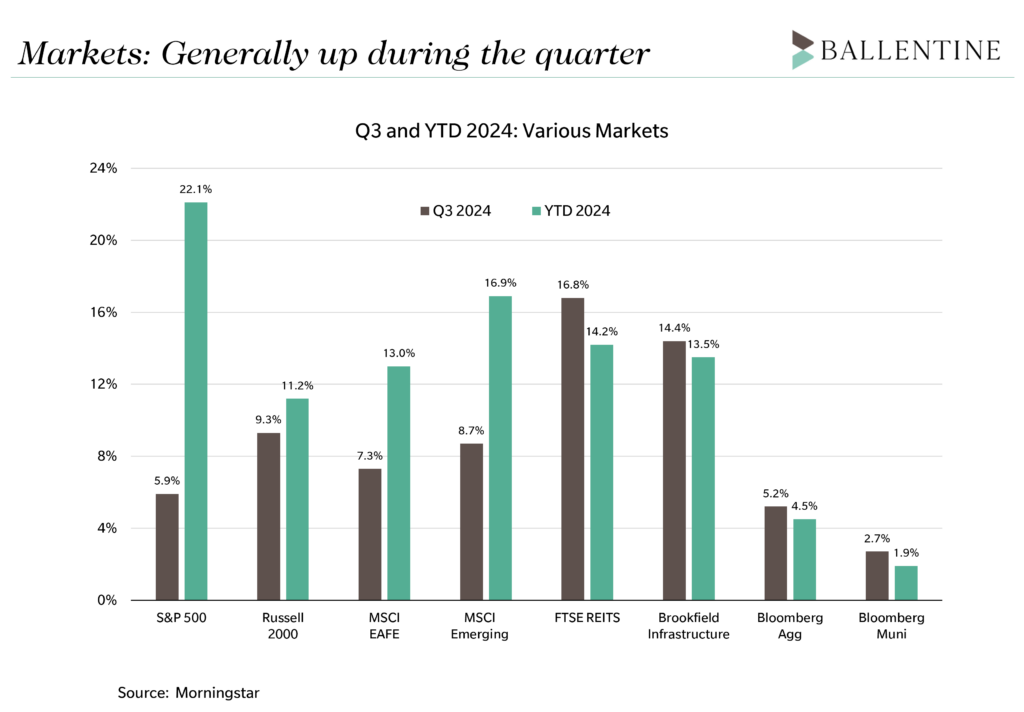

Markets enjoyed another notable rise in prices this quarter. If you went to sleep on June 30 and woke up ninety days later, you would have noticed a seemingly smooth and pleasant rise in your brokerage statements. The S&P 500 was up 5.9% while small-cap stocks performed even better, with the Russell 2000 up 9.3%. International stocks gained over 7%, and emerging markets rose 8.7%. Real estate and Infrastructure experienced a remarkable rally, with the FTSE REIT index surging almost 17% and the Dow Jones Brookfield Global Infrastructure index posting gains of 14%. The quarter also rewarded bonds as healthier yields and a small rally created gains of over 5% for the investment grade sector and gains of 2.7% for muni bonds.

These impressive returns, however, gloss over some stomach-churning air pockets encountered along the way.

- Air pocket #1: Nvidia. Much of the rise in equity markets over the past few quarters, even years, has been driven by a narrow basket of stocks, sometimes referred to as “The Magnificent 7.” One of the seven is Nvidia, the maker of processing chips underpinning the artificial intelligence revolution. Nvidia is so large that any movement of its stock price literally moves the market. In mid-July, Nvidia stock came under pressure as investors worried that the torrid pace of growth and the high P/E multiples were unsustainable. From early July to early August, Nvidia suffered a nearly 30% drawdown, bringing the market down with it. However, markets – and Nvidia – recovered almost all of the drop in the ensuing two weeks. This recovery was fueled by ongoing stories of wide-ranging AI use cases and efficiency potential, which continued to support the growth narrative.

- Air pocket #2: The labor markets. In early August, the unemployment rate rose from 4.1% to 4.3%, triggering the Sahm Rule and prompting concerns about a potential recession. Named after Claudia Sahm, a former Federal Bank official, the “rule” has historically been a reliable indicator of impending recessions. The market’s reaction was swift and severe, with the S&P 500 suffering a 10% selloff within a matter of days. However, this appeared to us to be an overreaction, as the rise in unemployment had been driven by relatively benign forces, namely temporary job losses and more workers deciding to enter the workforce (which counter-intuitively can send the unemployment rate up a notch or two). Interestingly, Ms. Salm agreed with this interpretation. She stated on various financial media outlets that the Sahm Rule was never intended to be a hard and fast “rule”, was not designed to be a predictor of recessions, and that if there were ever a period when the “rule” might not work as expected, the current economic climate would be that time. Her statements served to calm the markets, which recovered nicely in the ensuing week.

- Air pocket #3: Fed rate cut uncertainty. In early September, markets saw a 4% sell-off, driven largely by the debate surrounding the size of the Fed interest rate cut – whether it would be 0.25% or 0.50%. As sentiment built for the larger cut, the market initially interpreted this as the Fed “knowing” that the U.S. economy was deteriorating and needing additional support. The Fed ultimately did cut rates by 0.50% on September 24. The markets eventually interpreted the move positively – that the cut signaled the Fed’s view that inflation was getting closer to its target and less restrictive monetary policy was warranted. This more benign interpretation calmed the markets which consequently recovered.

Outlook and Strategy

Our confidence in the U.S. economy remains steady for now, predicated upon a few items. First, despite some modest softening in labor markets, unemployment rates remain low – maybe not 60-year lows, but low, nonetheless. And while unemployment ticked up during the quarter, it was modest and appeared to be driven by a few non-alarming factors, as discussed. There is little evidence of massive or growing layoffs. Second, wages continue to rise in real terms so despite the visible pain of higher food prices and other items, the economic balance sheets and income statements of most American households are still on solid footing (rents and housing prices for new homeowners are a different story). Forecasted earnings growth also looks healthy. Double-digit growth is expected for the S&P 500, for example, in both 2024 and 2025, an uncommon event.

The geopolitical pot of tensions continues to bubble: rising conflicts in the Middle East, the Russia-Ukraine war, and the long-simmering uncertainty surrounding China’s intentions in Taiwan and the Philippines. Any one of these has the potential to flare, potentially bringing the U.S. and its allies into a broader conflict.

From a valuation perspective, we advise caution regarding U.S. large-cap stocks, as their valuations remain elevated. However, we believe comparisons to the 2000s Tech Bubble are exaggerated. While continued volatility in the mega-cap sector is expected, we assign a low probability to a bubble-bursting scenario. Additionally, where appropriate, we have reallocated capital to small and mid-cap stocks within our equity portfolios, as these companies are trading at significant discounts to their larger counterparts. This decision was not driven by any short-term tactical insight but reflects a prudent shift toward better-priced assets that could or should experience a multi-year cycle of outperformance. The Fed’s interest rate cut in mid-September has already benefited small and mid-cap stocks. Nonetheless, this adjustment was not intended as a short-term repositioning of the portfolio. We anticipate maintaining an overweight in this sector for years to come.

Another concern for us is the condition of commercial real estate (which includes office buildings, multi-family housing, industrials, data centers, hotels, and retail). However, there are signs that the market may be stabilizing. The recent rate cut should provide some relief to the sector. Suburban and downtown office space remains incredibly weak, but we take some comfort that the public REIT markets hold less than 4% in office space exposure – a figure that may surprise many.

From a positioning standpoint, we maintain an overweight to US stocks combined with a proportional underweight to international and emerging equities. As mentioned, our U.S. equity allocation reflects a deliberate tilt toward small-cap stocks. In real assets, we have a bias towards infrastructure stocks and an underweight in real estate. We extended the duration of our bond portfolio modestly earlier in 2024, thinking that we were at or near a period of declining rates, and that has proven true. For high yield, we maintain an underweight, as it is paying you a little extra for the risk but not enough to warrant an overweight.

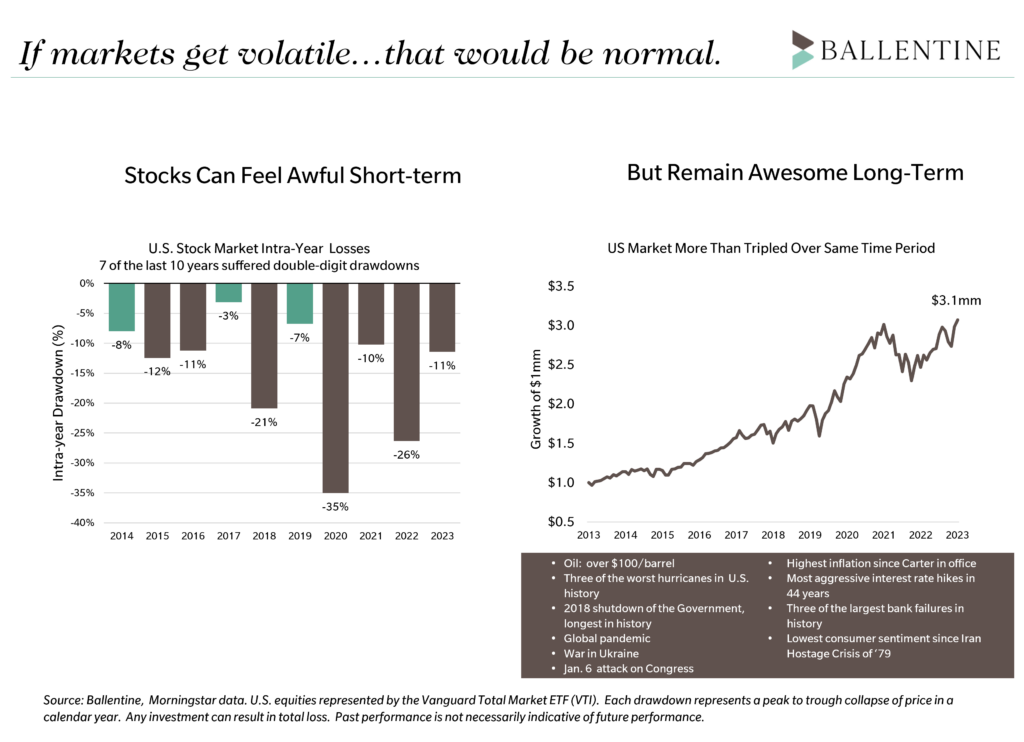

Any additional uncertainty – it is an election year, after all – could see U.S. equities experience more and deeper air pockets. While painful to experience, it would still be completely normal. See chart above. We remind our clients constantly that in seven out of the last ten years, U.S. equity markets suffered gut-wrenching double-digit drawdowns. Yet during that same ten-year period, US equity markets tripled your money! Drawdowns and corrections are not a “bug” of equity investing. They are a necessary feature. Per usual, we don’t attempt to time these movements or sidestep them but instead have a well-established game plan if the markets encounter some volatility: harvest those valuable tax offsets, rebalance as necessary, and put cash to work.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.