It matters. Just be cautious of repositioning an investment portfolio as if you know exactly how it matters.

The people have spoken.

At 5:34 AM The Associated Press declared Trump the winner of Wisconsin’s 10 electoral college votes, enough to push the former President past the 270-majority mark.

While probably not officially meeting the definition of a “landslide” victory (not that there is an official definition), the GOP wins should be called “decisive.” Reliably blue states stayed blue and reliably red states remained red. But of the seven swing states (Pennsylvania, Wisconsin, Michigan, Georgia, Arizona, Nevada, and North Carolina), Trump appears to have swept all seven. Further, Republicans gained control of The Senate and extended their control of The House.

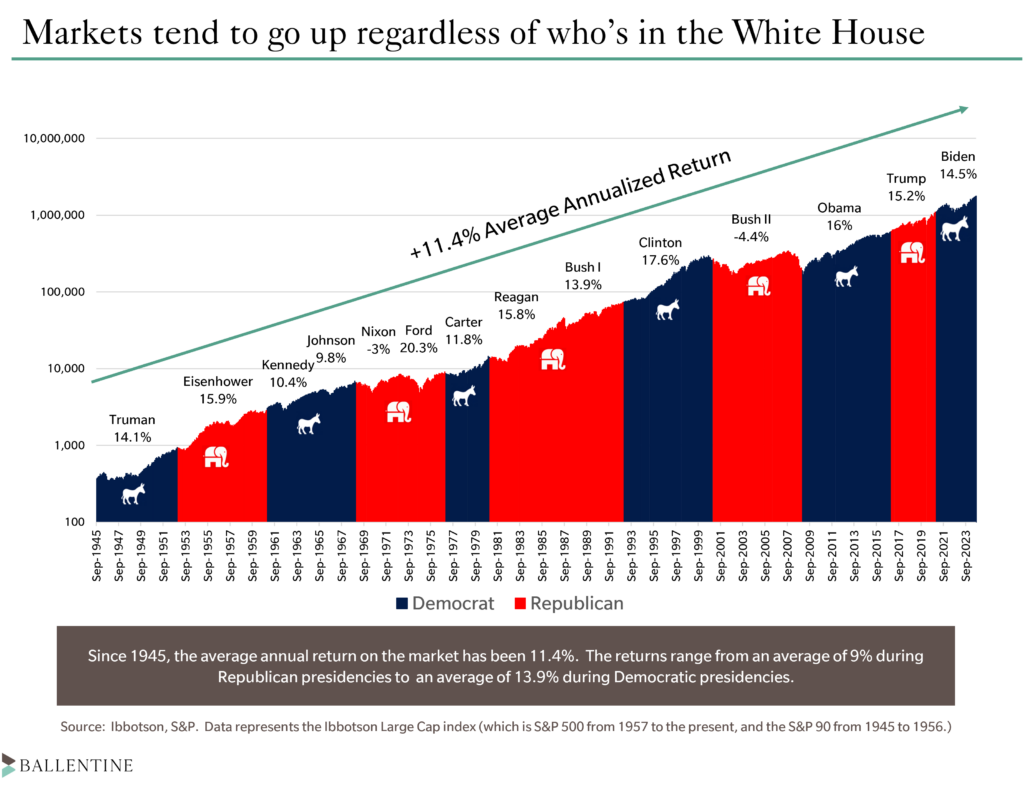

At Ballentine, we humbly believe that we cannot outsmart the electorate or even the political pundits. And while the election has many other social and policy implications, our chief role as your advisor is to study its likely impact on the markets and the economy. Our general view has been that equity markets, through history, tend to go up over time, no matter who occupies The White House. See the chart below. Since World War II, the S&P 500 has been on a solid upward trend even as the red and blue administrations take turns. On average, the stock market has outperformed during Democratic administrations as compared to Republican administrations. This might surprise many, as Republicans have historically been viewed as more corporation and investor-friendly.

This only goes to show that other forces must be at work: earnings, valuations, innovation, competitive environment, and other more fundamental drivers of stock returns. And no amount of White House policy tinkering can change that formula too dramatically.

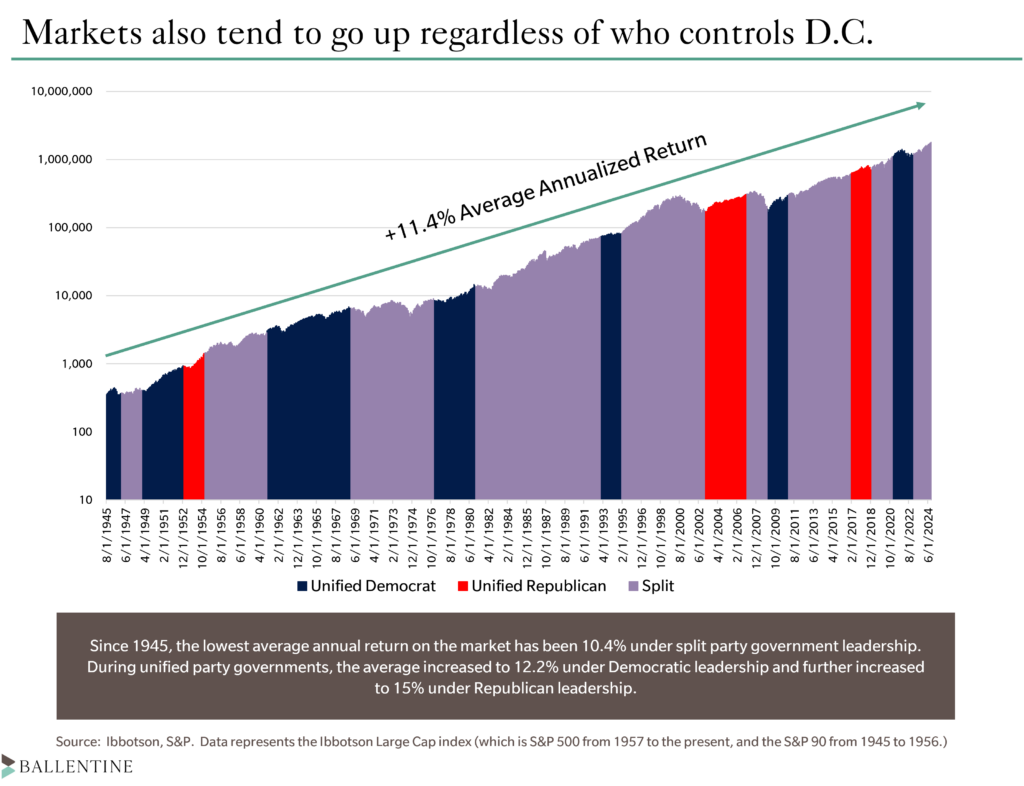

More interesting is our analysis of split vs. unified governments. See the chart below, which shows stock returns depending on whether a government was unified (a single party controlled the White House, Senate, and House) or was split. Here, the pattern is a bit more pronounced. Split governments, represented by the purple bars, have historically experienced slightly lower-than-average returns. When we see unified government – the one we are looking after today’s result – returns have been higher. Here, too, we would humbly urge caution in repositioning the portfolio or making any drastic changes as these interesting observations may be just that – interesting, but statistically insignificant and most likely driven by other driven factors.

Nevertheless, it would be silly to say that elections don’t matter. They do. Whether any of this is actionable investment information is a debatable point for a few reasons. First, we have no way of knowing how much of the GOP wins were already priced in. Second, as we discussed, so many other factors drive markets and sectors. Third, there is the inconvenient reality that historically, only 3 to 5% of bills ever become law. Many economic proposals from Trump have to run the gauntlet of getting through Congress. While the GOP controls both houses, it is fair to say that there is no unanimity even amongst the GOP on important topics. And finally, for taxable investors, any tactical shifts always have a frictional cost associated with them; as we have pointed out since the birth of our firm, Family Office and High Net Worth investors need to think differently than tax-exempt institutions. Portfolio tactical shifts, no matter how genius they may be, inevitably trigger costly capital gains taxes, eating away at that genius.

Still, it is worthwhile reviewing likely winners and losers in the equity and bond markets.

Sectors Likely to Benefit:

- Energy & Fossil Fuels: Trump has historically advocated for deregulating fossil fuels, which would benefit oil, natural gas, and coal industries. Companies focused on domestic drilling, pipelines, and fossil fuel infrastructure might see relaxed environmental restrictions and increased government support.

- Defense & Aerospace: Trump emphasized a strong military during his previous tenure, pushing for increased defense spending. Defense contractors and companies involved in aerospace manufacturing and logistics could see heightened demand from government contracts.

- Financial Services: Trump’s focus on deregulation would likely reduce regulatory burdens on financial services firms, including banks, investment managers, and private equity firms. This could make it easier for them to expand operations, reduce compliance costs, and increase profitability.

- Construction & Infrastructure: Trump has consistently supported large-scale infrastructure projects, advocating for improved highways, bridges, and even potential new border wall construction. Companies in construction, materials, and engineering might benefit from increased federal spending on these projects.

- Manufacturing & Industrials: Trump’s “America First” policy framework emphasizes reducing reliance on imports and bringing manufacturing jobs back to the U.S. This could benefit sectors like steel, auto manufacturing, and electronics assembly, particularly if additional tariffs are imposed on imports.

Sectors Likely to Be Hurt:

- Green Energy & Renewables: Renewable energy companies, particularly those in solar, wind, and electric vehicles, might suffer if subsidies, incentives, or federal support for clean energy projects are reduced or rolled back. Trump has previously expressed skepticism of climate change policies, so funding for initiatives like electric vehicle tax credits or green infrastructure might face cuts.

- Healthcare: Trump has previously sought to reduce the influence of the Affordable Care Act and change drug pricing structures. If his administration pushes for healthcare cost controls or reduced federal support for Medicaid, healthcare providers, and insurers that rely on ACA policies or Medicaid revenue could see a negative impact.

- Technology: The tech industry is not one monolithic bloc. Yet certain tech sectors could face challenges. Trump has expressed concerns about certain social media companies and has pursued regulations targeting data privacy and content moderation policies. Increased scrutiny and regulation, along with potential trade disputes involving technology imports and exports (especially with China), could impact large tech companies.

- International Trade-Dependent Sectors: Companies heavily reliant on imports or export markets, especially in retail and consumer goods will likely face challenges if Trump’s administration imposes or maintains tariffs. Although some sectors like agriculture might benefit from eased tariffs, companies dependent on inexpensive imported goods, like electronics and textiles, could see higher costs from trade wars or tariff escalations.

- Non-US equity exposure, broadly: Trump policy is likely to strengthen the U.S. dollar. This means that non-US equity returns, when translated into U.S. currency, may be weakened.

These effects would largely depend on the implementation of his policies and the overall economic environment at the time. Some sectors, especially green energy and healthcare, could be highly sensitive to regulatory and policy changes.

Bond and credit markets

Three Trump Trade policies, should they go through, would prove inflationary. First, his penchant for deficit spending and tax cuts has been estimated to add roughly $6 trillion to the current debt pile.1 Second, tariffs, despite arguments to the contrary, will likely be inflationary. It will simply be a matter of degree depending on which and how much the tariff blanket spreads. Finally, Trump’s more restrictive immigration policies, including plans for small or large deportation of immigrants, will likely remove a substantial portion of the U.S. workforce and could apply upward pressure on wages, especially given extremely low current unemployment numbers.

With that said, here are some ways that various segments of the bond market could be affected.

U.S. Treasury Bonds

- Potential for Higher Yields: Trump has historically favored increased government spending, particularly on defense, infrastructure, and tax cuts. If this fiscal expansion were to increase the federal deficit, it could put upward pressure on Treasury yields due to the larger supply of government debt and expectations of higher future inflation. Many analysts have pointed to the recent run-up in yields as the work of “bond vigilantes”, deficit hawks trying to rein in what some are calling unsustainable levels of debt.

- Interest Rate Expectations: If inflation expectations rise due to increased government spending or trade policies, the Federal Reserve might lean toward a more hawkish stance to contain inflation. This could further push up Treasury yields, especially on the long end of the curve. However, Trump’s past criticism of Fed rate hikes suggests he might advocate for lower rates, which could create some tension between the White House and the Fed.

- Yield Curve Steepening: If growth expectations rise in anticipation of fiscal stimulus and inflation, the yield curve could steepen, with long-term rates rising faster than short-term rates. A steeper yield curve generally reflects investor expectations for stronger economic growth and higher future inflation.

- Meddling in Fed Policy: Trump has hinted that he would like to bend the ear of the Fed President, perhaps even having a seat at the table in future policy decisions. This would likely not be perceived well by the bond market.

Corporate Bonds

- High-Yield (Junk Bonds): Sectors like energy, defense, and manufacturing could benefit from fiscal stimulus and deregulation, supporting high-yield bonds in these areas. However, if inflation expectations rise and interest rates increase, borrowing costs for high-yield companies could rise, potentially putting pressure on lower-rated issuers.

- Investment-Grade Bonds: Investment-grade corporate bonds might face rising yields if overall bond market yields increase. However, demand for high-quality, credit-worthy issuers may remain steady. Companies in energy, defense, and industrial sectors might have better credit fundamentals if policies favor their industries, making them potentially more attractive within the investment-grade space.

Municipal Bonds

- Higher Borrowing Costs: If the Trump administration focuses on deficit-financed spending, municipal bonds might see yields rise due to increased competition for investor capital. Additionally, if federal tax cuts were part of the policy approach, some high-tax states might face fiscal pressure, which could impact credit quality and increase borrowing costs for certain municipalities.

- Infrastructure Spending: Infrastructure-related municipal bonds could benefit if federal spending is directed to state and local projects. This could support demand for municipal bonds issued for infrastructure improvements, potentially leading to improved credit ratings or lower borrowing costs for those projects.

As of the writing of this note, U.S. equity markets are rallying strongly. And bond prices are falling (i.e., yields are rising). Some of this must surely be the market rationally pricing in the impact of future policy decisions. But it is also just as logical to think that what is happening is simply a reaction to having more certainty about the outcome of the election. Just that it is finally over. Equity markets hate lots of things – government regulatory overreach, high corporate taxes, administrative red tape, recessions, etc. – but what they hate the most is uncertainty.

[1] The Penn Wharton Budget Model, August 26, 2024. This is an estimate over the next 10 years.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.