The year 2024 is now in the history books and we are looking forward to 2025. It is always challenging to distill an entire year (or give our views on the coming one) in a few bullet points, but here we go. 2024 in three bullets, and 2025 in thirteen, a baker’s dozen. More details follow, of course.

2024: A look back.

- A very good year for U.S. stocks.

- The AI gold rush broadened out to other industries and sectors.

- A surprisingly tough year for U.S. bonds.

2025: A look ahead.

- U.S. economy will show resilient strength.

- U.S. households remain uniquely immune from the pain of higher interest rates.

- U.S. economy superior to its global peers.

- Inflation will stay frustratingly sticky and above the Fed’s 2% target.

- Maintain overweight to U.S., and within U.S., overweight small and mid-cap.

- Continue to hold a geographically diverse exposure.

- Maintain a balance between real estate and infrastructure.

- Leverage broader equity market opportunities in alternatives.

- Higher yields mean bonds are better positioned today. But uncertainty warrants a prudent approach.

- Underweight public credit.

- Expect an increase in private deal flow and exits in 2025…finally.

- Risks: Valuation risks to U.S. large-cap and inflation resuscitation risks remain.

- Risks: There will likely be a double-digit U.S. equity market drawdown during the year.

More details follow…

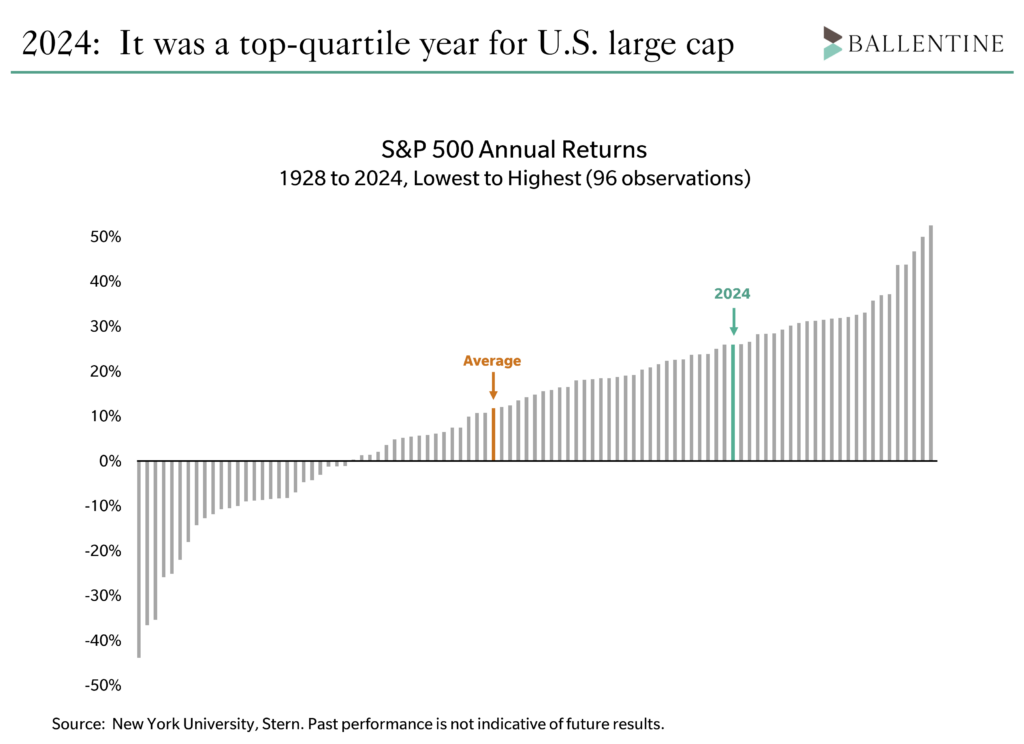

- 2024 was a very good year for U.S. large-cap stocks.

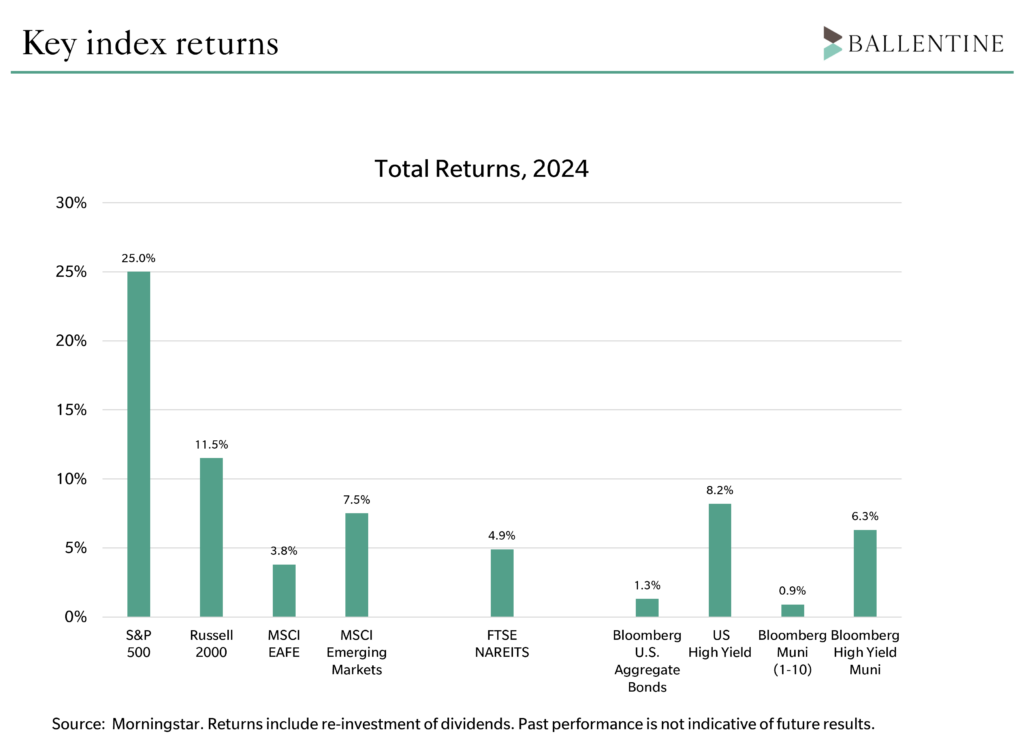

- It was another terrific year for the U.S. stock market, driven by a rock-solid economy, AI, and Fed rate cuts (and hopes of even more). The S&P 500, a large-cap index, was up 25%, impressive by historical standards. The rally was mostly driven by a narrow handful of names and themes – the Magnificent 7 and the AI gold rush– but even small-cap delivered returns approaching 12%. Non-U.S. stocks notably underperformed the U.S. with the MSCI EAFE index up only 3.8% and emerging stocks up 7.5%.

- The AI gold rush broadened out to other industries and sectors.

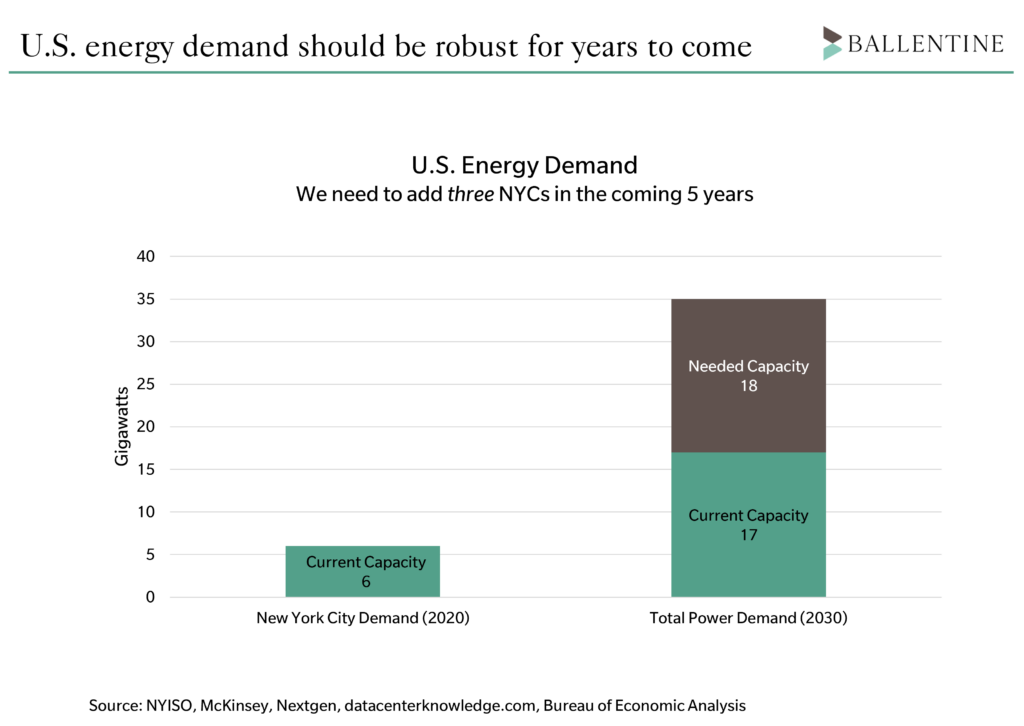

- Nvidia was a market darling, up another 180% on the year (+240% in 2023). However, AI’s influence goes beyond technology. Of the top ten performing stocks in the S&P 500, half were utilities or energy companies. The energy infrastructure demands of AI, as we’ll talk about later, are profound. Boring old utilities – and their suppliers – are having their day in the sun. Vertiv, an Ohio-based supplier of cooling equipment to utilities, is up +732% over the last two years.

- 2024 was a surprisingly tough year for U.S. bonds.

- On the other side of the ledger, it was a tough 2024 for bonds. The year began with high hopes. First, yields on longer-term bonds started 2024 hovering around 4%. Second, the Fed was expected to start cutting rates, ostensibly a catalyst for even better returns.

- Instead, we saw these long-term rates rise, not fall, throughout 2024, even as (perhaps because) the Fed did indeed start cutting. It was a painful reminder that the Fed only controls the short end of the curve. The “market”, however, controls the long end. The economy showed strength throughout the year, too strong for the inflation hawks. The November election ushered in a fear that the new administration’s policies would add to the huge debt burden and resuscitate what had been a seemingly defeated inflation monster. Long-term interest rates rose (prices went down) dramatically all through the fourth quarter of 2024, resulting in paltry returns for the entire year.

A Baker’s Dozen Thoughts on 2025:

U.S. Economy

- The U.S. economy will show resilient strength.

- We expect the U.S. economy to grow moderately, driven by consumer spending, easing financial conditions, and productivity gains from technology investments.

- Continued U.S. consumer strength is key to this scenario, bolstered by low unemployment, rising real wages, and a wealth/income effect from asset appreciation (stock market wealth and home equity wealth).

- There is stress in lower-income households, evidenced by growing delinquency on car loans and credit cards, however.

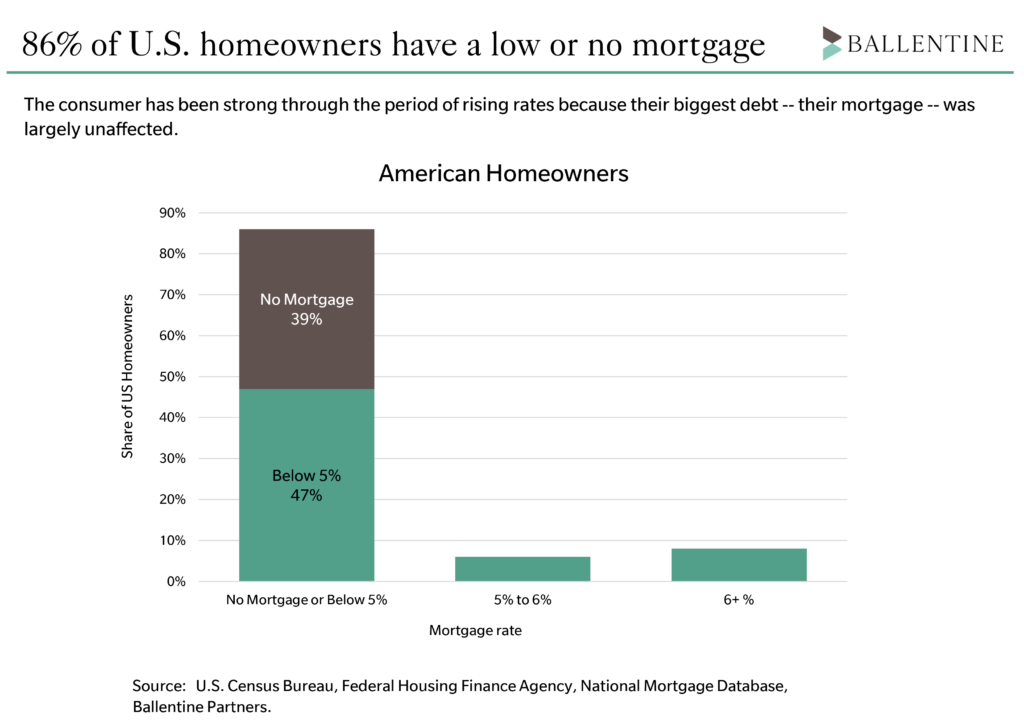

- U.S. households remain uniquely “immune” from the pain of higher interest rates.

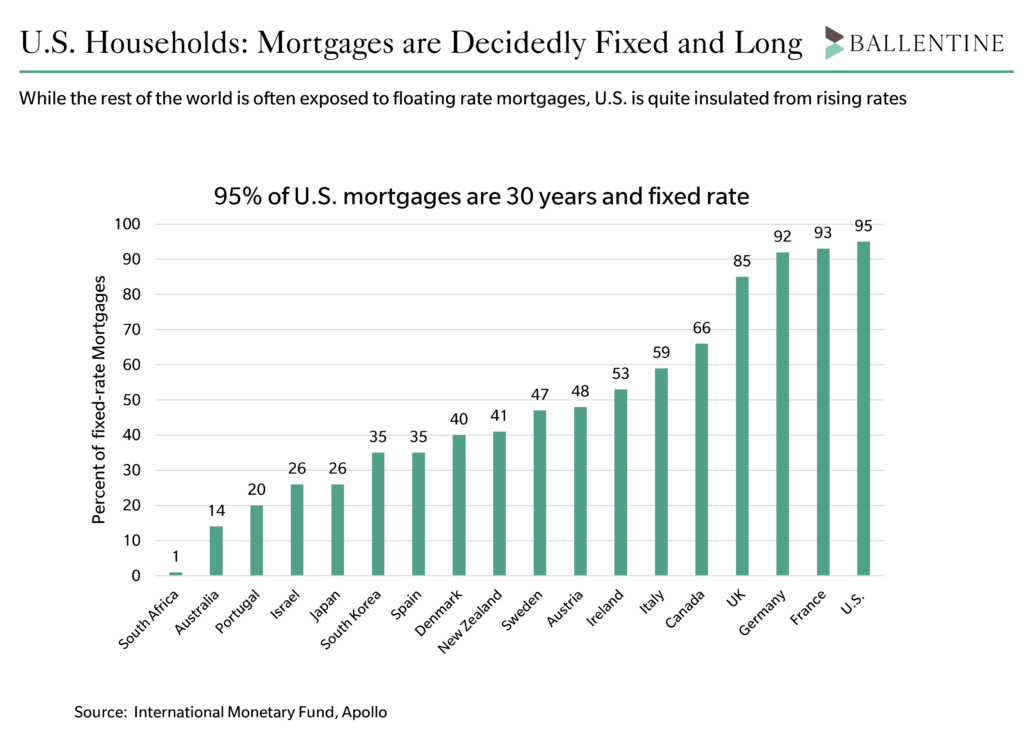

- American households generally locked in or refinanced their mortgages from 2010 to 2021, when interest rates were the lowest in American history. Today, 86% of homeowners have low or no mortgage payments.

- The U.S. mortgage market is unique, as 30-year fixed-rate mortgages are the norm. This is not nearly as true in other countries. Combined – the ability to lock in low rates for extended periods – meant that the U.S. consumer generally remains shielded from the pain of higher interest rates.

- U.S. economic picture superior to global peers.

- The U.S. economy is on solid footing. European economies, in contrast, suffer from low growth, continued sclerotic regulations, and structural economic disharmony. China and emerging markets remain vulnerable to tariff uncertainty.

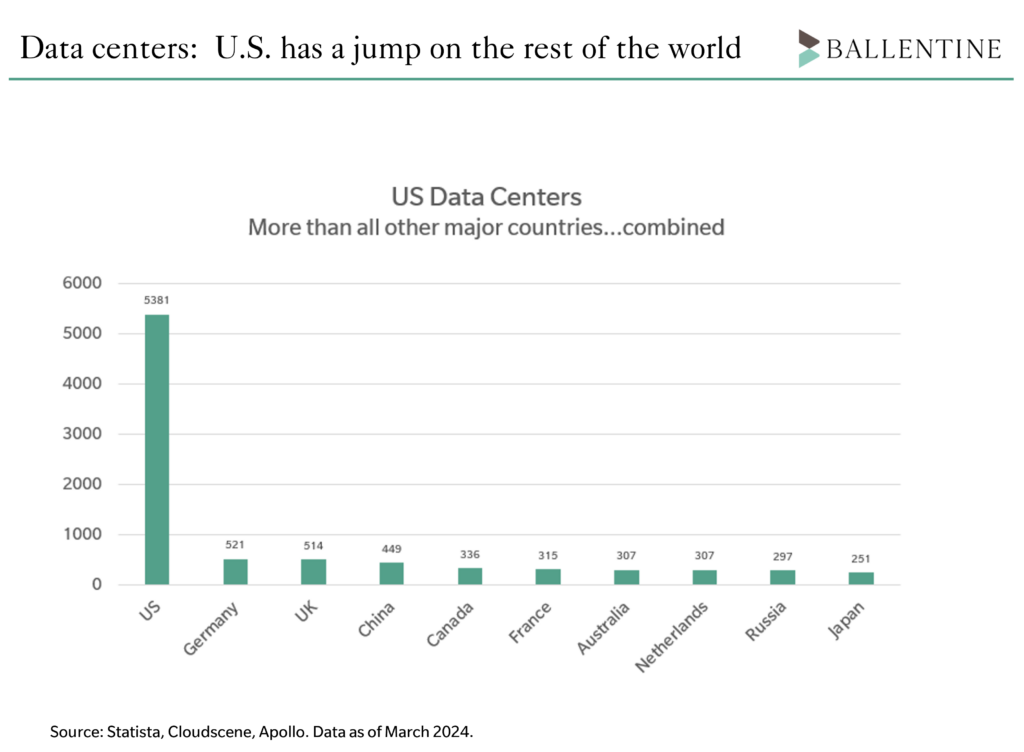

- U.S. corporate investments in AI, automation, and other innovations, dwarf other parts of the world. We are witnessing wider adoption, more niche applications, productivity gains, massive capital expenditure, and increasing monetization.

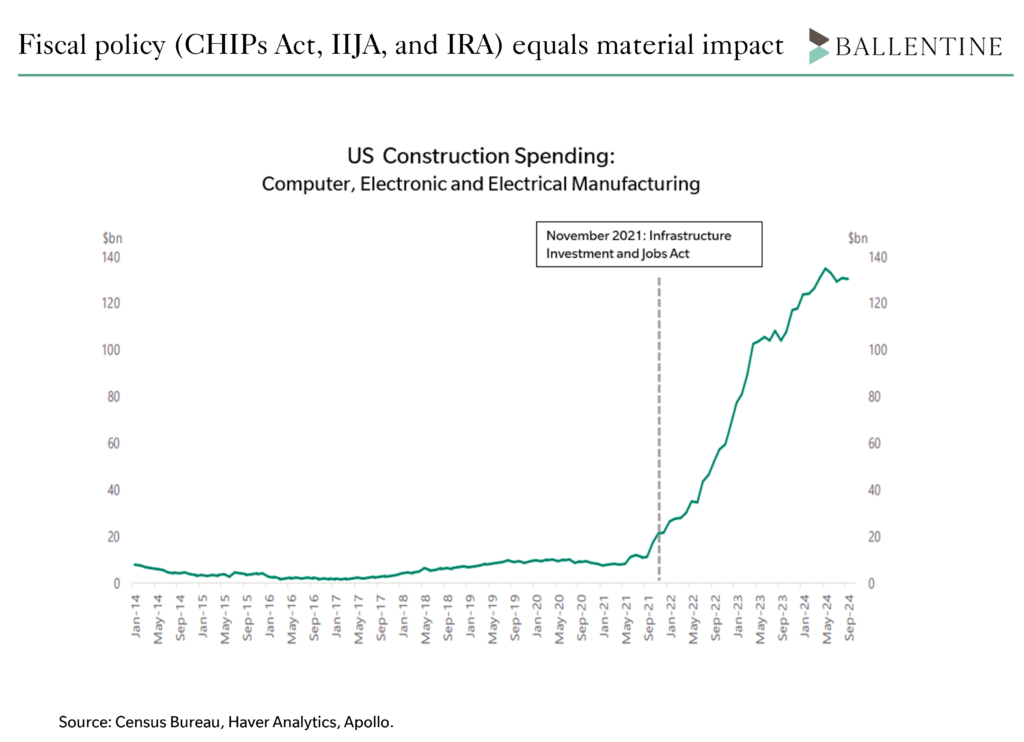

- Fiscal policy helps. Existing legislation like the Inflation Reduction Act, the Infrastructure Investment and Jobs Act, and the CHIPS Act will continue to stimulate industrial investment and innovation, particularly in manufacturing and energy. Europe and Japan have no such coordinated massive programs in place.

- Inflation to stay frustratingly sticky and above the Fed’s 2% target

- We expect only modest improvement on the inflation front due to elevated risks and policy uncertainty: tariffs, tighter immigration, and potential stimulative tax cuts.

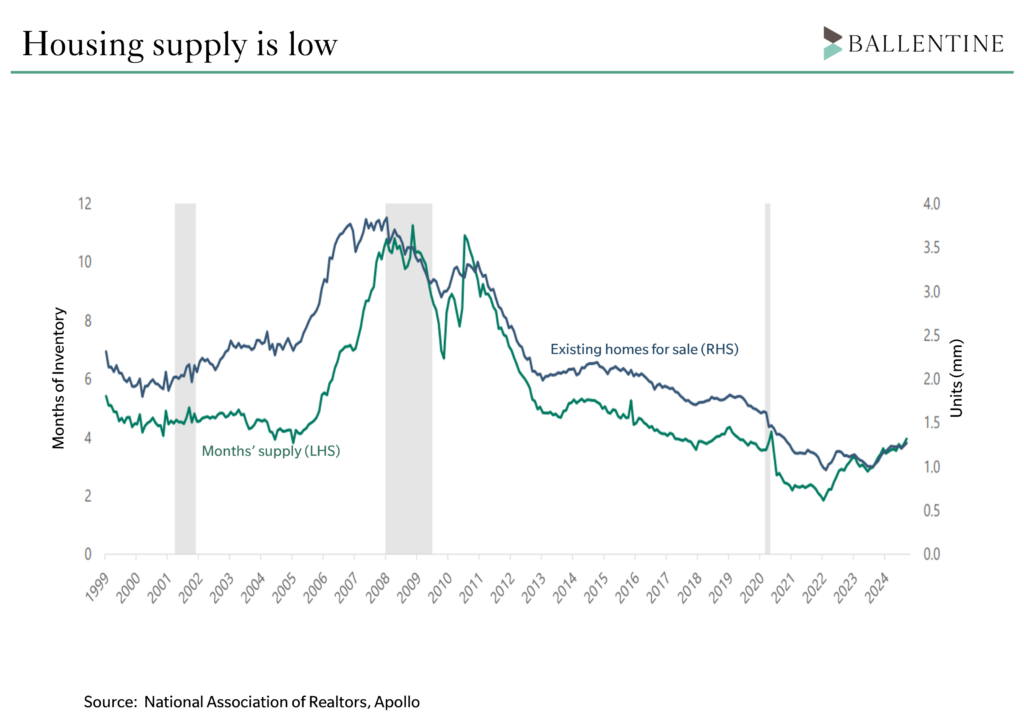

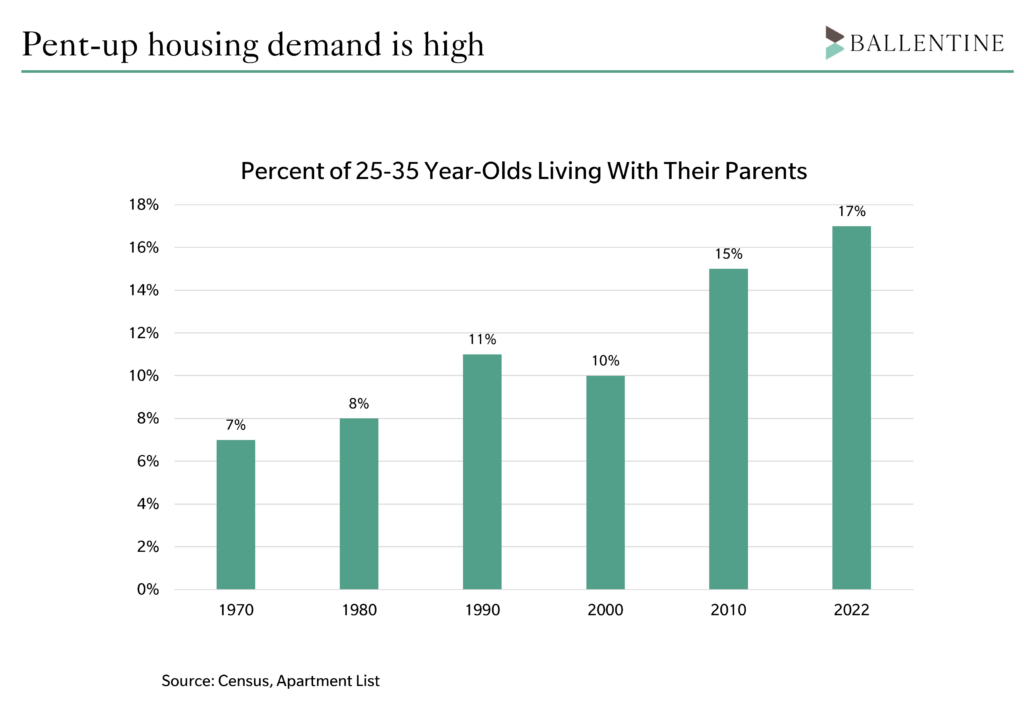

- Housing prices will drive continued stickiness. The odds of prices softening materially are low, as housing supply shortages remain, and demand will grow. There is a historic and latent pent-up demand for housing from the high concentration of young people still living with their parents.

Equity portfolio strategy

- Maintain overweight to U.S. Within US, overweight small and mid-cap (smid).

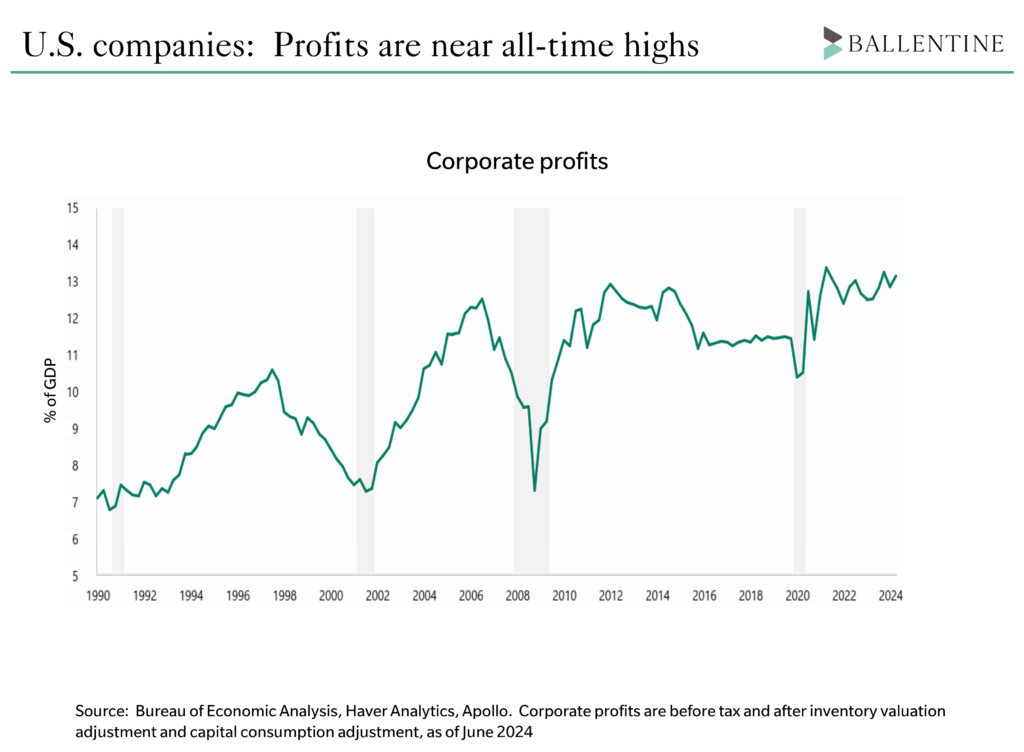

- We are cautiously optimistic, as U.S. companies are demonstrating higher earnings growth than other parts of the developed world. Favorable business conditions, a friendlier regulatory environment, and a solid economic backdrop all bode well.

- We expect multiple waves of innovation and efficiency gains from AI. Infrastructure development to support AI (e.g., data centers, robotics) should also drive productivity. This means the market should broaden beyond the mega-cap “obvious” AI names.

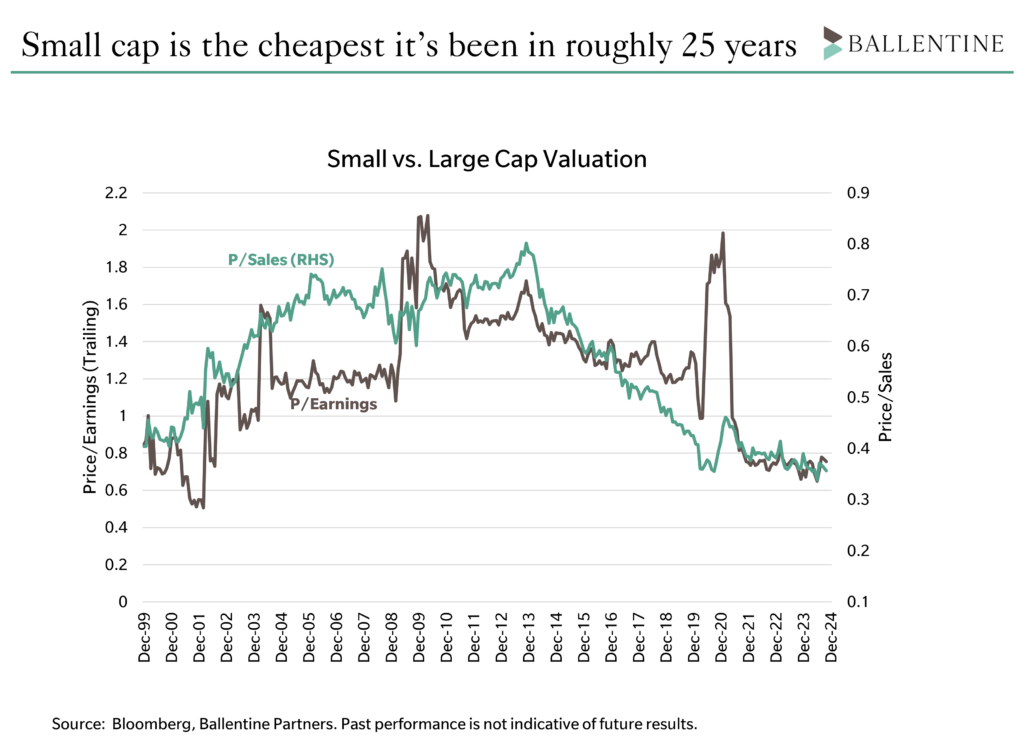

- Within the U.S., we recommend an overweight to U.S. smid-cap stocks. US large-cap valuations are high, typically a headwind for forward returns. Smid-cap stocks, in contrast, are trading at 25-year lows in relative valuations. The last time smid-caps were this relatively cheap was in the early 2000s. Small-caps went on to outperform large-caps by over 150% over the following decade.

- Proposed economic policies from the incoming Trump administration should improve the outlook for smaller companies. Tax cuts, deregulation, and a better backdrop for M&A activity should all disproportionately benefit smid-cap stocks. Smid-cap stocks performed well in 2017 and 2018 after Trump’s similar policy agenda was enacted.

- Continue to hold a geographically diverse exposure.

- Despite our bias towards the U.S., we still maintain a globally diversified portfolio. High policy uncertainty exists, as tariffs and retaliations could lead to trade wars, derailing U.S. and global momentum. These things are impossible to predict, so prudence dictates some level of diversification.

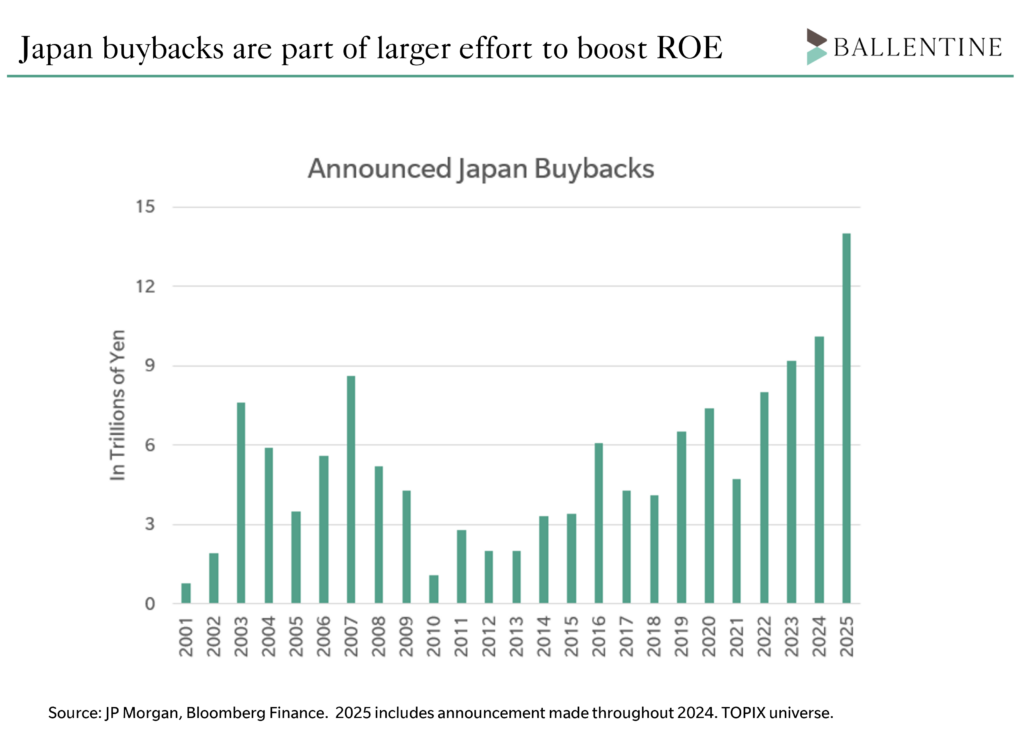

- Japanese companies continue to devote more attention to ROE metrics. The recent threat of the Tokyo Stock Exchange to delist underperforming companies has lit the fire of stock buybacks – an easy tactic to boost shareholder return. Europe will likely be lowering rates more dramatically, which could bolster stocks. With the US dollar at two-decade highs in some instances, the chances for a reversal are high, which could be a further tailwind for international stocks.

Real asset strategy

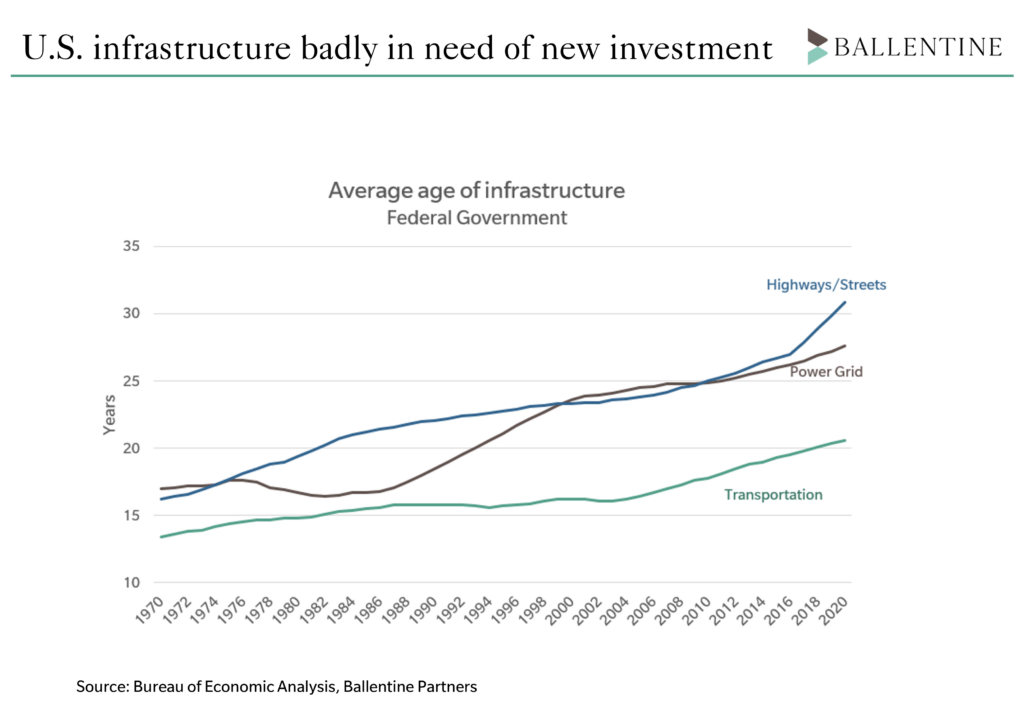

- Maintain a balance between Real Estate and Infrastructure.

- The Office Building sector is actually a small part of a typical REIT universe, making up less than 4%. While this area has been beaten up in the post-Covid work-from-home world, we believe it is starting to find a bottom. Still, office space will remain under some stress.

- Other areas of the real estate market remain attractive: seemingly endless demand for data centers, which is both a real estate and infrastructure play, and single-family housing. Onshoring, re-shoring, and continued investments from CHIPs, IIJA, and IRA translate into a robust picture going forward for industrials and logistics.

Alternatives

- Leverage broader market opportunities and policy divergence.

- Broadening of the US equity market should reward long-short managers with increased return opportunities for smid-cap names. The divergence of central banks and macro-economic conditions for various geographies creates trading opportunities for global macro managers trading currencies, interest rates, commodities, and equities. A new regulatory regime should result in increased M&A and spinouts benefitting hybrid managers with both public and private mandates.

Bonds and credit strategy

- Higher yields mean bonds are better positioned today. But uncertainty warrants a prudent approach.

- With the pain of the yield curve steepening behind us, bonds are now better positioned to do what bonds do best: provide income and provide protection in the event of a recession.

- Policy uncertainty is high, however, as the inflation picture unfolds. Maintaining an intermediate duration portfolio seems prudent today.

- Underweight public credit

- Credit performance was strong in 2024, and we remain constructive on the U.S. economy as companies have largely been able to cover the higher debt burden with strong earnings. Default rates remain low at under 1% for both high-yield bonds and leveraged loans.

- However, investors are simply not getting paid enough for risk, as credit spreads are remarkably tight by historical standards. So hold a lower-than-average amount.

Privates strategy

- We expect an increase in deal flow and exits in 2025

- We hold a somewhat optimistic view on IPOs in 2025 driven by a significant backlog, with 40% of US unicorns held in portfolios for over nine years—representing $1 trillion in value.

- Lower short-term interest rates, improved public market performance, substantial dry powder in large-cap private equity, and increased M&A activity with changes at the Federal Trade Commission all suggest a potential increase in deal flow and activity in buyouts.

- We will continue looking for opportunities in the lower end of the buyout market. Smaller buyout deals (under $1 billion) are more attractively priced and offer better risk-adjusted returns compared to larger transactions.

- The private credit market has continued to mature as a significant financing option for companies going forward. The expected increase in M&A activity should also benefit private debt markets in terms of transactions and exit activity.

Risks we think about…and try to mitigate

- Valuation and inflation resuscitation risks remain.

- As discussed, there is much to celebrate regarding AI’s further adoption, productivity gains, and monetization. But valuations on large AI-related companies may already reflect that good news. Any misstep could be severely punished. Mitigating considerations: the valuation worry is isolated largely to the U.S. large and mega-cap. The compelling valuations of U.S. smid cap, Europe, Japan, and a large chunk of the emerging markets all act as mitigants to this valuation risk.

- The U.S. economy may be confronting more “good news is bad news” inflation risk. Its very resilience is forcing the Fed to take a more hawkish approach to rates. Inflation is trending the right way, but sticky components remain sticky. Further, the new administration’s policies related to tariffs, immigration, and stimulative tax cuts could see an inflation resuscitation. Mitigating considerations: the last two years have demonstrated how corporations have masterfully blended cost-cutting, supply chain and workflow efficiencies, and the ability to pass costs onto consumers. In the end, they were able to protect and even improve profit margins. This is what equities are all about, the best long-term hedge against inflation.

- There will likely be a double-digit U.S. equity market correction during the year.

- Panic-inducing equity market declines are not a bug of the market. They are a feature. One might argue a necessary feature, as this is why the market compensates you so well in the long term: because it can frighten you dearly in the short term.

- In the past ten years, the U.S. equity market tripled your money. But it was not a straight line upwards. Far from it. In 7 of those 10 years, you would have suffered gut-wrenching double-digit drawdowns. This is the price of admission.

- Attempting to sidestep these drawdowns is a dangerous game, as we have no idea when they will happen, what will cause them, how long they last, or when to get back in. Further, getting in and out is ruinous for taxable investors, like yourselves.

- Instead, we encourage you to think differently. These drawdowns are opportunities to blow off valuation steam, re-balance, re-set more reasonable expectations, and harvest those valuable losses for tax management purposes.

Best to you and your loved ones in the coming year.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.