When stock markets suffer a painful drawdown, panic, doubt, and self-preservation instincts to de-risk often kick in. History suggests that it is wiser to stick to your original plan.

Honest Abe had sage advice for his political party in 1864, as they contemplated removing him, the incumbent, from the Republican ticket in the midst of the Civil War. He was obviously against such a move. True, his words were a bit self-serving, but the reason this aphorism has become part of the American lexicon is that it spoke more broadly to the importance of planning, strategy, and follow-through.

All plans, all strategies – political, business, investing, etc. – at some point encounter setbacks and turbulence. That is guaranteed. What is also guaranteed is that human emotion and panic kicks in at these stressful periods. Second-guessing. The cancerous creep of doubt. Cold sweats. Middle of the night heart palpitations. Fear of further loss. And, of course, the strong desire to make the pain go away.

For many investors, this has been the story of 2022 in the capital markets. The last few months have seen a rapid and painful repricing of global equity markets. Here in the U.S., as the financial press and blogosphere has pointed out ad nauseum, this has been the worst start to a calendar year since 1939 (as measured by U.S large-cap stocks). Seeing headlines like this as well as seeing one’s own accounts decline in value, can trigger all the emotions mentioned above. Forget ad nauseam. How about just plain nausea.

Many, we suppose, have been tempted to “get out” or at a minimum dramatically reduce exposure to the equity markets after suffering some uncomfortable losses. Many have been tempted to throw out the very plan and strategy that they – alone, or in consultation with an advisory team like ours – had so carefully devised. Many have been tempted to change horses mid-stream.

But is this wise? Is this prudent? And what can history tell us? Remember, despite the headlines, corrections like we are experiencing are nothing new. Also remember that the projections, modeling, and stress-testing that went into the original investment strategy did so with the full knowledge that markets can be volatile, sometimes painfully so. Since 1980, the average intra-year drawdown for a given calendar year from peak to trough was -14%. The last decade for U.S. stocks was one of the best ever, yet in 7 of those 10 calendar years, the market suffered intra-year double-digit drawdowns.

The reason we tend to forget this is that most of the time, markets find a base and then recover. Not every time, but enough times so that in the long term, equities have been a great wealth-creator. Some argue, rightfully, that the entire reason why equities offer such attractive long-term returns is because of, not despite, these drawdowns. In academic and quantitative circles, it is called the “equity risk premium”, but in plain-speak, it is the bribe the market must offer you as an enticement to take risks. Long-term returns are awe-some precisely because short-term drawdowns can be aw-ful.

History can also help us conduct a what-if analysis. What if an investor, after suffering a dramatic loss, changed horses? Now, we wanted to be somewhat realistic, in that we know most investors, certainly those working with prudent advisors, would never go from 60% equities to 0% equities. That’s a form of radical market-timing and not very common. Instead, we modeled out a more likely response to market turbulence wherein an investor changes horses by moving to 40% equities. Make no mistake: this would be a substantial move, but one that more closely aligns with actual behaviors.

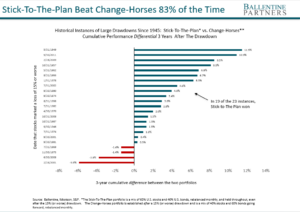

In broad strokes, then, we modeled out two investors. One “sticks” with a strategic mix of 60% U.S. stocks and 40% U.S. bonds throughout. The other investor, however, “changes horses” in the panic of a market shock and shifts to a 40%/60% mix. From 1945 onwards, we identified over 23 instances, on a month-end basis, where the U.S. stock market suffered a painful (if not normal) 15% or worse decline. This was the trigger for the shift from 60/40 to 40/60 in our analysis. We then compare the performance differential over the ensuing three years between the two portfolios. The results below speak to Mr. Lincoln’s sage advice.

Take a look at the first example on the chart, the top blue line, when the market suffered a large loss in the period ending May 31, 1949. After that drawdown, we tracked the 3-year difference in performance between the Stick-To-The-Plan portfolio and the Change-Horses. The Stick-To-The-Plan outperformed by 11.5%. As you see, in 19 historical examples, or 83% of the time, sticking to the plan would have resulted in better outcomes. Frankly, this analysis understates the results, as we have not even considered the effects of taxes. If the investor had embedded capital gains, making large de-risking moves can trigger taxes on those gains, payable that year. Market downturns are the exact wrong time to create negative cash flows, as it compounds the pain. The main point is that history has shown that sticking to the plan tends to result in better results in the longer term.

But does Mr. Lincoln’s advice mean “do absolutely nothing”? Absolutely not. In fact, Lincoln, himself, made many changes during the War, firing Generals and promoting new ones throughout. And as a contemporary poet/philosopher Ralph Waldo Emerson famously reminded us above, we must remain open to making changes, at times. How to reconcile these seemingly opposing thoughts? Easy. We must stick to the plan but remain flexible and opportunistic within those plans.

Investing is no different. We here at Ballentine have been making small shifts throughout 2022. This is not a change in strategy or changing horses, it is a case of making reasonable and modest trades, cognizant of the end goals. Past trades in the last few months have included a modest trim of our U.S. overweight to add to our European equity position, which was trading at an extremely attractive valuation discount, relative to its history. We added a modest new position to high yield municipal bonds to take advantage of their now higher yields and the much higher tax-equivalent yields of muni bonds today, more broadly. As for taxes and our focus on after-tax returns, we have judiciously taken advantage of the recent downturn to harvest tax losses for our clients where they exist, importantly replacing the equity exposure, not reducing it (i.e., keeping the strategy intact, but tweaking the tactics). More trades are possible as we navigate these turbulent streams.

Time will tell whether these modest adjustments play out well. Further, the overall strategy itself may still suffer additional losses as 2022 and beyond unfolds. The study above certainly includes episodes with horrific losses beyond those initial drawdowns. The point is that sticking with a strategic mix of diversified assets, supplemented with modest shifts as opportunities or risks present themselves, is not borne out of a foolish and stubborn consistency; it is a prudent manner of portfolio management, borne of patience, long-horizon thinking, tax awareness, and frankly, humble acknowledgement that massive, horse-changing deviations from the plan are not only difficult to time, but usually ill-advised.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.