There were many reasons to watch the US Open tennis tournament, which ended this past weekend.

First and foremost, it was your last chance to watch one of the greatest athletes ever compete in her farewell tournament. Tennis legend Serena Williams was playing her last few sets after 30 years in the spotlight (she has won the tournament six times in her career).

Another good reason to watch was US player Frances Tiafoe, as he tried to be the first American to win the men’s trophy in nearly 20 years. He is also the only Black American man to reach the semi-finals since Arthur Ashe, doing it on the court bearing Ashe’s name.

There was another seemingly obscure reason, however, to be watching the US Open, related to any interest you might have in the stock market, bond markets, currency markets, or more broadly, a key question that many of us in the investment management field are spending a lot of time thinking about -the rate of inflation.

Bear with me. More on how the US Open figures into inflation-thinking in a moment.

We all know the Fed and central banks around the world are fighting a pernicious bout of inflation, the worst we’ve seen in over 40 years, on American soil, at least. Rising rent and home prices, food, and gasoline are weighing heavily on the minds of average citizens, politicians, and importantly, central bankers. Economists and policymakers have expressed grave concern about a possible “wage-price spiral .”As the quote from the Wall Street Journal above indicates, a wage-price spiral is when wages and prices get “trapped” in a dance that spirals out of control. The theory goes something like this: employees and labor unions, in particular, see costs rising and therefore demand contractual and regular pay increases; management passes those costs along, raising prices further, which triggers contractual obligations to raise wages further. The cycle continues, like a nuclear chain-reaction.

It’s not just a theory, however. Many point to the US inflation spike in the 1970s as a real historical example, while others often point to episodes in some developed economies in Europe. Inflation is never driven by a single force, of course, but the ‘70s bout of inflation was undoubtedly tied to or exacerbated by union contracts. [This statement is not meant as a criticism, as labor was simply trying to protect its economic interests.]

Many economists and pundits are drawing fear-mongering parallels to the 1970s. Nobody wants to see a wage-price spiral, yet chatter that we are in one has already begun.

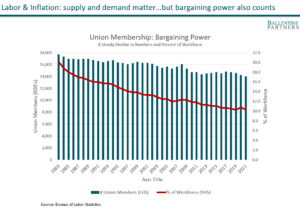

We at Ballentine think this fear is misplaced. While we, of course, fully acknowledge the dramatic rise that started last summer, we have every reason to believe that wages will not spiral out of control, as labor costs are not solely a function of supply and demand. The negotiating power of labor is also part of the equation. And on that front, the evidence is clear — labor has been losing power over the decades in a structural, not cyclical manner.

Please look at the historical charts below. The first chart goes back to the early 1980s and tracks union membership. On both an absolute basis and as a percentage of the US workforce, the story of unions’ dwindling negotiating power is well documented. While labor movements at Amazon and Starbucks in the past year made the headlines, their efforts were the exception that proved the rule.

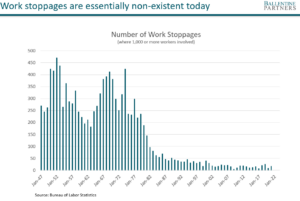

Further, labor’s ability to exact economic “pain” on management as a bargaining tool has also diminished through time. See the chart below which shows the frequency of large work stoppages, or “strikes”, over the last 70 years. As you can see, strikes were a staple of the 60s and 70s — they still happen, but today they are so infrequent as to rarely make the news. In the past few years, employees at large companies such as John Deere, Kellogg’s, Kaiser Permanente have either struck or threatened to. And as I write this note, UPS drivers are contemplating a strike — their first in 25 years — but it is notable if for no other reason than strikes are so uncommon today.

Further, much of the pressure on wages has come from COVID’s effect of driving people out of the workforce (for a host of reasons). Today, we are seeing those workers return, with a notable pickup in the US labor participation rate. People are returning to work for many reasons: COVID infection fears are shrinking, households seek income due to higher food and gas costs, and finally, the higher wages themselves are drawing people back. In other words, the markets are doing what markets do: they adjust, adapt, and find new equilibria.

And finally, the reason to believe that a wage-price spiral is likely not in the cards is the overwhelming power of innovation, productivity enhancements, and the technological revolution.

Which brings us to the US Open.

Now, there are countless examples in our everyday lives where technology has changed work patterns. We make our own travel reservations. We often chat with non-human customer service bots. Robots assemble large pieces of the cars we drive. Again, the list is endless.

But I was struck by something in particular when watching the US Open these past few days. I thought the courts looked less “crowded”. It turns out that back in 2020 and 2021, due primarily to COVID restrictions, the US Open began experimenting with some new camera-optical technology to supplement the human line judges. It’s called Hawkeye-Live, an elaborate set of 12 cameras and computers, each focused on distinct sections of the court. Back then, it was not meant to replace the tennis line judges, just to be there in case of disputes. Well… it turns out that the accuracy of the Hawkeye-Live calls approached 99.9%, while human accuracy hovered around 75%. The US Open, this year, decided to replace all the human line judges with Hawkeye-Live. When the cameras detect that the tennis ball is out of bounds, a pre-recorded human voice automatically yells, “out”. Same with “faults” or “lets”. Nobody in the audience is the wiser.

See the two photos below of Serena Williams firing a serve to her opponent. In the 2020 photo, do you see the two line judges? Now look at the photo of Serena in 2022. See what’s missing? No more line judges. In fact, over 250 jobs have been eliminated. Wimbledon — which employs 300 line judges — is also experimenting with the technology.

What does this have to do with inflation, labor negotiating power, and wage-price spirals? Lots. It turns out that line-judging is a very specialized skill set. Line judges are not necessarily locals. Often, they are flown in from all over the world, put up in nice hotels, fed, and paid well during the two-week tournament. All those costs have been rising — airfare, hotels, food, and wages. Cost reduction may not have been the primary motivation, but the reality is that businesses will always and have always been looking for ways to reduce costs and/or increase efficiency. It is how companies and economies function. “Necessity is the mother of invention” is really just another catch-phrase for competitive capitalism. Inflation costs are today’s mother of invention.

None of us here at Ballentine officially practice the “dark art” of economic forecasting. But drawing parallels to the wage-price spirals of the 1970s seem, to us at least, a bridge too far. The decimated negotiating power of unions, ever-present technological innovation, and the harsh “need” to drive costs down in the face of 40-year highs in inflation rates, make a repeat of the 1970s-style inflation wage-price spirals quite unlikely.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.