During the very difficult economic and market environment of 2022, we’ve maintained the view that a recession in the United States, should it occur, would likely be shallow. Our thinking was supported by a strong labor market, continued growth in corporate earnings, and the solid balance sheets of consumers, businesses, and municipalities. While we recognized that asset prices could be threatened by the Fed’s plan to raise the cost of money, we believed that the US economy was on sound enough footing to avoid a serious downturn. Our views haven’t changed: we continue to view that as the most likely outcome.

What has changed is a notable upsurge in geopolitical tensions around the world. From Ukraine to China to North Korea and Iran, we observe a growing number of hot spots that are threatening the stability of the world order. While we assign a low probability to any one these situations escalating into a global conflict, taken together they represent a fundamental risk to our outlook. So it makes sense to review past experiences with serious global conflicts to determine how markets have responded, both leading up to the crises and in their aftermaths.

The most urgent threat appears to be Russian President Vladimir Putin’s increasingly aggressive statements regarding the use of a nuclear device in its war with Ukraine. Faced with devastating losses on the ground and unified opposition from western allies of Ukraine, Putin is searching for ways to turn the tide of public sentiment in his favor. Absent the presence of a face-saving exit from Ukraine, many analysts believe that an escalation in the conflict is the most likely path for him. More recently, support from India and China seems to be wavering, which may help turn the temperature down a bit.

In China, the long-awaited Chinese Communist Party Congress recently concluded with President Xi extending his term for at least an additional five years and consolidating his grip on power. Markets were unnerved by Xi’s stacking the influential Politburo Standing Committee with party loyalists, thereby muffling or silencing those voices willing to present him with conflicting viewpoints. In addition to highlighting a growing geopolitical confrontation with the West, Xi has made no secret of his intention to reunite Taiwan with mainland China at some point, even if it is by force.

In the past week, North Korea launched more than 85 missiles and conducted air force drills involving 500 fighters to demonstrate their resolve and unhappiness with a series of joint military exercises involving the United States and South Korea. The missile launches were more than in any previous year and included the testing of a new intercontinental ballistic missile. North Korean President Kim Jong-un has spoken in increasingly belligerent terms about the threat from the United States and his willingness to use nuclear weapons if provoked.

In Iran, demonstrations have continued for more than 50 days after a young woman died in custody after her arrest for an alleged breach of the country’s dress code for women, the most significant uprising in Iran since the revolution in 1979. The protests have been met with a firm crackdown on the protesters by Iran’s powerful paramilitary Revolutionary Guard, but so far have continued unabated. Iran has blamed the demonstrations on the United States’ efforts to foment instability in the country and have supported Russia with arms in its war with Ukraine. To distract attention from their current internal strife, Iran could choose to lash out at one of their sworn enemies such as Saudi Arabia.

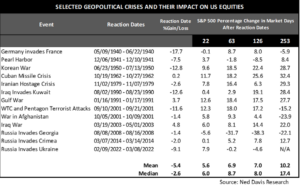

How have markets responded in the past when faced with a significant geopolitical crisis? The table below is a compendium of selected past geopolitical crises that involved war, a hostile invasion, or brinkmanship between two countries that nearly led to war.

It may be surprising to learn how subdued the equity market’s reaction was when these crises erupted. Although Germany’s invasion of France in 1940, the start of the Korean War, and the September 11, 2001, attacks on the World Trade Center were met with painful initial declines, the market’s response to other significant crises were less severe. One possible explanation may be that these events were telegraphed well in advance, allowing time for investors to take preemptive measures. It is also important to reflect on other events that were happening concurrently that may have impacted investor behavior. For example, the attack on the World Trade Center in 2001 occurred in the midst a US recession.

What may be more surprising is how quickly the equity market recovered. In virtually every case, the S&P 500 was higher in the 22-, 63-, 126-, and 253-day periods after the initial event (essentially corresponding to 1-, 3-, 6-, and 12-months following). As shown in the table, the mean return of the S&P 500 approximately one year after the initial crisis was 10.7%, with many posting 20+% recoveries.

Are we really at risk of global nuclear war? We don’t think so. There are checks and balances in place, and the response from other countries should act as an effective deterrent to any country or autocrat seriously contemplating such a move. But is important to not be complacent about the growing threats.

In the event of a serious escalation from any of the hot spots discussed above, we recommend having adequate reserves on hand to move quickly to take advantage of the panic selling that sometimes occurs. That means holding US government bonds, high quality investment grade municipal bonds, and some cash in reserve. As Sun tzu noted 2500 years ago in his seminal work The Art of War, “In the midst of chaos, there is also opportunity”. A potent reminder even today.

About Bruce D. Simon, CFA, CPWA®

Bruce is a Partner and the Director of Research at the firm. In addition to working directly with a number of family clients, Bruce serves on Ballentine’s Investment Committee, which is responsible for the oversight of all of the investment activities for the firm.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.