Executive Summary

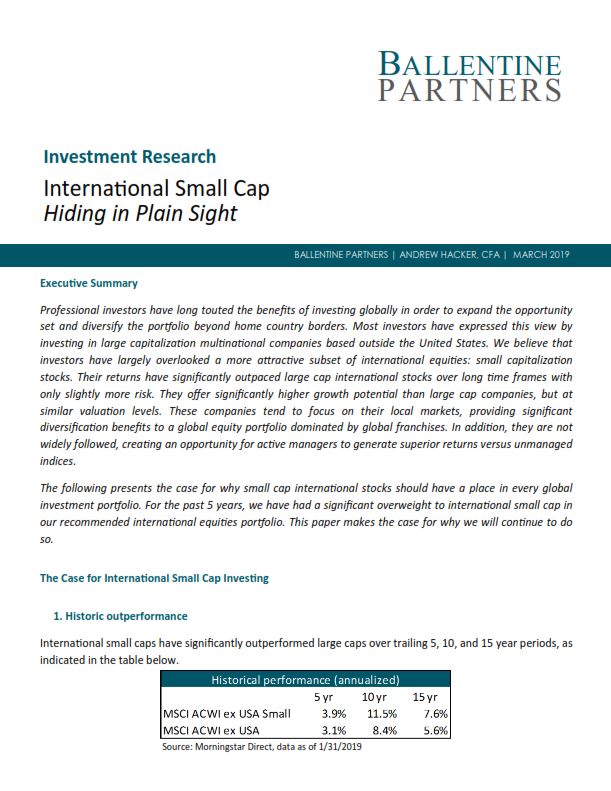

Professional investors have long touted the benefits of investing globally in order to expand the opportunity set and diversify the portfolio beyond home country borders. Most investors have expressed this view by investing in large capitalization multinational companies based outside the United States. We believe that investors have largely overlooked a more attractive subset of international equities: small capitalization stocks. Their returns have significantly outpaced large cap international stocks over long time frames with only slightly more risk. They offer significantly higher growth potential than large cap companies, but at similar valuation levels. These companies tend to focus on their local markets, providing significant diversification benefits to a global equity portfolio dominated by global franchises. In addition, they are not widely followed, creating an opportunity for active managers to generate superior returns versus unmanaged indices.

The following presents the case for why small cap international stocks should have a place in every global investment portfolio. For the past 5 years, we have had a significant overweight to international small cap in our recommended international equities portfolio. This paper makes the case for why we will continue to do so.