Market participants are hyper-focused on looking for clues as to whether the Federal Reserve will be able to orchestrate either a “soft landing” or “no landing” for the economy. The credit markets may have just given a clue.

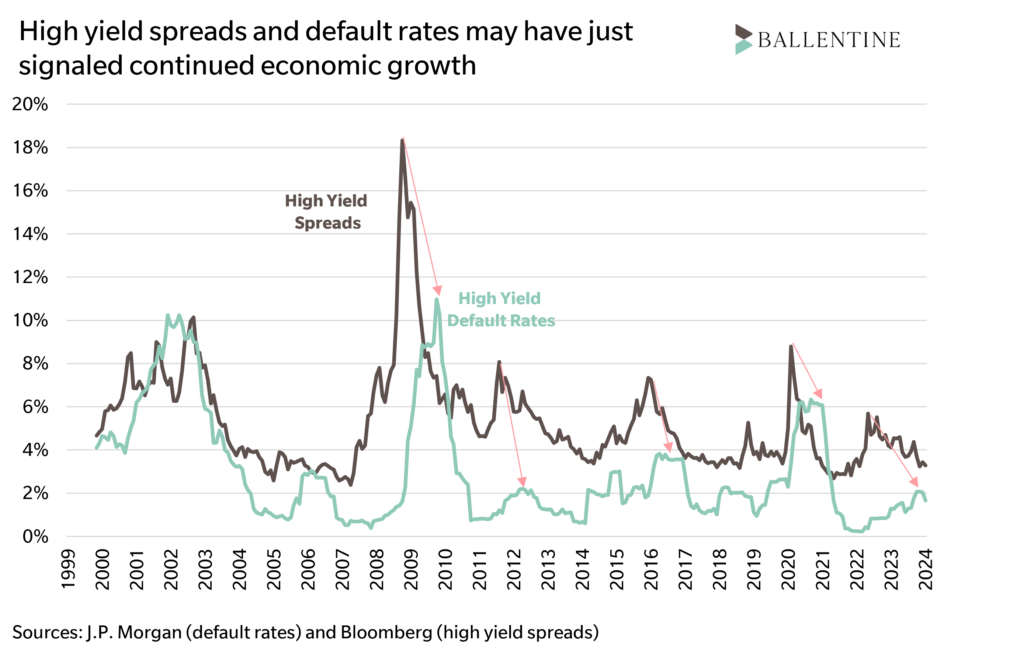

One typical metric looked at as a forecast for the economy is the spread in the US high-yield corporate bond market (calculated as the difference in the yield of high-yield corporate bonds and the yield on US Treasuries). If this difference is small (or tight), fixed income investors are sanguine about the outlook for the economy. When spreads are wide, investors expect the economy to deteriorate and defaults to rise. There is often a strong relationship between spread widening and an increase in defaults, and the pattern has been for spreads to peak before the default rate. This relationship has played out in history as seen in the following chart.

In the current cycle, spreads last peaked at 5.5% in September 2022 and have been on a downward trend since. Correspondingly, default rates peaked at 2.1% in December 2023 and have fallen in January and February of 2024. The relationship between spreads and defaults has followed the typical pattern in this recent cycle.

So what does this mean for the future? If spreads and defaults have peaked, this is good news. It implies the Fed has executed a “no-landing”. We must be vigilant for false peaks – they do occur. But since the Fed completed their historic rate increase, Ballentine Partners’ base case has been benign, and any chance of a recession is likely to be short and shallow. This has been the experience so far with low unemployment, rising real wages, and the fact that the vast majority of U.S. households are actually shielded from higher mortgage rates (80% of mortgages are locked in below 5%, while 40% of homeowners are mortgage-free). Per usual, we are closely monitoring lots of indicators such as corporate interest coverage ratios, upgrade/downgrade patterns, and even more broad-based indicators (such as the disappointing GDP print for Q1) for signs of a deteriorating economy, but the high-yield spreads and default rate relationship may have just signaled continued prosperity.

Read the PDF of this article here.

About Michael Chimento, CFA, Principal & Senior Investment Director

Michael is a Senior Investment Director and Principal at the firm. He is solely responsible for the investment outlook and manager due diligence within fixed income and other yield-oriented strategies while maintaining some research responsibilities within private equity. Michael also oversees the day-to-day activities of the research analysts. In addition, Michael manages the investment responsibilities related to certain client relationships.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.