Important Note: Ballentine Partners takes no position on the health and societal effects of the use of cannabis. Our goal in this paper is to analyze the investment opportunity and risks in this growing industry. We recognize that some clients have strong opinions on this subject, and our goal is neither to endorse nor reject the use of cannabis for either medical or recreational usage.

Executive Summary

Recent legislation and changing public opinion has led to the birth of an exciting, fast-growth new industry: cannabis. The Wall Street Journal conservatively estimates that US sales of cannabis-related products are expected to exceed $50 billion by 2025, about two-thirds the size of today’s US liquor market. Companies eager to capitalize on the trend toward legalization are moving quickly to establish a toehold in an industry that is expected to generate explosive growth in coming years.

At the same time, investors considering ways to participate in this growth are faced with a unique set of challenges. Despite recent liberalization of cannabis laws, marijuana sale and distribution remains illegal at the federal level in the US. Unless changed, the legal and regulatory minefield that must be navigated to establish a successful cannabis business will continue to hamper industry growth.

This paper outlines the key investment issues in deciding whether, and how, to make an investment in the cannabis industry. Our bottom line: we expect that the legal cannabis industry will grow substantially in the U.S. over the coming years. We are on the lookout for managers that offer a compelling perspective on the industry, and those that will benefit if the legal and regulatory landscape shifts in their favor. At this point, however, we are concerned that the risks facing the industry, coupled with extreme valuations in publicly traded companies, are combining to create a poor investment environment.

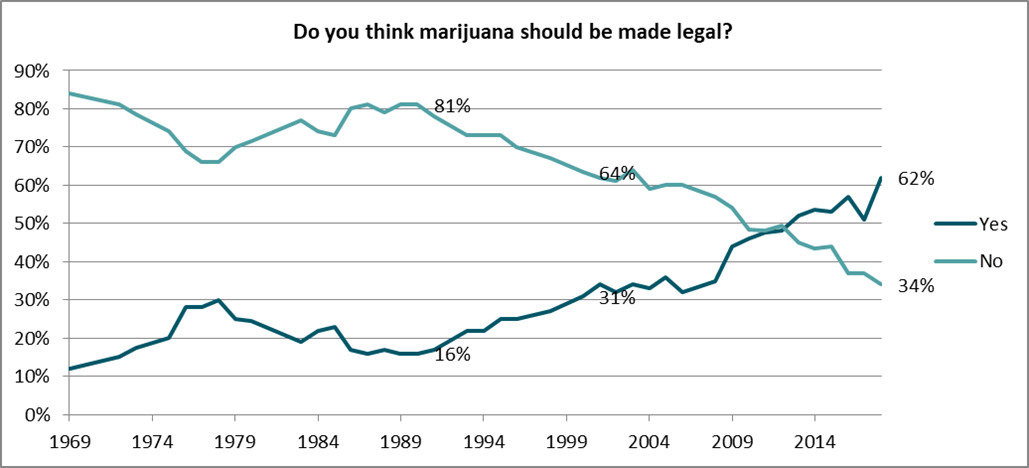

Source: Pew Research

Birth of an Industry

The cannabis industry is in the midst of a dramatic change. Public opinion in the U.S. has been shifting in favor of legalization since the late 1980s, and the trend has accelerated over the past decade. A 2018 Pew Research Center survey shows 62% of American adults favor legalization, double the percentage since 2000, and over triple the figure from 1990, when only 16% of U.S. adults favored legalization. This change in public opinion is leading to new laws, which are setting the groundwork for a thriving industry.

As of June 2019, 11 U.S. states and Washington, DC have fully legalized the recreational sale and use of marijuana. Medicinal use is legal in 33 states. The availability of legal cannabis is expected to grow in the coming years, as public opinion continues to shift, and ballot measures that seek to change its legal status are advanced in more states. Lawmakers across the country are reviewing the impact that legalization has had on early-adopter states such as Colorado, where recreational cannabis has been legal since 2014. Data is mixed on the impact that legalization has had on public health there, but one certainty is that it has generated significant tax revenue for the state. Sales tax on cannabis products has generated over $1 billion for Colorado since 20141.

The dynamics of the industry are unlike any other in recent memory. In many ways it is a nascent industry, but its primary product has been used for millennia. In the U.S., 24% of 18-29 year olds use it regularly, according to a 2018 Gallup poll2. There will undoubtedly be companies and investors that capture significant profit as the legal market opens up3. There is an entire industry and supply chain that is developing that will present opportunities for investment.

Current Industry Dynamics

The cannabis business can be decomposed into four main industry segments:

- Recreational: primarily made up of products that contain THC, the chemical compound that gets users “high”.

- Neutraceutical: primarily refers to over-the-counter health and wellness products containing CBD (cannabidiol, the second most prevalent of the active ingredients of cannabis).

- Medical: refers to products that need to be prescribed by a doctor. These products may contain THC, CBD, or other compounds found in the plant.

- Industrial: primarily refers to hemp products. Hemp is defined as a cannabis plant containing no more than 0.3% THC. There are many potential industrial uses for the product, with its strong fibers having potential uses as a material in construction, paper, and other industries.

Each segment of the industry has its opportunities and challenges. THC and CBD are at the center of much of the federal legislation impacting the industry. There is currently one FDA-approved drug that has CBD as an active ingredient. Research efforts into medical uses of the compounds found in the plant are picking up steam as restrictions on research have started to relax. The 2018 Farm Bill effectively legalized hemp at the national level, so the legal hurdles are far lower for hemp than for other segments of the industry.

As the legal cannabis industry matures, there will be winners and losers – likely more of the latter. There are companies today that likely won’t exist if legalization becomes the norm. Indoor growing facilities are a good example of this. They require significant capital and power generation to artificially create an optimal growing climate. If cannabis becomes a commodity like tobacco, easily transported across state and country lines, cultivation of the product will shift to areas that have climates that are naturally conducive to growth. We see some companies in the industry already buying agricultural land in South America in anticipation of this. Dispensaries are also likely to suffer as the products they are selling become more available elsewhere.

On the other side, there will be significant opportunity for companies to develop products and brands to appeal to consumers. There is also an opportunity for companies to gain a foothold in a niche area of the supply chain and perhaps become ubiquitous in the industry. Segments such as testing and tracking cannabis products are interesting as these are functions often required by law, and there are fewer competitors in these areas. Companies that find innovative ways to use hemp to reduce costs and increase quality in repeatable industrial processes may have promise as well.

In the long run, we expect the industry dynamics to be similar to those of alcohol and tobacco – consumers each have different tastes and preferred brands, but most of those brands will be owned by the same few companies. Existing companies with established supply chains and deep pockets will win out. Companies with significant resources will have a major advantage. The cost of navigating a complex and evolving legal landscape will be significant. Additionally, establishing a wide-ranging and effective marketing strategy will be extremely important as consumers establish brand loyalty to commoditized products. This will tend to favor large companies with established supply chains (Philip Morris’s parent company Altria is a good example of this), and companies partnering with more sophisticated private equity investors. Along the way, innovative, smaller, companies will get bought out, providing significant gains to early investors.

The Legal Challenges

The potential rewards from any investment in the cannabis industry must be measured against the risk inherent in the fact that marijuana is still illegal at the federal level in the U.S.

The federal government regulates drugs through the Controlled Substance Act (CSA). The Drug Enforcement Administration (DEA) rates each drug based on the drug’s potential for abuse and its medical value. Marijuana is classified as schedule 1, the highest classification, similar to heroin4. This creates a regulatory hurdle for businesses in the industry as federal law enforcement retains the ability to raid businesses that may be operating legally according to state law and prosecute along harsh schedule 1 guidelines.

As a result of its legal status, businesses in the cannabis industry do not receive the same federal tax deductions – such as rent, employee salaries, and utility bills – that are typically granted to business owners. And banks are reluctant to partner with these entities, forcing owners to operate as cash only businesses and severely restricting the ability to borrow funds for expansion5.

The Obama administration attempted to reconcile the federal vs. state regulatory tension with the release of the Cole Memo in 2013. The memo outlined a set of rules that, if followed by the states, would let them carry out their activities with little interference from the federal government. The Cole Memo was largely viewed as the federal government ceding control to the states for industry regulation and potentially taking a softer approach on legalization. Attorney General Jeff Sessions rescinded the Cole Memo in January 2018, reinstating federal control over the marijuana landscape, even when legal on a state level. This reversal opened up the door to federal raids on any company that touches the cannabis plant along the supply chain. Raids of state legal companies haven’t been widespread since then, but the possibility presents a significant risk for investors in these businesses. There have recently been a number of bills introduced in Congress that seek to change this dynamic, by either allowing states to decide on legalization, or by legalizing cannabis at the federal level. Political analysts don’t expect any of these bills to make it into law in the near future.

This ongoing uncertainty from a regulatory standpoint will likely stall industry growth. As currently constituted, the operating model of many businesses in the industry is technically illegal. Even the expanding sales of CBD creams and oils are illegal under FDA guidelines, since it is an active ingredient in an approved medication. In practice, the government has been turning a blind eye to most legal cannabis businesses, provided that they are operating fully within a state where it is legal. However, the murky legal environment presents significant challenges for investors. First, the underlying investment could lose money or even be forced out of business as a result of a federal crackdown. Additionally, there is a non-zero chance that the government could target investors in those illegal businesses. We haven’t heard of that happening, but potential investors need to consider that low-probability, severe-impact risk. Private investments also suffer from the inability of moving cannabis-derived revenue across state lines. Some private equity funds in the industry are suffering from this problem, unable to distribute income to fund investors until laws change.

This legal uncertainty is currently allowing early gains to accrue to those that are willing to take on the legal risk. Investing in an illegal entity and hoping authorities don’t enforce the law is not a sound investment strategy. As a result, many institutional investors have remained on the sidelines until the legal environment becomes more favorable. However, retail investors have been jumping into the space, leading to extreme valuations for publicly traded companies in the industry, most of which are Canadian companies.

Buy the Rumor, Sell the News

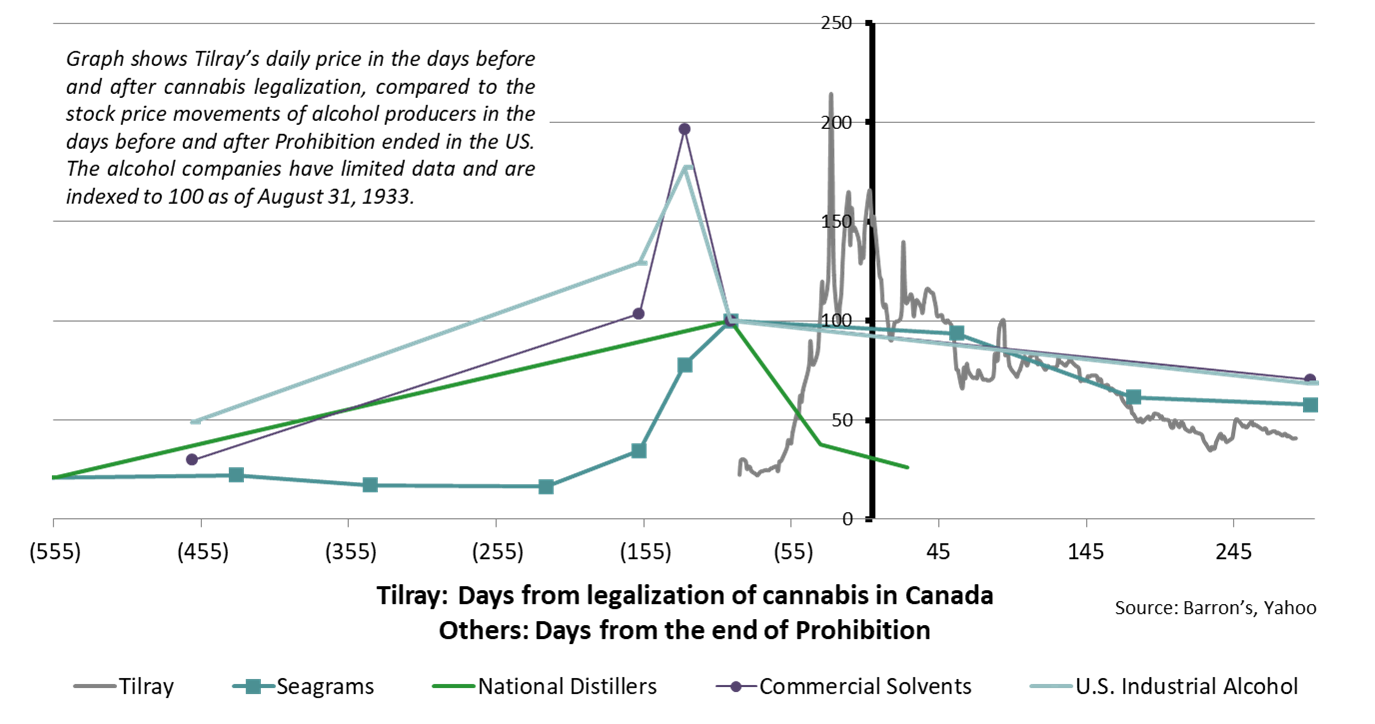

The legalization of an industry that has thrived in the black market in the U.S. conjures up visions of bootleggers and speakeasies. The end of Prohibition in 19336 is one historical precedent for this situation. Trading patterns of alcohol-related stocks saw a significant amount of volatility around the time of Prohibition. The share prices of alcohol companies spiked up as the idea of ending Prohibition started to become more realistic. However, stock prices in the sector peaked in the months before Prohibition ended. As euphoria in the market gave way to realism, prices came back to earth and stocks actually declined in the year after Prohibition was made official.

More recently, Canada legalized marijuana on the national level. A similar story unfolded, as excitement surrounding the newly legal industry peaked in the months before legalization became official. The hype and euphoria in the industry is epitomized by the story of Tilray, Inc. Tilray is a Canadian cannabis producer. Legalization of cannabis at the national level in Canada was slated to begin in October, and several US states had ballot questions to be voted on in November to move cannabis in the direction of legalization. US investors hoping to profit off the industry’s growth led a frenzy of buying activity. This caused the company’s share price to skyrocket. In September, the stock’s price rose to $300 in intraday trading (after beginning in July at $17), before losing two thirds of its value in the next few days. As of August 2019, the company’s shares trade around $30.

Tilray isn’t alone in the industry. Valuations of publicly traded cannabis companies have skyrocketed. We can look at the top ten positions in the cannabis-focused Prime Alternative Harvest Index as a proxy. The 3-month average price-to-sales ratio for the median company in this group has been a staggering 60.3x. This compares to the Russell 2000 Growth Index, which has had an average P/S ratio of 1.7x over the same period7. Investors looking for a valuation rationale to justify their purchase decisions are stretching logic. Some are comparing company valuations only to other companies in the industry, assuming that a 100 times multiple is more attractive than a 200 times multiple in a growing industry. They may be right, and many early investors that got in before the hype took hold have likely made a generous profit. Many others that mistimed their investments have lost capital.

Investment Approaches

For investors who want a piece of the industry despite substantial risks, there are a few different ways to invest. They can invest through direct investments in cannabis companies, traditional private equity funds, or the equities of publicly traded companies.

Direct investment Direct investments in cannabis-related companies carry unique risks. Marijuana is still illegal under federal law, and the legal risks that result could have a substantial impact, including a total loss of capital. Many US banks will not do business with companies or people who earn money from the sale of cannabis for this reason. We recommend proceeding with extreme caution before embarking on a direct investment.

Private equity funds Investors can also access the industry through a traditional private equity fund that focuses on the cannabis industry. Potential investors should seek out fund companies that have established track records, including experience navigating complex legal environments. With so much hype in the industry, investors should beware of upstart funds with inexperienced founders. It is also important to understand the focus that the fund will have. Will it be investing in companies that produce and sell marijuana and related products that are legal at the state level but illegal federally? Or will they invest in federally legal, marijuana-related industries? It is unlikely that investors would be held legally liable for investing in a diversified private equity fund that invests in the federally illegal side of the industry, but it is not certain. It will also be important to have a full understanding of how the fund intends to get around hurdles such as storing revenues from the companies, moving funds interstate, and navigating a changing legal landscape. If the fund is working with a third party legal team, how will their compensation impact fund performance?

Publicly-traded companies Publicly traded companies are the easiest way to invest in the industry. Investing in individual companies presents its own risks (as in the aforementioned Tilray, Inc. example), as public market valuations in the space are plagued by extreme volatility. Publicly traded companies in the industry tend to be small, have a small number of shares trading, and have a heavy percentage of trading volume driven by individual retail investors, rather than institutions. The companies also tend to trade more heavily on headlines than on fundamental prospects. As a result of this dynamic, an actively managed fund run by an experienced investment team might be superior to an indexed approach or attempting to identify individual company winners and losers.

In any investment decision, the potential return must be evaluated against the risks being assumed. In a young industry such as cannabis, the range of potential outcomes is extraordinarily wide. Even an investment in a good company in a rapidly growing industry can be a poor investment if made at the wrong time. Investors may recall that the market value of Microsoft climbed above $600 billion at the peak of the dot-com bubble. After the crash, it took over 17 years for the company to reach that valuation again.

When we consider these factors – valuations, legal hurdles, and regulatory uncertainty, we advise caution in considering an investment in this growing industry. Nonetheless, we will monitor the changing landscape and continue to look for opportunities in the future.

1 https://wjla.com/news/nation-world/colorado-made-1b-in-marijuana-tax-revenue-what-could-this-mean-for-federal-legalization

2 https://news.gallup.com/poll/240932/snapshot-one-four-young-adults-marijuana.aspx

3 WSJ: Weed Versus Greed on Wall Street, 1/25/19

4 https://www.vox.com/2014/9/25/6842187/drug-schedule-list-marijuana

5 https://www.vox.com/2014/5/10/5699376/why-marijuana-shops-are-forced-to-run-like-lemonade-stands

6 https://www.barrons.com/articles/marijuana-stocks-alcohol-prohibition-1540262230

7 Bloomberg, data as of August 12, 2019

Learn more about our Investment Team and our investment approach.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.