Jerome “Jay” Powell is the chairman of the Federal Reserve and one of the most powerful men in the world. He was a respected investment banker, a partner at one of the world’s largest private equity and alternative investment management shops, served as Under Secretary of the U.S. Department of the Treasury under President G.W. Bush, and holds a bachelor’s degree from Princeton and law degree from Georgetown University.

He has never met my son, Mike.

Raphael Bostic is president and chief executive officer of the Federal Reserve Bank of Atlanta and all through 2021, he was a key member of the Federal Open Market Committee, one of the most influential groups driving monetary policy. He graduated from Harvard University and earned a doctorate in economics from Stanford University.

Dr. Bostic has never met my son, either.

They would both like him, though. Mike is a fine young man. We were especially proud of him when he graduated from college last May, a degree in one hand and a Boston job offer in the other. And we did not even have to make good on our threat to “change the locks,” as he and some college buddies got an apartment in a fun neighborhood called South Boston (“southie” in the local vernacular).

I thought of all three men this week, as inflation indicators surprised many.

Mike received his job offer in the spring of 2021, just when inflationary pressures were starting to bubble up. Mike graduated and then started work. All through the summer of 2021 and into the late fall, however, Chairman Powell continued to assure the nation and the world that upward price movements for milk, cereal, lumber, etc. were “transitory” in nature. Many respected economists around the world also pointed to data indicating that inflation would ultimately prove to be “transitory.” Mr. Powell explained that many of the supply-chain issues would resolve themselves, as they often do.

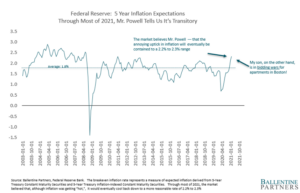

And the markets believed Mr. Powell. Indeed, some of the most-followed indicators of future expected inflation seemed to be saying exactly what Chairman Powell was saying. It’s called the breakeven inflation rate. It is a simple calculation. First, you need the yield on the 5-year U.S. Treasury. Second you need the yield the on 5-year Treasury Inflation Protected Securities (or TIPS). Then subtract one from the other. This number is the market’s inflation expectation over the next 5 years. All through 2021, even into the late fall — the “market” and the Fed — kept thinking that while, yes, recent inflation numbers looked elevated, inflation would settle down into normal ranges in relatively short order.

My son was telling me otherwise. In that summer, he and his buddies found an apartment they liked in a location they liked, at a listed price they thought they could afford. The operative phrase here is “listed.” Because what happened next stunned me and my wife. Now, as background, my wife and I had lived through two crazy real estate periods. The first was back in 2006, when we sold a home in a Boston suburb. We received multiple offers within hours of our listing. Many were “all-cash” deals. Many said, “no inspection needed.” Many said, “whatever the highest bid is, we’ll beat it by $20,000.” There was a bidding war for our house. We were not alone, as this phenomenon played out all across the country. The second period of crazy is happening today. All through 2021 and into 2022, we heard and read about similar stories not just in Boston but around the country. So we are no strangers to bidding wars for homes. But never in my life had I heard about bidding wars for apartments! But that is exactly what happened to Mike. There was the listed price of the apartment, but it was essentially meaningless. He and his buddies would offer 10-15% above listing, and they still would lose out to the highest bidder.

So while Mr. Powell was assuring the country that this inflation was “transitory,” my son was telling us something very different, as rents almost never come down and are priced infrequently — they’re what economists call “sticky.” And only now do we know that the market should have been listening to my son. See the chart below, which updates inflation expectations through March. They are the highest they’ve been in 25 years. This is a meaningful breakout.

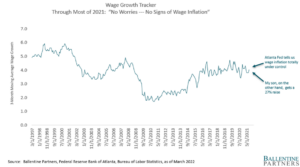

Another key metric that the Fed watches is called the Wage Growth Tracker, and it is monitored by the Federal Reserve Bank of Atlanta, run, again, by Dr. Raphael Bostic. They watch it so closely because wages, as well, tend to be very “sticky,” and they typically become entrenched in the psyche of the workforce. This is quite unlike the price of milk, lumber, or gasoline at the pump, whose prices can go up and down based on normal supply/demand volatility. Wages are very strong indicators of when an inflation mindset is starting to take hold in the economy.

Yet all through 2021, Dr. Bostic’s Wage Growth Tracker — and economists that watch this metric as signs of inflation — was saying, “no worries.”

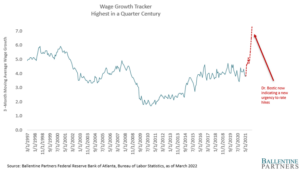

My son was telling me otherwise. He started work that summer, and I am quite sure he was doing a fine job. He’s an intelligent young man with a good work ethic! But within a few months, his employer gave him a 27% raise! That’s right, 27%. Now, I don’t mean to take anything away from my son, and I’d like to think it was because he was so awesome. But everybody in his office got that raise. The employer was forced to do so in order to retain its good employees and to attract the next batch of college grads. He was a leading indicator for what came next. See chart below.

There is a new urgency in Dr. Bostic’s voice, as the Wage Growth Tracker shot up dramatically in the last few weeks. In a recent speech to the National Association for Business Economics, he indicated the Fed needs to get its benchmark Fed Funds rate to “neutral” as quickly as possible. This is necessary, he added, so that very high wage growth does not become a permanent feature. Permanent is the opposite of transitory, last I checked. Are his words code for “further and faster” rate hikes than previously planned? I have no idea. But they are consistent with some of the more hawkish phrases emanating from Jay Powell this week. We’ll be the first to admit that making macro calls on GDP growth, unemployment, and something as important as inflation is tough for anybody, including we here at Ballentine. Macro is a tough game. But when you’re the Fed, you’ve got reams and reams of data at your disposal. Maybe next time they (and we) will add my son Mike to the list!

*Not his real name. He preferred that I use a made-up name, which is fine. He also wanted to let everybody know that his 27% raise was somewhat related to the awesome job he was doing. Duly noted!

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.