It is tempting to paint a picture today of consumers struggling or on the edge. And let me be clear, many are. The rising cost of rent, food, gasoline, airplane tickets…heck, essentially everything… has been well-publicized in the financial press and certainly felt in the pocketbook. This could be worrying on its face, given that our U.S. economy is roughly 70% driven by the consumer. If U.S. households were feeling the pinch and possibly cutting back their spending, then this must be bad news for the economy. Or so the logic goes.

But inflation worries are only one side of the equation. As with most things, there’s more to the story.

We have contended for some time that the odds of a recession have certainly risen in the last year or so, given the Fed’s tightwire efforts to slow the economy without triggering a recession – a difficult task with a spotty track record. But we have also contended that if a recession were to occur, our base case was that it would be “short and shallow .” Our primary rationale: the health of the consumer. Has our base case changed?

No.

And for three main reasons: First, consumers, by and large, have put their financial houses in order by locking in low interest rates or refinancing their largest debt obligation – their mortgage. Second, they were saving more, helped by COVID-era largesse from the Federal government, and spending it down in a responsible manner. Finally, the employment picture was very favorable, reflected in low unemployment and rising real wages.

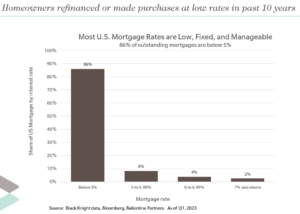

For roughly 13 years, from 2009 to early 2022, American consumers were presented with an amazing opportunity. Interest rates during this time frame for mortgages, cars, and frankly any other form of debt was absurdly low. In 2020, in fact, the yield on the 10-year Treasury touched 0.32%, the lowest in 230 years, basically since the creation of the U.S. Treasury Department in 1789. [In Europe, interest rates fell to 500-year lows!] Homeowners did not sit still. They bought homes with long-dated terms, and they refinanced their mortgage – multiple times, in many cases – all at multi-century low rates. Today, the vast majority of homeowners are sitting on mortgages in the 4% to 5% range, with many many below 4%. See chart below. Importantly, these mortgage payments are predominantly fixed and protected against rising rates. Further, the number of homeowners who were able to completely pay off their mortgage free and clear rose to 39%. So think about this for a moment: your monthly mortgage payment – the largest monthly bill, by far – is not moving one penny. This, while your income is rising. The difference went right into the bank.

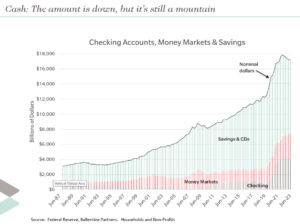

Second, the Federal government’s response to COVID was massive and quick. Unemployed consumers were essentially “made whole” in terms of their paychecks – but they weren’t spending it on restaurants, movies, amusement parks, travel, etc., because they couldn’t! They were stuck at home. Again, the difference went right into the bank.

And finally, real wage growth (wage growth net of inflation) has been positive for over a decade. True, real wages dipped into negative territory during the peak inflation of 2021 and 2022, but they are now back in solid positive territory. So, while the price of items is going up, wages are more than keeping up. And for those switching jobs – job-switching has been at a multi-decade high – wage increases have been even higher. Once again, the difference goes right into the bank.

The net net of these three forces was that cash balances – broadly defined by the Fed as checking, money markets, savings, and bank CDs – became mountainous over the decade and accelerated during the last 3 or 4 years. See the graph below.

There has been a stream of headlines recently about how consumers are eating into this cash hoard, and that is true. Further, the future is always a bit murky, so any number of bad events could put a damper on consumption and result in a recession much worse than our base case. Further still, the mix of what consumers are buying is shifting, so there will be winners and losers in the economy. But let’s be clear. American households are sitting on a ton of cash right now, and that should act as a buffer for most bad events. The amount might be coming down, but it is still a mountain. And for that reason, we still think the consumer is on solid footing.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.