Many of you might have watched the final game of the 2022 World Cup played in Qatar between France and Argentina. You are in excellent company, as some estimates peg the TV audience at 2 billion people worldwide watching it with you. It was a breathtakingly entertaining game for a whole host of reasons, which we don’t need to review.

What we do want to review, however, is an important part of the game – penalty kicks – and how they relate to investment strategy. As you may recall, penalty kick goals were an essential part of the regulation play, and a penalty kick shoot-off determined the winner.

There is a famous behavioral economics study that was published in the Journal of Economic Psychology [1] in 2007. It was a fascinating research piece on “action bias” by elite soccer goalkeepers. Using a vast database of soccer statistics that tracked the incidence of penalty kicks in professional soccer, the researchers came to a stunning counter-intuitive conclusion about goalkeeping and penalty kicks. The best strategy for a goalie – i.e., the highest utility or optimal choice, in the language of the study – when faced with the pressure-filled scenario of a penalty kick was not to dive left, not to dive right, but, instead, to remain still, right in the center. To not move. For those goalkeepers holding their ground, the success rate of blocking the kick more than doubled.

Yet 94% of the time, goalkeepers still dove.

Why?

This is not a mere academic question. Goalies have unusually large incentives – economic psychologists call these “motivations” – to make optimal choices. Much is at stake. Penalty kicks often determine the game’s outcome (as 2 billion people recently witnessed), as the number of goals in a typical game is quite low, so the importance of a single penalty kick goal is weighty. Further, elite professional goalkeepers can make tens of millions of dollars over the course of their careers. The ten best paid goalkeepers in England’s Premier league, for example, earn roughly $8mm [2] annually with even more to be made from product endorsements for colognes, expensive watches, and the like. Any edge that could boost their success rate would have a huge monetary payoff. You would think goalies would pay attention to these statistics. So why do they still choose to dive?

The authors of the study had an interesting hypothesis tied to how keepers’ brains, and ours, are wired. They all feel immense pressure to “do something.” It’s called an action-bias. It turns out that at a subconscious level, the goalie is doing some mental calculus: if they dive to the left or right and the ball still goes in (which happens very frequently), at least they cannot be accused – by their teammates, their coach, or their adoring fans – of not trying. Their reputation does not suffer. The dramatic leap in the air, the flared arms, the gloves, and the grass-stained jersey are all proof that the goalie had at least tried valiantly, even if to no avail.

Conversely, if that same goalie chose not to dive, with the ball still going in the net (i.e., the same negative outcome as above), imagine the derision, shame, and embarrassment he (or she) is likely to experience. Even though standing still is statistically the most logical and prudent choice, by a wide margin, the potential pain of that derision – from teammates, the coach, and those now-not-so-adoring fans – is enough to override rational decision-making. They simply cannot stand still. Their rational brain gets hijacked. And 94% of the time, they dive.

What does any of this have to do with the investment management industry? Plenty.

Professional portfolio managers are under tremendous pressure, as well, to “do something” when managing portfolios. Like goalkeepers during penalty kicks, they are highly motivated to pick the right stocks, trade their best ideas, and make some big, bold bets. If they manage to beat their benchmarks, they get interviewed on CNBC, end up on the cover of Barron’s magazines, and get quoted in The Wall Street Journal. And that’s just the reputational payoff. The monetary payoffs are over the top. They are paid hefty bonuses, new money inevitably flows to their funds that generate even more fee income, and often they are given new funds to manage as they are heralded as “the next Warren Buffett.”

This pressure to act – to “do something” – is essentially constant. The Fed raises interest rates by 0.75%, it’s time to do something, or so the thinking goes. The CPI print is different from what Wall Street was expecting, and it’s time to do something. A company posts earnings that are lower than expected, it’s time to do something. OPEC announces a new oil production target, it’s time to…ok, you get the idea.

If they fail to beat their benchmarks, however (which happens very frequently), they can at least defend their underperformance with compelling charts, diagrams, and impressive narratives rationalizing why they did what they did. Clients are typically mollified, or at a minimum appeased by the fact that their portfolio managers are doing something to justify the management fees. “Well, at least I can see you’re trying really hard,” the client says. And so the portfolio managers keep on doing what they’re doing.

Yet just like with penalty kicks, the statistics argue for just the opposite. All this “doing something” typically comes with a cost. Transaction costs, getting the bet or the timing wrong, misjudging the impact, generating taxable short-term and long-term capital gains, etc., all have a negative effect on returns. The more rational choice, even when faced with tempting tradeable and actionable information and news is…to stand still.

The most extreme example of standing still is, of course, those low-cost and tax-efficient ETFs that don’t trade a lot, if at all. Instead of diving right and diving left, so to speak, these ETF strategies resist the pressure and resist their temptation to act. And, it turns out, investors are rewarded handsomely for this discernment.

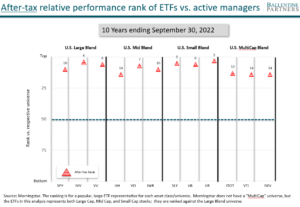

See below. This chart shows the percentile ranking of various ETFs in the major U.S. equity asset classes. These rankings are for after-tax returns over the last ten years (ending September 30, 2022). Let’s take IVV, for example (the second triangle in from the left). This is the ETF that is designed to track the S&P 500 index. Over the last ten years, this ETF has ranked in the 4th percentile, all the while simply doing nothing – very little trading, just replicating the market exposure, but in a low-cost, tax-efficient manner. Yet this “do nothing” approach has beaten 96% of all other active managers.

But it’s not alone. Essentially all of these funds rank at, near, or above the 10th percentile, meaning that they beat roughly 90% of all active managers, all those managers jumping left and jumping right. And all for naught. The non-intuitive – but statistically convincing – message when it comes to picking stocks in the U.S. or staring down Argentinian star Lionel Messi in a penalty kick shootout is this: Don’t just do something! Stand there!

[1] “Action Bias Among Elite Soccer Goalkeepers: The Case of Penalty Kicks”, Journal of Economic Psychology, Volume 28, Issue 5, October 2007. Michael Bar-Eli, Ofer H. Azar, Ilana Ritov, Yel Keidar-Levin, and Galit Schein. With acknowledgement to James Montier, a former colleague of mine, for highlighting this research to me many years ago.

[2] https://www.spotrac.com/epl/rankings/goalkeeper/.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

Disclosure: The return rankings shown for the various ETFs are entirely hypothetical, in that we assume an investor simultaneously made lump sum investments in an Exchange Traded Fund (ETF) and the Morningstar actively managed mutual fund universe on exactly the same date, held those investments for the entire period and reinvested all dividends. The ETF we have selected is an investable security. However, the Morningstar actively managed mutual fund universe is not an investable security; rather, it is a database created by Morningstar to track the performance of actively managed mutual funds. The results shown here are actual results, not back-tested results. All data is provided by Morningstar. The ETFs we selected for this presentation represents the major market indices and, in our opinion, represent an actual investment a knowledgeable investor might consider as an alternative to selecting one of the actively managed mutual funds that, according to Morningstar, invests in stocks similar to those held by the corresponding ETF. The ETFs shown here are among those we consider for use in our clients’ portfolios; but, due to differing circumstances some clients’ portfolios may hold ETFs or index funds different from the ones shown here. This chart is solely for educational purposes. We make no representation that any client of Ballentine Partners received the investment results shown.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.