US equity markets have significantly outperformed their global counterparts over the past decade despite a chorus of market strategists extolling the virtues of global diversification and cheaper overseas markets. European markets have consistently lagged, compounding at approximately half the annualized pace of the US Russell 3000 Index over the past 3, 5 and 10 years. Many analysts have been recommending European equities based on expected “normalization” after a lengthy period of underperformance. Yet, the richly valued US market has remained dominant. The question is: are European equities a bargain or a value trap?

A Long Period of US Dominance

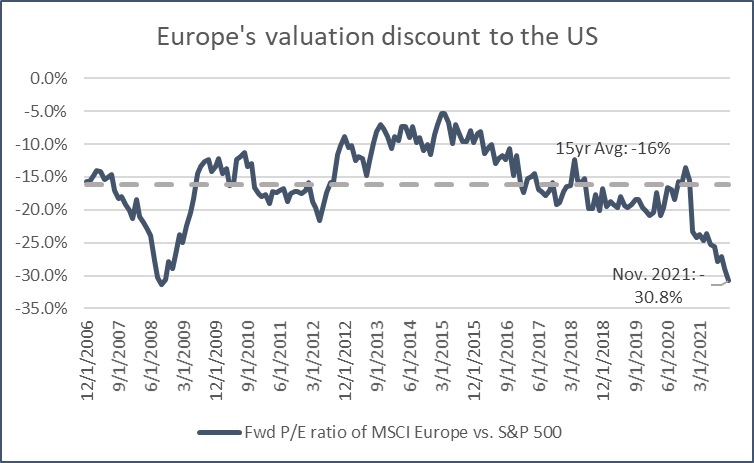

US and European stock markets have traded performance leadership for the last 50 years, but the past 14 have been marked by US dominance. The below chart from JP Morgan outlines periods of US vs. European leadership since 1970.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

The current epoch of US outperformance stands out in both duration and magnitude. But there have been notable periods of European leadership such as the mid-late ‘80s and the early-mid 2000s.

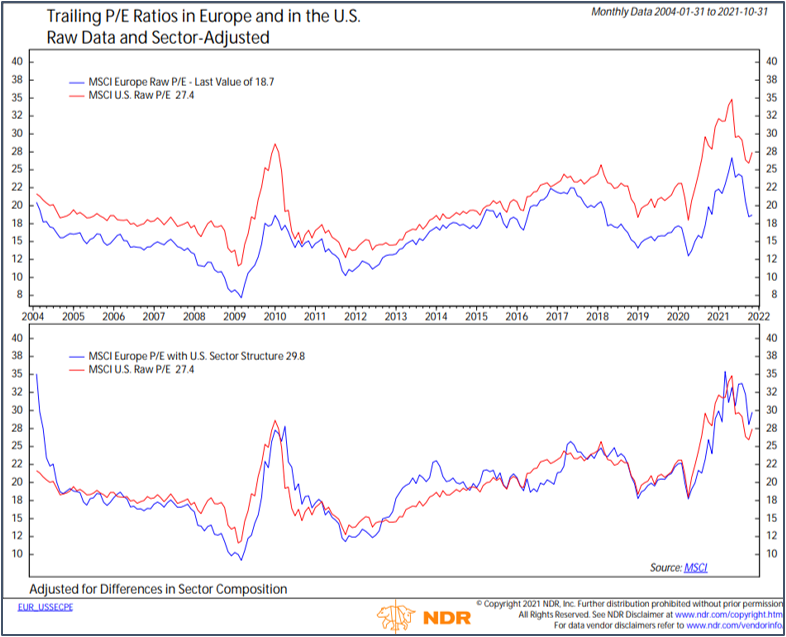

Is US equity market dominance growing long in the tooth? Evidence for that argument can be found in relative valuations as measured by forward price-to-earnings ratios.

As shown above, European equities have traded at a discounted valuation relative to the US for the past 15 years. That discount has widened rapidly since 2015. Investors in European stocks will be handsomely rewarded if relative valuations revert towards their 15-year average.

What accounts for this widening valuation gap? We believe there are three factors at play: 1) superior earnings growth among US companies; 2) important changes in the composition of the industries that comprise these geographic regions; and 3) inherent structural advantages in the US economic system. Let’s explore these three factors in greater detail.

Higher Earnings Growth

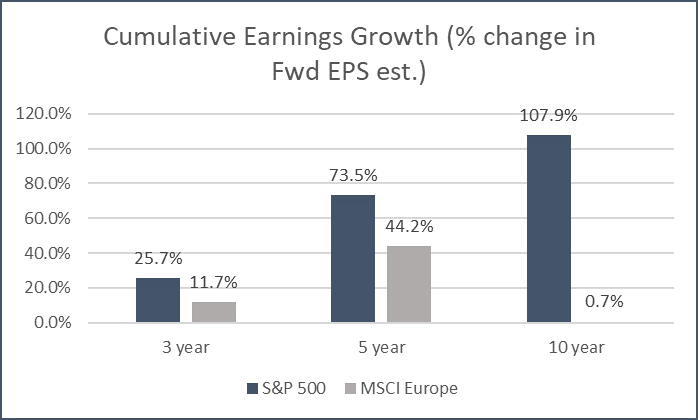

The S&P 500 has grown its next-12-month earnings estimates by 108% in the last decade, while MSCI Europe generated less than 1% growth. The story is similar over the past 3 and 5 years: European earnings growth has not kept pace with the US.

Data per Bloomberg as of 10/31/2021.

Data per Bloomberg as of 10/31/2021.

Not only have earnings for the S&P 500 grown at a faster pace than MSCI Europe, but the market places a higher value on US profits. Lower interest rates have encouraged investors to place a premium on faster earnings growth, which the market expects the US to deliver going forward.

Industry Composition

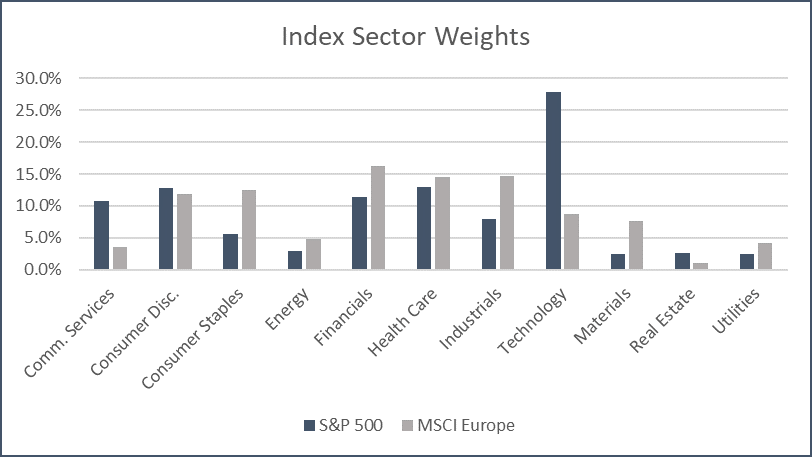

What are the underlying drivers of relatively robust US earnings growth and valuations? Some growth can be attributed to the strong US economic expansion in the post-financial crisis period. But there is another answer lurking below the surface. The past decade has seen a massive boom in technological innovation. Naturally, the technology and communications services sectors of global stock markets have led the charge in both earnings growth and multiple expansion. Those two sectors are more heavily represented in US stock indices than in any other region. As highlighted in the chart below, tech and communications comprise 36% of the S&P 500 versus just 13% for MSCI Europe. The Continent tilts instead towards the economically sensitive (“cyclical”) sectors of financials, basic materials, and industrials. In short, US indices are more exposed to secular high-growth industries while European indices are tilted towards old-line cyclical sectors. In a “lower for longer” period of falling interest rates and relatively weak economic growth, investors have been rewarded for betting on secular growth industries. Growth has not only been stronger in these sectors but also more reliable and consistent – characteristics which markets tend to reward with high valuations.

Data per S&P, MSCI as of 10/31/2021.

Data per S&P, MSCI as of 10/31/2021.

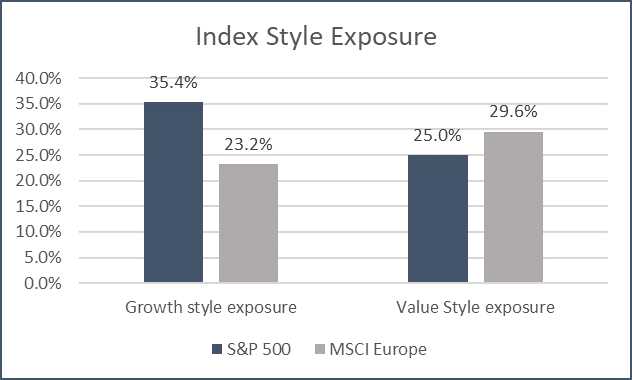

Sector and style compositions of market indices go a long way in driving relative performance. Economically sensitive sectors tend to be comprised of “value” stocks, while secular growth sectors are tilted more towards “growth.” If value stocks are in favor, Europe performs well. If growth stocks are in favor, as they have been for the past decade, US markets perform better.

Data per Morningstar Direct as of 10/31/2021.

Data per Morningstar Direct as of 10/31/2021.

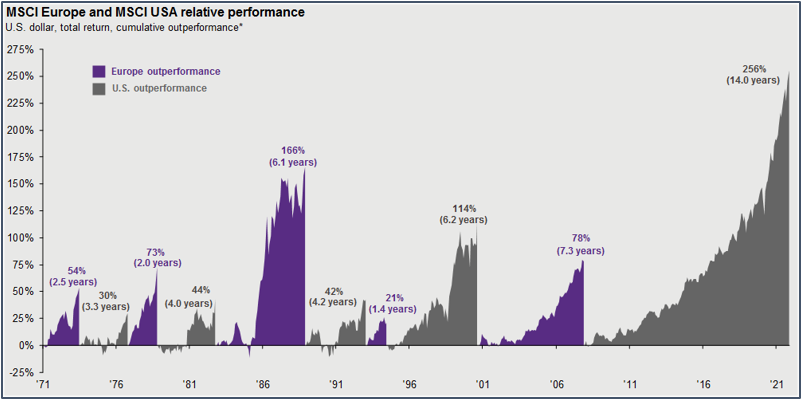

Investors should recognize that overweighting European equities within a global portfolio is a bet on the value style. Value stocks, in turn, are a bet on economic growth, inflation and interest rates. Which begs the question – are European equities the most efficient way to express a value tilt? Notably, the US Russell 1000 Value Index trades at a lower forward P/E ratio than MSCI Europe but has posted stronger earnings growth over the last 3, 5 and 10 years.[1] According to Ned Davis Research, when adjusted for their different sector compositions, US and European indices have traded at similar valuations. In fact, European valuations (bottom chart) are now higher than the US after sector adjustments.

Without a significantly discounted valuation once adjusted for sector and style differences, we believe investors may be better served by gaining exposure to value-oriented sectors and growth-sensitive assets within the US.

Structural Advantages

There are structural factors, which we believe give US equity markets a leg up across sectors and styles. Highly developed capital markets and a more business-friendly environment are fundamental advantages for the US. A well-ingrained entrepreneurial and optimistic spirit pervades the US national psyche. We recognize a “Silicon Valley effect,” whereby network effects lead to more and more innovation within sectors such as technology and biotech. A larger venture capital and private equity industry ensures that new companies are well-funded. Deep public capital markets help companies scale.

Robust venture capital and IPO markets have created a surplus of mid-sized, rapidly growing public companies in the US. A screen of US-domiciled public companies between $10 and $100bn market cap found 221 stocks with over 20% estimated revenue growth over the next 12 months.[2] A similar screen for European companies found just 108 names. There is truly a remarkable number of high-growth companies in innovative industries in the US, which will be difficult for Europe and other global markets to keep up with.

Capital is not necessarily lacking in Europe, but fragmentation exacerbated by Brexit and the sovereign interests of countries in the European Union have certainly been detrimental to capital allocation and market efficiency. Political instability and long-standing fiscal issues across Europe have also weighed on investors’ minds. These are secular issues that are likely to maintain the premium valuation that US companies enjoy over their European counterparts.

Bottom Line

We recognize the current high valuation of US equity indices as an impediment to future returns. Although valuation levels in Europe have also expanded, the disparity between the two has continued to widen. The relative performance of the two regions will likely come down to macro factors such as economic and earnings growth, in addition to how well European policymakers resolve their competing interests. But we believe that the value-correlated nature of a bet on Europe may be inferior to expressing such a position by investing in US-domiciled value stocks that will benefit from the robust capital markets, business-friendly environment, lower tax regime, and relative political stability of the US. European indices could continue to be hampered by long-term fundamental challenges and a less fertile ground for innovation and entrepreneurial activity. As a result, except for occasional bouts of cyclical outperformance, we believe investors will be better served by overweighting US stocks and maintaining below-index allocations to European equities.

[1] Per FactSet as of October 2021.

[2] Per Bloomberg as of 10/31/2021.

About Andrew Hacker, CFA

Andrew is a Senior Research Analyst at the firm and is responsible for research coverage of global equity markets. He is responsible for portfolio construction & manager selection for publicly traded equities. His research also contributes to our overall market outlook.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.