A thematic ETF’s investment thesis sounds compelling. It’s an obvious growth story. And its name is so darn clever. Which means only one thing. Hold onto your wallet.

Thematic ETFs – Exchange Traded Funds, or baskets of stocks and companies focused on a narrow theme, trend, or concept – tap into our deep desire for spicy growth stories. Artificial intelligence. Trillions needed for rebuilding American infrastructure. Insatiable demand for lithium in a world of EV (Electric Vehicle) batteries. The “Graying of America” with companies positioned to benefit from the inexorable aging of baby boomers. Their narratives are compelling, dotted with the promise of unbridled growth or monstrous market size. These thematic ETFs are beautifully marketed with clever ticker symbols – memorable, catchy, and a signal that they were the first to identify this money-making mega trend: BOTZ. PAVE. LIT. BATT. AGNG. The investment management industry has launched literally hundreds of these things through the years, collecting hundreds of billions of dollars in assets and countless millions in fees.

Our advice: be wary. The themes paint a breathless picture of growth. Our research paints a very different picture.

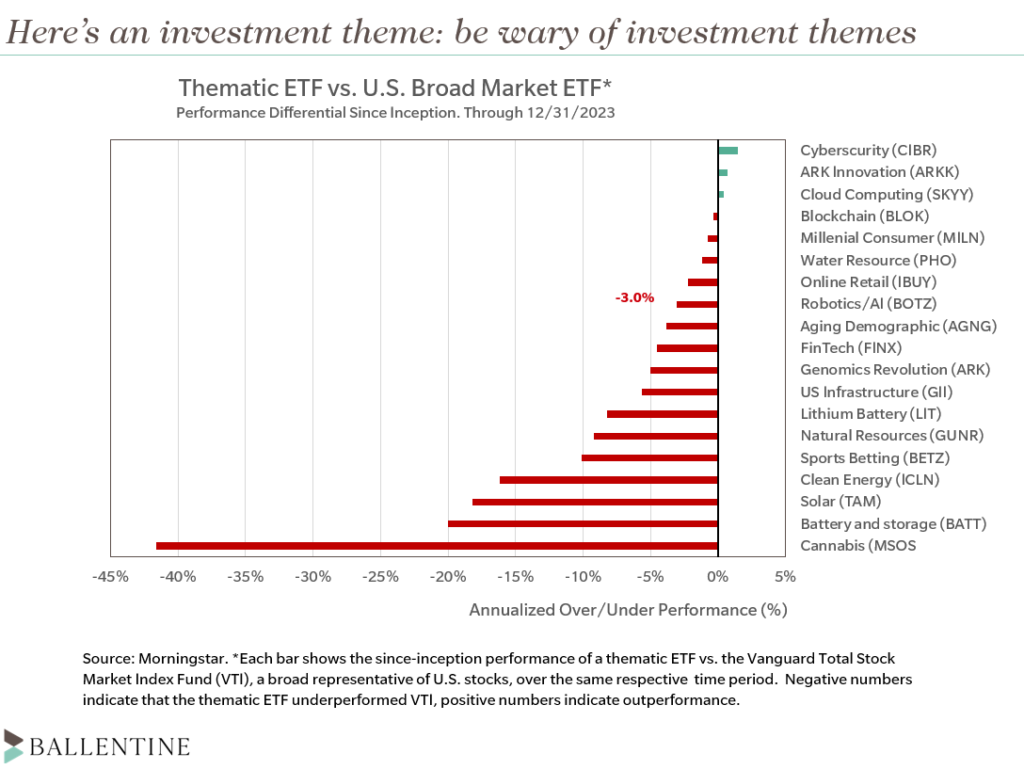

We conducted a performance analysis of nineteen large thematic ETFs, not an exhaustive list but not a bad sampling, either. Each ETF was chosen because it was either the largest in its category or had the longest track record. These ETFs capture many of the popular opportunistic themes over the past decade, everything from cloud computing to online sports betting to robotics to genomics to the legalization and hyper-growth of recreational marijuana sales.

This analysis asks a question: are these thematic ETFs worth their costs, across a few dimensions?

- Opportunity cost: outperformance vs. broad market. Since their inception, did the thematic ETF outperform the default option of simply owning the entire market (represented by VTI[1])?

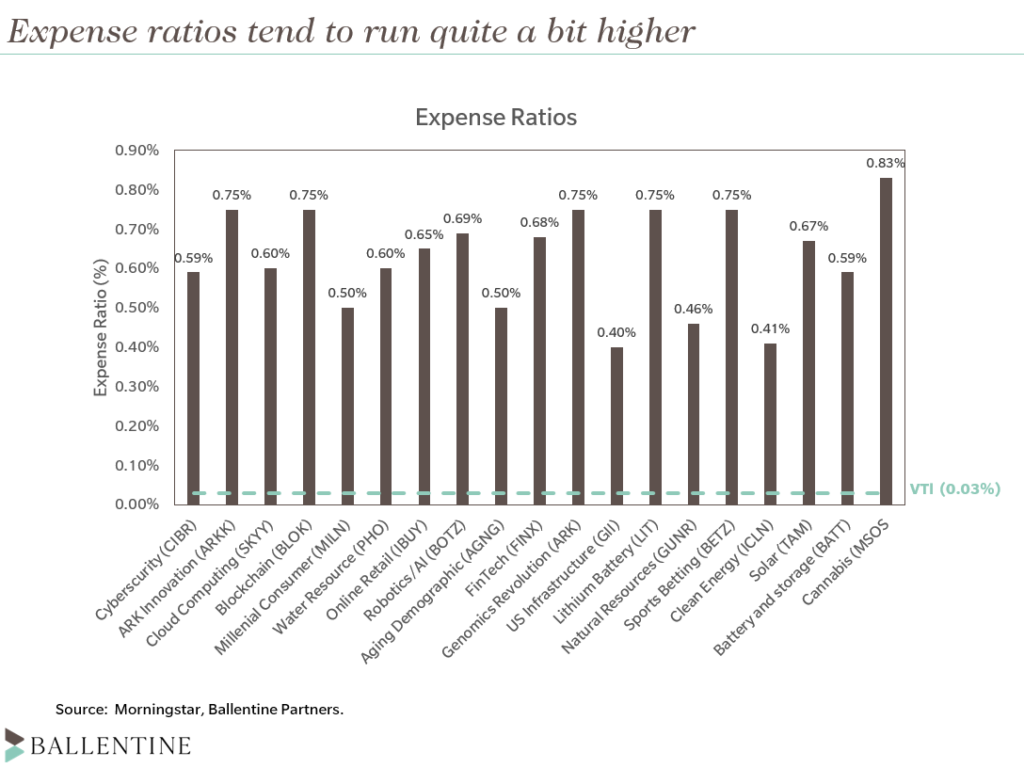

- Expense ratios. Did their performance overcome their expense ratios? Many thematic funds have expense ratios of 0.75% or higher, significantly more expensive than the Vanguard Total Stock Market Index ETF (VTI, only 0.03%). See the chart on expense ratios.

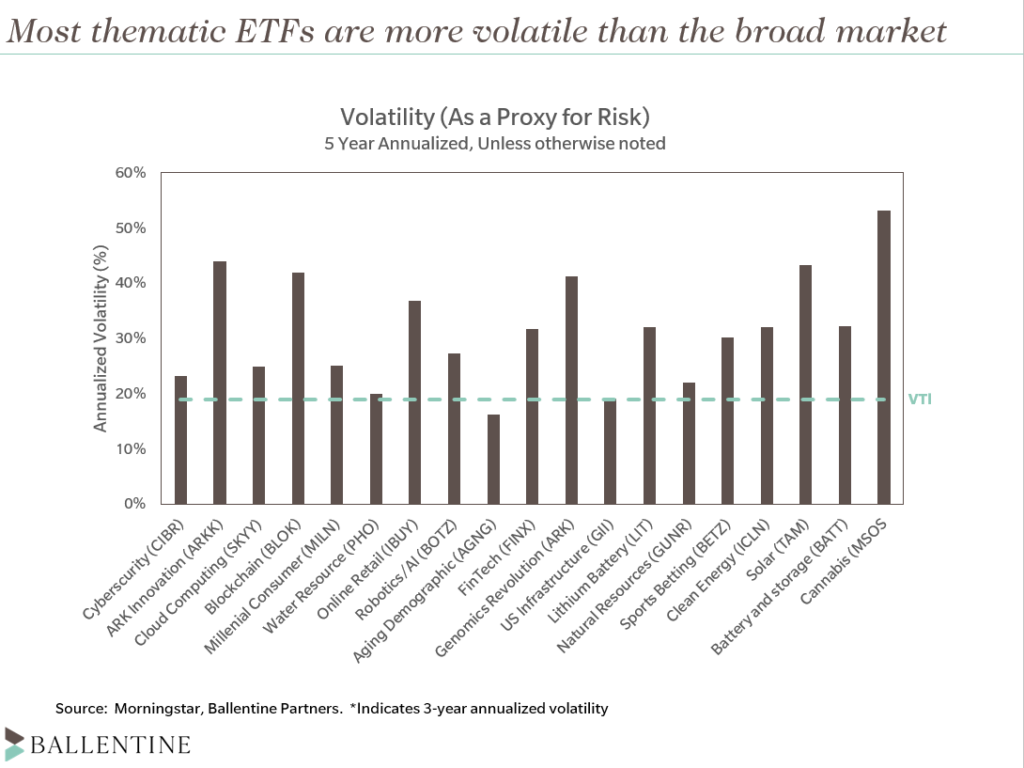

- Volatility. Given their narrow scope, these ETFs exhibited much higher volatility. Were investors compensated for that additional risk? See chart on volatility.

- Tax. Did their performance overcome the likely round-trip capital gains tax hurdle triggered by funding the ETF in the first place and the eventual sale. Both of these transactions create costly taxable gains.

Nothing scientific here, but let’s say, for argument’s sake, that we demand an excess return (over the broad market) in the 1.5% to 2% range. This seemed like reasonable compensation for all of the additional risks and costs. See results below.

So which of the ETFs were able to deliver? In a word, none. Zero for 19. Sixteen of them, the red bars, underperformed VTI since their creation. (We have theories as to why, and you can read those on your own, if interested[2]). The AI and Robotics ETF, for example, underperformed VTI by 3.0% annually since its inception seven and half years ago, even though Nvidia was its largest holding[3]. Three of them outperformed the broad market, but none of them crossed the excess performance threshold. And every fund but one had higher levels of volatility (risk). See chart below. The Innovation/Disruption ETF[4], for example, beat the broad market ETF by only 0.6% since inception, despite gut-wrenching volatility – essentially the same return, more than double the risk, and twenty-five times the expense ratio. Hold on to your wallet.

So what to do when a compelling thematic ETF is tantalizing you? Our advice is the same it’s been since we started this business forty years ago. Look away. Focus on what matters. Keep costs low. Think about taxes…a lot. Don’t get distracted by shiny new objects with beautiful packaging and slick marketing campaigns. In the short term, you may not be able to join in on cocktail chatter about “spicy” thematic plays. But in the long term, it’s the most prudent way to grow and preserve your hard-earned wealth.

[1] The Vanguard Total Market ETF.

[2] First, all of these themes are exciting; that’s why the marketing departments launched them! Investors typically have already bid up the price of “exciting” underlying stocks long before the ETF is launched. Second, the argument for buying the ETF is often: “these stocks are growing quickly.” That’s not a good investment rationale. For stocks to do well, the companies have to do better than expected, challenging given the already lofty expectations. Third, what does “fast growing” mean? Sales? Customers? Click-throughs? Solar panel sales, for example, were experiencing hockey stick growth during the first decade after the launch of the solar energy-themed TAN. Unfortunately, almost no company tied to this growth theme was making any profits. Fourth, it appears that thematic ETFs buy the stocks because they fit the theme, regardless of their valuation, a recipe for disappointment. Fifth, as discussed in the paper, high expense ratios.

[3] The performance analysis was through December 31, 2023. But as of this writing, in late February of 2024, BOTZ is still underperforming VTI, even with the dramatic run-up in Nvidia stock in January and February of this year.

[4] The Innovation/Disruption category is represented by ARKK, the Ark Innovation ETF.

About Pete Chiappinelli, CFA, CAIA, Partner and Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.