No headline is ever going to read: Everything’s Fine. Nothing To Worry About. That’s not how the financial press attracts eyeballs and generates click-throughs. They know that we are drawn to fear. Our advice is try to see through this fear. Often, like today, scary headlines are outshouting a different narrative: that U.S. households’ and corporate balance sheets, while not impervious, are actually in pretty good shape.

Every financial news headline writer in America, whether they work for the CNBC website, The New York Times, or the Financial Times, knows that the best way to catch someone’s attention is to scare them. Consciously or subconsciously, our brains are constantly on alert for what might go wrong, and any headline that taps into that reptilian instinct automatically gets prioritized.

I’ve been thinking about this concept recently, as the press is having a field day trying to scare people. It certainly is possible to find reasons. Janet Yellen speaks of the calamity that would ensue should the U.S. default on its debt. Financial media outlets are literally out-shouting each other on how horrific the fallout would be. Almost unimaginable. If you wanted to get scared by this market, the political brinksmanship playing out in Washington D.C. right now would certainly give you plenty of reasons.

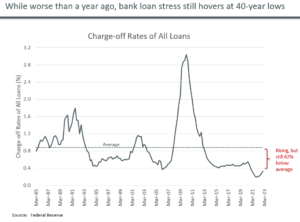

If you wanted to worry about this market because of the damage that rising interest rates have done to U.S. consumers and businesses over the past year or so, you could certainly make a case. With selective focus, the latest data from the Fed tells us that bank loan charge-off rates (these are loans that are essentially “written off” as losses) are up a whopping 73% from last July. That headline, alone, could tie you up in knots.

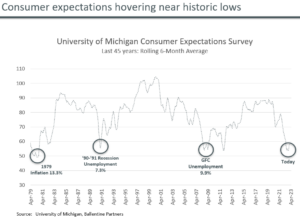

If you wanted to get scared by this market because the mood of consumers is sitting at some of the lowest levels we’ve seen in years, in line with other dark periods of U.S. history – think double-digit inflation of 1979, the deep recession of 1990-91, or the Great Financial Crisis of 2008-09 – you’d have a case to be made. See below the most recent reading from the University of Michigan consumer survey data. Given that the consumer drives over two-thirds of our country’s GDP, this foul mood could certainly spell trouble.

But should long-horizon investors take a look at these headlines with a critical eye? We certainly think so. Yes, some bad things could get worse. While the inflation numbers are improving with almost every reading, the stickiness of certain key economic components – wages or home prices – could make the Fed’s job a bit trickier. There’s legitimate concern surrounding the continued fallout from the regional bank crisis from early March and its impact on credit availability. And the war in the Ukraine remains a constant worry. Make no mistake. We at Ballentine Partners are not naïve about things that might still get off-track. But we must also acknowledge that much of the worry may be overblown. And that it is possible that the markets could shake off some of the doom and gloom that seems to pervade current thinking.

So while we absolutely recognize that a U.S. default would be catastrophically bad, we must also recognize that the odds of that actually happening are infinitesimally small. We wrote about this last week, and we re-iterate it here, as well. While both parties seem entrenched in their positions and hope for a win, the first few hours of a dramatic market sell-off would bring those same parties back to the negotiating table faster than you can say “2011”.

And yes, it is true that rising interest rates have hurt both consumers and companies, a seemingly bad omen. But let’s put today’s environment into historical perspective. If we just step back a little, we see that the reality is much more benign. See below, which tracks national loan charge-off rates over the last four decades. The lower the number, the better. It is true: the number has ticked up from last summer, but it is nowhere near as catastrophic a reading as some fear-mongering headlines would have you believe. Write-offs are still near their 40-year lows, so even if things worsen, that does not make them bad in any absolute sense.

U.S. household balance sheets are in very good shape today, as they largely took advantage of low rates over the past 13 years – refinancing their largest debt obligation, their mortgage, at bargain rates. Eighty-six percent of American households have a mortgage rate under 5%. Stimulus checks during the COVID era also helped shore up their finances. They are experiencing the lowest unemployment rate in 50 years, and their wages are rising in a stickier way, while the price of milk or eggs (wholesale egg prices are down -83% from six months ago) have turned notably downwards.

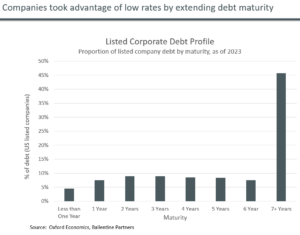

Finally, recent data from The Conference Board – a leading economic think tank – seems full of reasons to worry, as their Leading Economic Indicator is forecasting a 99% probability of a recession. On its face, that sounds like a scary number. But if you dig just a tiny bit deeper on their report, almost 90% of CEOs around the country believe that if a recession arrives, it will be of the “short and shallow” type. That does not make for scary headlines, so it gets buried. Those CEOs know something that the headline writer conveniently forgets to mention. Corporations also refinanced much of their debt during the last 13 years or so, locking in cheap money for many many years. This protects them from the recent rise in rates; yes those companies dependent upon short-term financing will feel the pinch, but for the vast majority of publicly-traded companies and their debt, they are shielded from the effects of rising rates. See the chart below.

As we said, we’re not blind to the risks that a recession might be approaching, so there are things we are doing and preparing for. We have recently started advising clients to trim their credit exposure in fixed income portfolios, upping the quality of the whole, as current spreads are not really compensating them for the rising potentiality of a recession. We’ve also developed a number of steps for our clients to take before and in response to any volatility arising from the ongoing debt-ceiling saga. But overall, we’re trying to keep our eyes on the longer horizon and the bigger picture. There will always be scary headlines. Our advice is to keep scrolling.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.