While the financial press painted a bleak, fear-mongering picture these past few months regarding massive tech layoffs, the real story got buried. Per usual.

The Mary Tyler Moore Show, a popular sitcom from the 1970s, has always had a special meaning to me. First, when I was 18, this New York kid headed off to college in Minnesota. Minneapolis, of course, was the setting of her show about a local TV news team. I remember warmly seeing the commemorative statue in downtown Minneapolis of Mary tossing her hat in the air, just like the opening scene of every episode when those catchy, upbeat lyrics played: “Love is all around, no need to waste it. You can have the town, why don’t you take it? You’re gonna make it after all.”

The show also had significant meaning to me because we used to watch it as a family. The seven of us felt connected to Mary, Lou Grant, Ted Baxter, Murray, and all of Mary’s lovable, if not quirky, friends, like Rhoda. But one episode, in particular, always stuck with me through the years. In it, Mr. Grant wants to do an exposé on a local politician, Charles Hartley, who he thinks is corrupt. So, Lou launches a muckraking investigation into Hartley’s personal finances, his campaign finances, and all other aspects of his life. After three weeks of digging for dirt, the whole team comes up empty. It turns out this guy is completely clean. A decent man. They’re all disappointed. But then, ever-cheerful Mary proposes an ingenious idea: why not still do the documentary about an honest politician? Some good news! Mr. Grant takes the bait.

When the final documentary is rolled out on a Wednesday night, Mary gets a large group of thirty of her friends to watch it on the TV at a local bar, ironically called Ballentine’s (you cannot make this stuff up!). But as the documentary rolls, her friends start to slink out. Everybody is bored. There are no “gotcha” moments. No scandal. No moral outrage. No shock. Even her closest friends cannot stick around to watch it. After everybody has left, Mary and Lou commiserate at the bar and conclude what everybody already seems to know about the news: “Nobody wants to watch the good things. They only want to watch the rotten things. If it weren’t for the rotten things, we’d all be out of a job.”

And that is the moral of the story for news organizations around the world. We only want to watch the rotten things. So that’s what they feed us.

The past few months have seen the financial press feeding us lots of rotten news, with horrifying headlines about large layoffs in the tech sector. Google was laying off 12,000 people. Microsoft made the headlines back in January, letting the world know 10,000 would be let go. But this was just more bad news piling on, as Meta (Facebook parent) had laid off 11,000 back in Q4 of last year, and Amazon had announced 18,000 layoffs in November.

These are eye-catching numbers, no doubt. And for those directly and indirectly affected by them, it is painful and jarring, and frightening.

But cynically, they also make for good copy, as every reporter knows. They are eye-catching, all right, and that is precisely the point.

Here’s where Mary Tyler Moore comes in. It turns out that these headlines, while true, were the attention-grabbers. It made us all read the stories, click the headline, and share with our neighbors and friends. It was pretty rotten stuff.

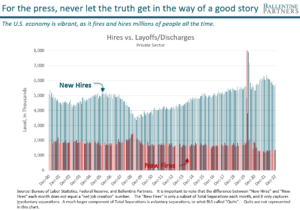

What got lost in the hysteria was that the underlying job-creating machine called the U.S. economy was still humming along just fine, doing what it’s been doing for years. See the data below from the Federal Reserve and U.S. Bureau of Labor Statistics. They keep track of job creation and layoff and discharges. The impressive “New Hire” numbers are just as eye-catching, but nary a headline.

What you see is that job creation and destruction is a constant in a vibrant economy. Yes, the creation/destruction phenomenon may occasionally tilt towards one sector vs another, but in the aggregate, the U.S. has been in strong job creation mode. Are there signs that the economy is slowing? If you ask a neighbor in Tech, the answer might be yes. Still, even that needs to be put into context, as it is highly likely that other large, mid, and small businesses will happily absorb these workers from Google, Microsoft, and Amazon.

Yes, at any one time, it’s possible that hundreds of thousands of employees might be losing their jobs. But at the very same time, hundreds of thousands are getting hired. In January alone, total employment rose by 517,000, blowing away Wall Street estimates. Sure, there were a few positive headlines, but the naysayers quickly took the mic to turn that into negative news. “It’s an anomaly.” “It will obviously get revised downward next month.” Or “Oh, no, now the Fed has to raise rates more aggressively.” And it reminded me of what Mary and Lou taught us all 47 years ago when that episode first aired, that when it comes to news, nobody wants to watch the good things.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.