As U.K. political turmoil swirled this past week and weekend, there was chatter about Boris Johnson possibly returning as Prime Minister. While that might have struck many as odd, given that he had been ousted only six weeks prior, it would not have been without precedent. Benjamin Disraeli, pictured above, actually served twice as Prime Minister in the 1860s and 1870s. Known for his silver tongue and quick wit, he remains one of history’s eminently quotable figures, with such wry beauties as: “England is governed not by logic but by Parliament”, and “There are three kinds of lies: lies, damned lies, and statistics” (often and erroneously attributed to Mark Twain).

We thought of him this week, as well, because prior to his two stints as Prime Minister, he served as The Chancellor of the Exchequer, which is the government’s chief financial minister, responsible for raising revenue through taxation and for controlling public spending. The quote above, certainly sage during his time, is meaningful today when we look at the finances of local governments around the U.S., who appear to have been listening to Disraeli’s ancient but wise counsel.

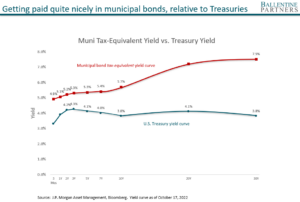

See below. The tax-equivalent yield curve for municipal bonds is looking steep and inviting relative to the U.S. Treasury Yield curve, which is flat to inverted. As a high tax-bracket investor, you could be staring at investment-grade municipal bonds which are paying you a tax-equivalent yield in the 7+%-plus range. If you are willing to assume more credit risk by venturing into high yield municipals, the taxable-equivalent yields are even more compelling.

Should we be lured by such munificent payouts? “That’s credit risk, and clearly the risk of a recession is rising,” you might say. And that would be fair. But this is where the story gets interesting, because the state of state finances appears rock-solid, at least for the foreseeable future. First, tax revenues are up due to inflated incomes (in those states with an income tax) inflated sales taxes, and rising property tax proceeds. (Remember, home prices are up materially year-over-year, and even if prices fall, tax appraisals will lag).

Second, costs have not kept pace with this rising revenue. Interest expense on municipal debt is low and manageable because so many municipalities locked in low interest rates during the last ten years. Also, see the chart below, which shows that employee labor costs, a major component of their budgets, have not risen nearly as fast as wages in the private sector.

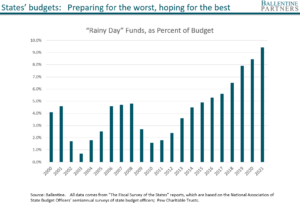

Third, the largesse from the Federal government during the COVID-19 crisis certainly put their finances on sturdier ground.

The net-net is that states and local governments are not only in pretty good shape, but they have been squirreling monies away to prepare for what some are calling the “inevitable.” If a recession were to hit, these local authorities have been preparing for years in something called their “rainy day” funds. As we stare at the latest figures, these municipalities have the highest rainy-day reserves in the history of tracking such data. In the words of Benjamin Disraeli, local authorities have done a decent job of hoping for the best while preparing for the worst. For this reason, we remain constructive on municipal bonds.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.