When the Fed started one of the most aggressive rate hikes in U.S. history, it was supposed to rein in the American consumer. And it has. But not with the vigor and speed that the Fed and the capital markets expected. The U.S. consumer has remained remarkably resilient. We think the Fed and the market underestimated the complex relationship consumers have with rates. Consider the Four I’s.

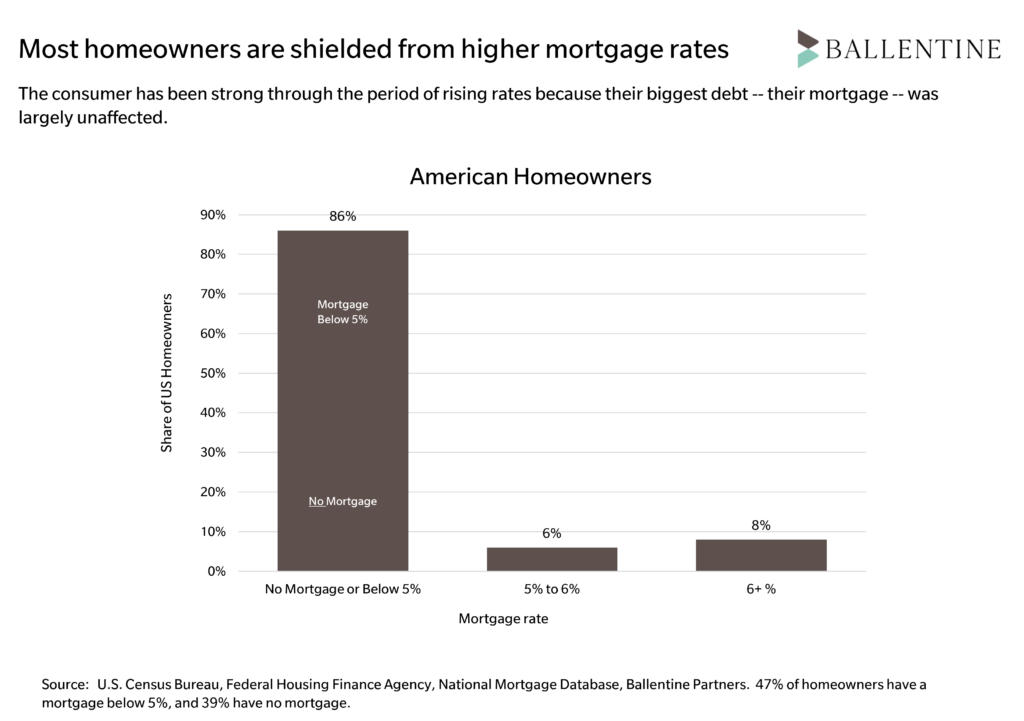

Insulation. Remember two important factoids about the American consumer. First, their mortgage dominates their exposure to debt. Yes, there are car loans and credit cards to pay, but mortgages outweigh those other loans by over 4 to 1. Second, 86% of American homeowners today are immune from today’s higher mortgage rates. A combination of historically low interest rates from 2010 to 2021 and aggressive refinancing meant that the vast majority of households today are locked into low or “no” rates (40% of US homes have no mortgage at all). The bottom line is that household debt payments, as a percent of disposable income, is still well below average. It turns out that consumers are “insulated”, that is, they are not nearly as sensitive to the rate hikes as the Fed had thought. See the charts below.

Income. Higher interest rates are also indicative of a healthy economy. Jobs are plentiful, real incomes are rising, and the unemployment rate just recorded its twenty-eighth straight month at 4% or below. Consumers – despite “mood” surveys to the contrary – are actually in quite good shape.

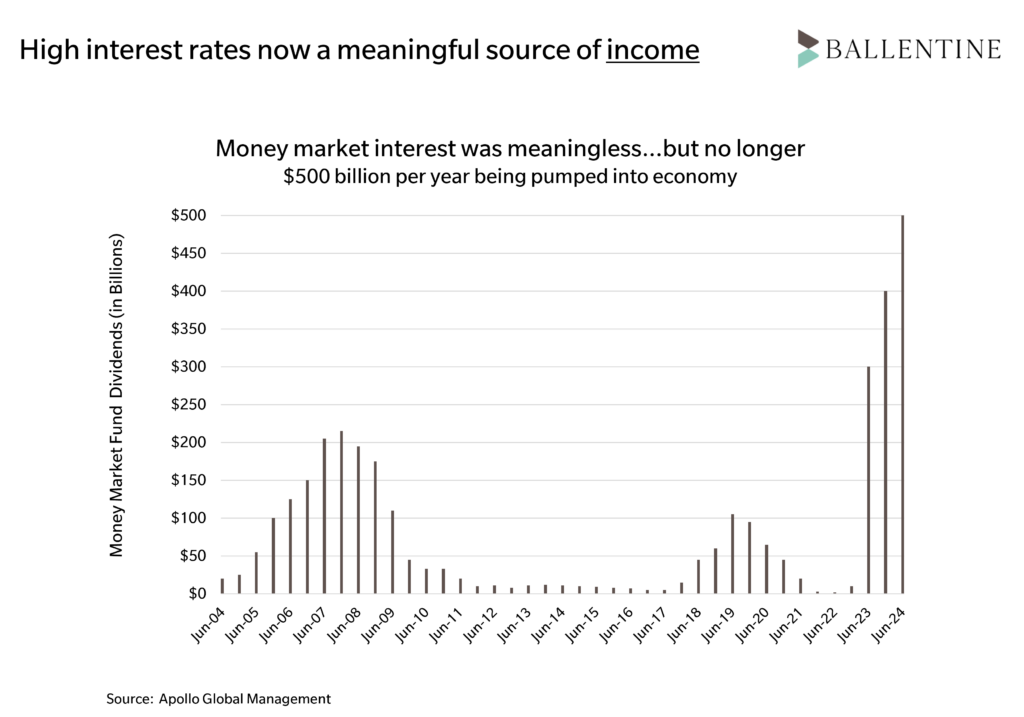

Interest Income. Finally, despite the handwringing about how higher interest rates are pinching wallets, there is a counter argument that these higher rates are also fattening those very same wallets. Unlike the 2010s, when bank CDs, and money market funds paid consumers essentially nothing, today’s higher rates are paying close to 5% or more. See the chart below, which estimates that close to $500 billion annually is getting pumped into the economy just from people earning a decent interest rate at the local bank.

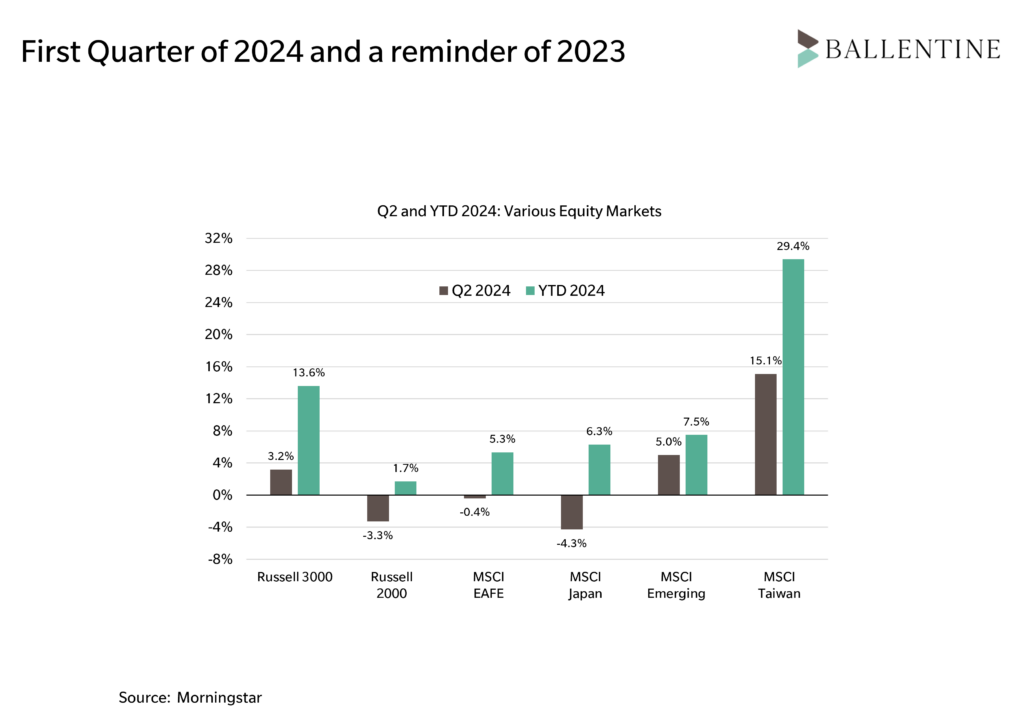

From a capital markets perspective, it was mostly a case of equity markets doing well and continuing a remarkable 2024 rally. We say “mostly” because the largest gains were isolated to US large-cap growth names, buoyed by continued Artificial Intelligence (AI) enthusiasm. Small-cap stocks and international markets lost some ground. Emerging stocks had a very strong quarter, helped by Taiwan and China, which were up 15% and 10%, respectively. See the chart below for more specifics. On balance, however, the first half of 2024 has been great for equity investors.

In the fixed-income markets, the strength of the consumer stoked fears of “higher for longer” and sticky inflation caused rates to back up a bit during the quarter. Yields on the 10-Year Treasury jumped in April (hurting bond prices), as bond managers stared at the same encouraging consumer data as equity managers but concluded that a Fed rate cut would likely be pushed out.

The other phenomenon dominating the financial news this quarter was Nvidia and the AI tidal wave of enthusiasm. It is true that the positive performance of the broad stock market has been driven by the performance of a narrow group of stocks. But here, too, we are a bit more sanguine than many. First, it is often the case that markets are pushed further by a few high-performing stocks. This has been true since the dawn of investing. Second, many are drawing parallels between the current AI excitement and the tech stock bubble of the 2000 era. The promoters of AI are guilty of some hyperbole, but our valuations today are not anywhere close to the exuberance of 2000. Growth stocks are not cheap, but their valuations are not crazy given that these companies are producing actual earnings and have been delivering better-than-expected earnings growth. It’s not the internet bubble when companies were valued on a price-to-eyeball metric.

Outlook and Strategy

We remain confident in the U.S. economy, although large durable goods purchases (think furniture) are starting to feel the pinch of higher rates. Fortunately, the economy is driven mostly by services, such as travel and healthcare, and spending in these arenas remains robust. Forecasted earnings growth also looks healthy. Double-digit growth is expected in both 2024 and 2025, an uncommon event.

From a valuation perspective, some caution is warranted. U.S. large-cap stocks are on the very upper end of reasonable ranges. We like the modest small and mid-cap tilt in our portfolios, given that these companies are trading at significant discounts to their larger counterparts.

Another worry for us remains the state of commercial real estate (which includes office buildings, multi-family housing, and retail). Remember though, that while post-COVID downtown office space is in trouble, the public REIT markets have less than five percent in office space exposure.

Any additional unexpected bad news on the inflation front — markets are already reacting to a possible Trump administration and their affection for higher tariffs — could see U.S. equities start to wobble. With the backdrop of high valuations and double-digit gains only halfway through the year, a pullback in equities would not be odd at all. Per usual, we don’t attempt to time these movements or sidestep them but instead have a well-established game plan if the markets encounter some volatility: harvest those valuable losses (i.e., tax “offsets”), rebalance as necessary, and put cash to work.

From a positioning standpoint, we maintain an overweight to US stocks combined with proportional underweight to international and emerging equities. During the quarter we trimmed a bit of emerging and added to international, simply to create a more balanced approach. Our U.S. equity allocation also reflects a deliberate tilt toward small-cap stocks, an antidote to high valuations in large-cap. In real assets, we have a bias towards infrastructure stocks and an underweight in real estate. We extended the duration of our bond portfolio modestly, thinking that we are at or near a period of declining rates. For high yield, we maintain an underweight; credit markets are paying a premium and the economy seems sound, but spreads are by no means robust at these levels.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.