Market Recap

There is an old saw in the investment business that “the market is not the economy.” This past quarter proved once again it might just be true. While the U.S. economy continued showing strength — good news, right? — This was bad news for stocks and bonds, both.

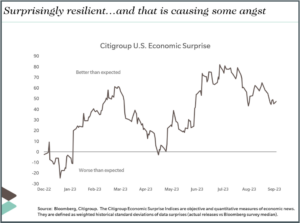

The U.S.’s economic resilience surprised many. In fact, many doomsday prognosticators officially threw in the towel during the quarter, conceding the Fed might actually be able to pull off an unlikely “soft landing.” See the chart below from Citigroup, which publishes an Economic Surprise Index. When the line is above zero, it means the economy is doing better than what a collective group of economists expected, while below the line means worse than expected. All through 2023, and especially all through Q3, the economy kept surprising to the upside.

Until July, this resilience was viewed favorably by the markets. Unfortunately, this continued strength was ultimately interpreted by the financial markets as bad news, too much of a good thing. It meant the Fed would likely keep rates “higher for longer” – crimping the consumer, slowing home purchases and home construction, and hurting growth companies whose future earnings are hurt by higher interest rates.

It also meant that the Fed might be forced to apply even more tightening, risking a recession.

Through the lens of this logic, August and September saw sizable selloffs. For the quarter, the S&P 500 recorded a -3.6% loss. The fear was felt globally, as developed international stocks (MSCI EAFE) dropped -4.1%. Emerging markets (MSCI Emerging Markets) were down -2.9%. On a year-to-date basis, global equities are still up over 10%; so while the quarter’s give-back is uncomfortable, equity portfolios have still delivered quite healthy returns so far in 2023.

Bond yields rose notably during the quarter, breaking decade-plus records. The yield on the 10-year treasury moved from 3.85% to over 4.5% (and has moved closer to 4.8% in the past few days). These are levels not seen since 2007. Mortgage rates, the same. While higher rates are good for savers, the move in rates caused some pain for current bondholders, as the Bloomberg Barclays Aggregate bond index lost 3.2% during the quarter, and muni bonds lost 2.2%.

Outlook and Strategy

We have maintained for some time that a recession, should it occur, would likely be shorter and shallower than past recessions. Our base case has not changed. We still believe that at some point, the dramatic rate hikes over the past year – historic in their speed – will tamp down spending and economic growth enough, reassuring the Fed that we are on a healthy path toward lower inflation. The data certainly paints that picture. But we also knew it would never be a straight line; economic data always move in a herky-jerky fashion. And that is what triggered the second-guessing and uncertainty, and, ultimately, volatility of the third quarter.

But our base case also has to contemplate some uncomfortable realities. Home prices have remained stubbornly high, wages appear sticky, labor has found a new assertiveness, and oil prices have materially surged in the past few weeks. This will put continued pressure on CPI and other inflation indicators, possibly forcing the Fed to do even more. The benign “soft landing” or even our own slightly more conservative “short and shallow” base case is far from a sure bet. The Fed could overreach. It would not be the first time.

From a positioning standpoint, we remain largely in line with client target allocations to equities. We’ve maintained an overweight allocation to U.S. stocks along with a modest underweight to developed international equities and a neutral view of emerging markets. Our U.S. equity allocation also reflects a slight tilt toward small-cap stocks, which have lagged in this year’s rally but appear quite inexpensive in relative terms. We are in the midst of a research project exploring whether to allocate even more to this “cheap” asset class; by many metrics, small and mid-cap stocks are the cheapest they’ve been in over 20 years. In real assets, we are biased toward infrastructure stocks, and an underweight in real estate. Further, we are watching rates with great interest and investigating whether it might be time to move out our maturities and duration, given the sizable moves in yields. Last quarter, we trimmed our High Yield overweight, mostly as a defensive move in the event our base case proved wrong. We maintain this position; credit spreads are paying you a “normal” amount against a backdrop of above-normal risk, and our belief is that credit risk should command additional compensation.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.