“It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.” -Harry S. Truman

I remember my father telling me about this quippy line above from Harry S. Truman many years ago. I thought of it often during some of the nasty recessions my peers and I have lived through over the decades. I’m thinking a lot about the quote right now as the financial press keeps wondering when and how horrible the next recession is going to be. Who am I kidding? According to many, we are already in one! But Truman’s famous line made me wonder, what do you call it when your neighbor is quitting his job? Because that certainly does not sound like a recession or depression to me. Not by a long shot.

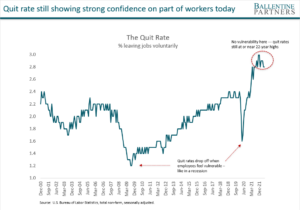

The typical recession playbook for employees is pretty straightforward. Workers instinctively know to “keep their heads down”, stop their complaining about working conditions, and simply be thankful for their paycheck. The last thing on their mind is quitting their jobs because they’re just so thankful to have one in the first place. That most certainly does NOT describe today’s environment. See data below from the Bureau of Labor Statistics. The data is from a package of employment-related surveys called JOLTS (Job Openings and Labor Turnover Survey) reports. One item they track is the number or percent of employees that are voluntarily leaving their job. That’s right, they’re quitting. As you might guess, the “quit rate” drops significantly during a recession when employees feel the most vulnerable. Conversely, when employees are feeling more confident, that’s when we see a tick up in the quit-rate. See where we are today? It’s one of the highest readings we’ve seen in over 20 years. If we are in the middle of a recession, employees did not get the memo.

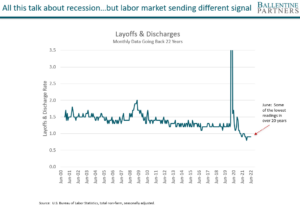

The other part of the playbook during recessions is from the employer perspective. No surprise, a recession — slackening demand — means that sales are slowing down, earnings might be at risk, and growth is stalling or reversing. So companies start to lay off their employees. It’s as old as time. But now look at another interesting data point from the JOLTs report on layoffs and discharges. The first thing that pops off the page, obviously, is the big spike in layoffs when COVID first hit in the early part of 2020. As you might have expected, as global economies saw both supply AND demand fall off a cliff, the layoff numbers jumped dramatically. That’s not the point of the slide, however. Look a bit closer at the latest reading from just a few days ago. The layoff metric is the lowest we’ve seen in nearly a quarter-century. Further, just this past week, U.S. payrolls jumped by 528,000 new jobs, more than double the consensus estimate, bringing unemployment to 3.5%, tying the lowest rate since 1953. If a recession is imminent, employers didn’t get the memo, either.

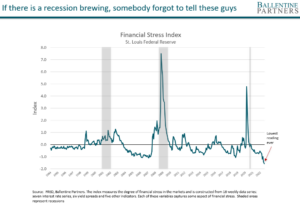

The final part of a recession playbook has to do with the inner workings of the financial system, itself. Typically, we begin to see stress — as measured by any number of metrics like credit spreads widening, liquidity drying up, etc. The Fed has even created a composite metric that tracks the level of financial stress; it’s literally called the Financial Stress Index and it tracks 18 weekly data series, trying to discern if there’s trouble a-brewing. That stress metric is the lowest reading ever recorded, going back to 1984. If a recession is looming, the Fed didn’t get the memo either.

In all fairness, many labor and financial stress metrics are lagging or co-incidental indicators, that is, they are mostly rear-view and current-view metrics. They are not as useful for forecasting and therefore will likely miss any rapid reversal of fortune. So, we must all continue to be “on watch” for other potential signs of a recession hitting our shores. And we here at Ballentine Partners are just as aware as you are about the tightrope that the Fed is walking right now in trying to tame inflation without triggering one of those nasty recessions from Mr. Truman’s darkly humorous quip. But we should also take a moment to breathe — and tune out the cacophony of ranting heads on CNBC and alarmist headlines from the financial press. Even if a recession is imminent or even inevitable, there are just as many reasons to believe that this one may be short and shallow. Balance sheets for corporations, U.S. households, and municipalities around the country are the strongest they’ve been in decades. And per this little post, the labor and liquidity markets are telling us to take a breath, as well.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.