After 12 years of polite incentives – the carrot approach – to get better stock returns out of Japanese companies, the Tokyo Stock Exchange is finally breaking out the stick. And it just might work.

For the past 12 years, Japanese policymakers have endeavored to break the country out of a long financial malaise dating back to the 1990’s. Deflation, a rapidly aging population, and an ingrained economic pessimism have created a formidable structural challenge which has proven hard to overcome. An ambitious program of economic policies known as Abenomics (after former prime minister Shinzo Abe) has put forward many reasonable solutions. A key pillar: structural reform of Japan’s inefficient corporate practices. Abenomics created many incentives for companies to shed unprofitable businesses, add independent directors to their boards and encourage M&A activity – offering “carrots.” While those have modestly improved Japan’s corporate efficiency, it has not translated into improved stock market performance. Last year, however, the Tokyo Stock Exchange changed tactics, shifting to the “stick.” The exchange “named and shamed” companies trading below their liquidation value and required concrete policies to raise their valuations. Unlike past carrots, this new stick approach is directly tied to stock prices. And it just might work.

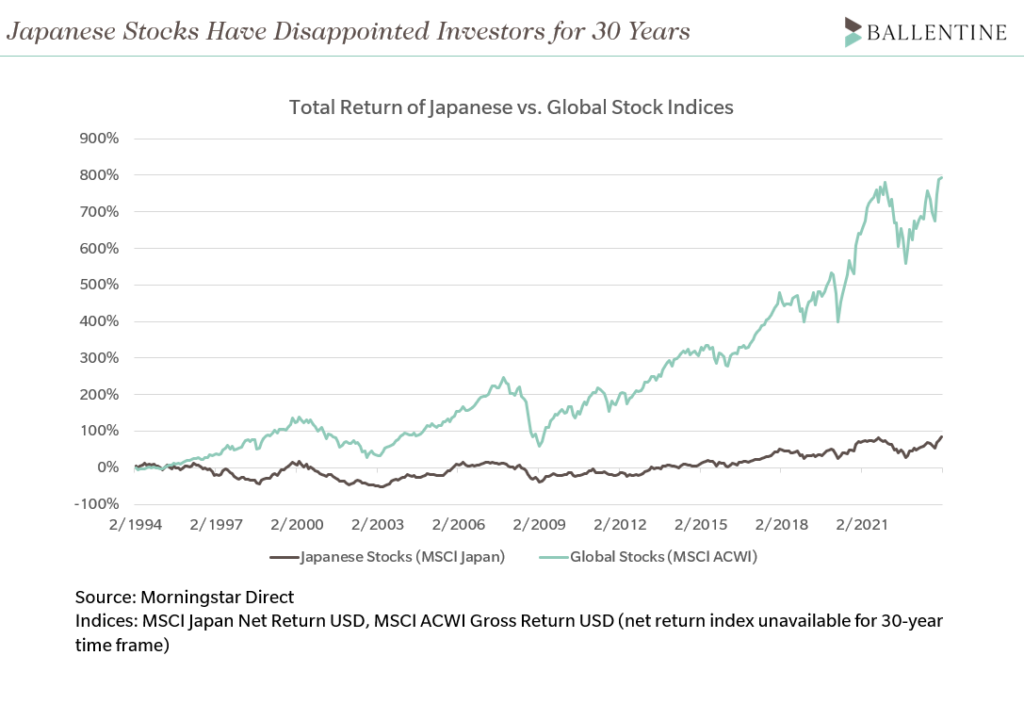

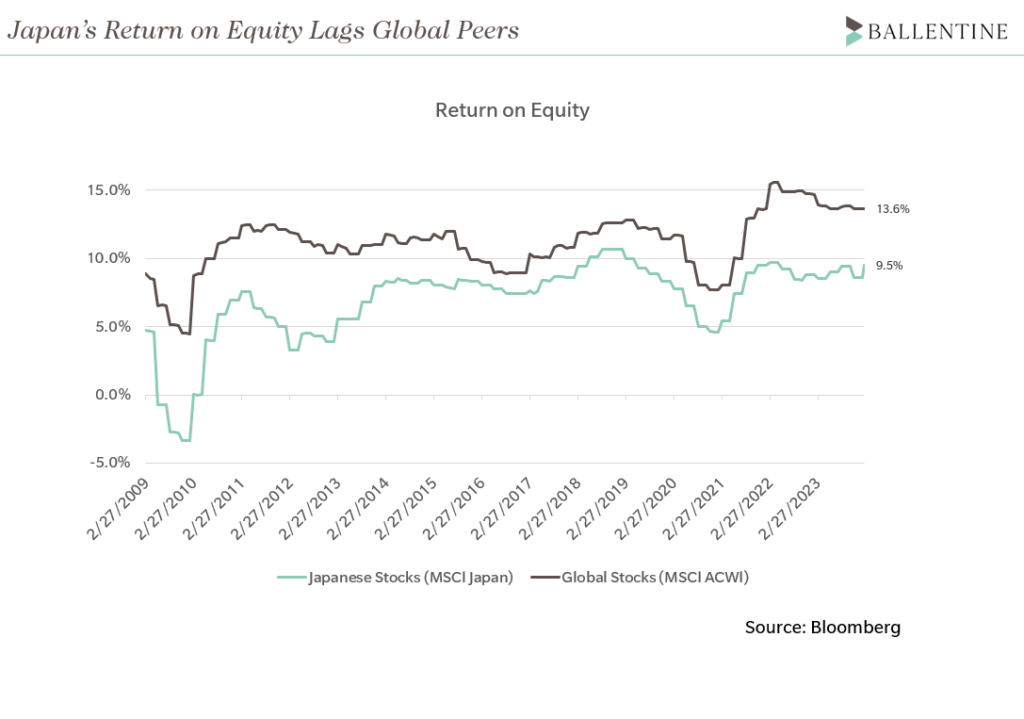

Japan has confounded investors for decades. On one hand, the island nation is renowned for its manufacturing and engineering prowess; its auto industry boasts two of the three largest automakers in the world by market share. Yet this operational success has not translated to investment success. Japan’s corporate culture lacks the laser-focus on shareholder returns and profit-making that is so commonplace in the United States and other developed nations. As such, Japanese companies tend to be less profitable and efficient than their peers. Japan’s return on equity, a measure of a company’s profits relative to its equity value, falls well below global market averages.

Abenomics employed the carrot approach for the past 12 years – incremental incentives and policies aimed at reforming corporate governance. But the Japanese stock market has continued to disappoint, underperforming global markets by 2.5% per year since the beginning of 2012.

Enter the stick. These new exchange requirements are finally sparking action. How? In a word, buybacks. 2023 saw record buyback announcements totaling 9.6 trillion yen across over 1,000 listed companies per Nikkei Asia. Japanese companies are sitting on a substantial pile of excess cash to the tune of 1trn USD – plenty of ammunition for further expansion of buyback programs.

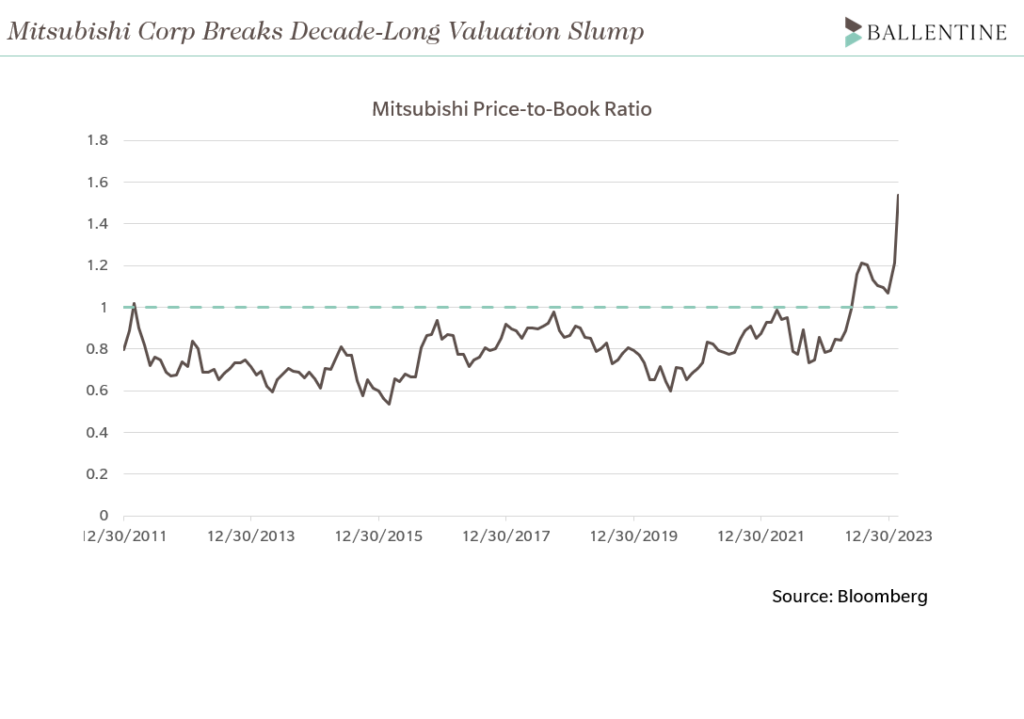

A concrete example: Mitsubishi Corporation, a large Japanese conglomerate that deals in businesses ranging from commodities to consulting to heavy machinery. The company’s price-to-book ratio languished below 1.0 for 12 straight years. In response to “the stick” and activism from global investors, including Warren Buffett’s Berkshire Hathaway which has taken positions in several large Japanese conglomerates, the company announced repurchases in 2023 and 2024 accounting for 6% and 10% of shares outstanding respectively. The market has since rewarded Mitsubishi with its highest price-to-book ratio in 16 years and its stock price has more than doubled.

As companies like Mitsubishi reap the rewards of better corporate governance, their peers cannot help but take notice – which may be developing into a trend for the broader Japanese market. MSCI Japan’s price-to-book ratio has risen from 1.27 to 1.46, the highest it’s been in over a decade. Japanese stocks also outperformed global markets on a total return basis since the start of 2023, returning approximately 26% vs 23% for the global MSCI ACWI Index.

At Ballentine Partners we are always on the lookout for “down and out” market segments that experience positive fundamental changes. Often when stocks are cheap, it only takes a small step in the right direction to spark strong returns for investors. On the other hand, we are always wary of thinking “it’s different this time.” But this shift in Abenomics policies from the carrot to the stick may well be the long-awaited catalyst to break Japanese stocks out of their long slumber.

About Andrew Hacker, CFA, Research Manager

Andrew is a Research Manager at the firm and is responsible for research coverage of global equity markets. He is responsible for portfolio construction and manager selection for publicly traded equities and digital assets. His research also contributes to our overall market outlook.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.