It may seem illogical on its face, but it is almost always true. Nasty and painful drawdowns are not a bug of equity markets, they are a requisite feature.

I remember getting extremely irritated once when I read an innocuous newspaper quote from a thoughtful investor, academic, and well-regarded practitioner. I had studied under him at graduate school, followed his work for many years, read all his articles and his white papers, and saw him speak eloquently at industry conferences. And what he said, I’m sure to your ears, would not be anything particularly offensive or off-putting: “Despite equity markets having occasional painful drawdowns, equities tend to be very good assets to hold in the long term.”

Why was I so irritated?

OK, bear with me, because I know I’m about to sound hyper-critical and “looking-for-a-fight” persnickety.

It was his use of the word, “despite.” Why was I reacting so strongly? Because it undermined an important understanding of why equities, in the long term, exist as capital markets financing tools and why they are such awesome investments. It’s not despite their shorter-term drawdowns. It’s because.

This is no small distinction. It speaks to the heart of what we mean by risk and compensation for risk. His quote seemed to imply that if it weren’t for those annoying and painful episodes, stocks would be great. I disagree. It is precisely because of these annoying and painful episodes that stocks NEED to pay you so well, ultimately. You get awesome returns from stocks not because they’re nice guys — those awesome returns are paying you back for all the headache and heartache they can put you through in the short term. You don’t get one without the other.

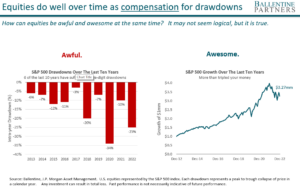

Equities are awful. Equities are awesome. It may seem illogical, but this statement has to be true. The past decade is a perfect example. Please look at the charts below. The one on the left is showing the intra-year drawdowns of the S&P 500 from 2012 to 2022. Through this lens, stocks were awful this past decade. They suffered an official bear market -20% drawdown in 2018, followed by a gut-wrenching swoon of -34% in 2020, only to cap off the decade with another heart-attack inducing intra-year decline of -25% in 2022. In fact, of the past ten years, six of them put investors through double-digit intra-year declines. Pretty annoying and pretty painful if you were living through it.

Through a very different lens, however, the past decade for the S&P 500 has been awesome. This basket of stocks compounded your wealth at almost 13% annually for the full ten years. In other words, any money you had in this basket would have tripled over this time frame. The past ten years rank up there as one of the better decades on record. And that’s pretty awesome.

How can this decade be both awful and awesome in the same breath? Easy. That’s how it works.

Let’s be clear. We are not just talking about the awful volatility of equities. That is just one small component of risk. Equities are awful not just because they can go down, but because they can go down at precisely the time you don’t want them to, as Ben Inker, a former colleague of mine, used to remind us all. Drawdowns don’t happen in a vacuum. Often, when stocks go down, it’s associated with a recession, that is, it’s happening exactly when you might be losing your job, your health benefits, your ability to pay for your kids’ college tuitions, your self-confidence, and your sense of purpose in life. Financially, losing your job during a down market means you may need to tap into your investment account at exactly the moment when you should not be doing so. For almost anybody at any stage in life, as we learned so painfully in 2022, stocks can go down just as inflation is rising – in fact, stocks went down because of rising inflation – so you are hit with wealth destruction AND rising costs. Elsewhere, stock market declines can trigger the drying up of venture capital and private equity financing, so other parts of your investment portfolio and business dealings are dragged down in concert.

In other words, it’s not just that stocks go down that can make them awful, it’s that usually a lot of other awful things are simultaneously happening in one’s personal, professional and portfolio’s life that are compounding the problem. It’s not a double whammy. It’s a triple, quadruple, quintuple, etc. whammy.

That’s a pretty bleak picture I’m painting for stocks, I know. But that’s the point. In order for you to feel compensated for all that pain, stocks better make it up to you, and how! And that is exactly what stocks do, better than most asset classes. They are powerful wealth-builders and wealth compounders. Over time, cash and bonds cannot hold a candle to the awesomeness of stocks. But it is worth reminding ourselves once in a while that the awful periods of stocks – like the really nasty drawdowns of 2018, 2020, and 2022 – are not a bug of the equity markets, they are a requisite feature.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.