Q1 2025 Market Review (with Early April Commentary)

By most measures, the start of the first quarter of 2025 painted a picture of positive economic momentum and optimism. Growth remained solid. Unemployment hovered near 60-year lows. Real wages were rising. Corporate earnings were on track for double-digit growth. Margins were historically high. CEO and small business optimism was notably improving. Investors were happily anticipating the promise of AI, infrastructure build-outs, and the new administration’s promise of lower taxes and a business-friendly regulatory environment. Equity markets reflected that optimism—the S&P 500 posted almost a +3% return in January alone, continuing the rallies of 2023 and 2024 that produced back-to-back 25%+ annual gains.

From Optimism to Uncertainty to Sheer Panic

And then it turned.

Markets hate many things—high inflation, rising rates, recession risks—but the uncertainty of tariffs, as it turned out, trumps them all. On February 19, the Trump administration surprised markets with a sweeping set of tariffs targeted at our three largest trading partners—larger in size, broader in scope, and announced in an erratic manner that the markets found unsettling.

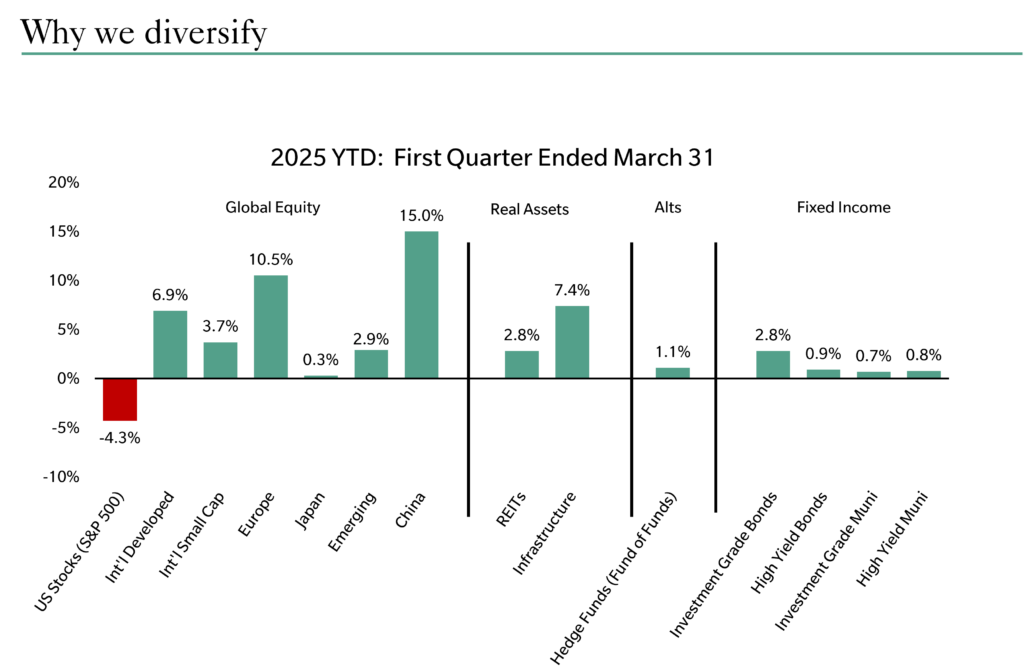

By quarter’s end, here’s what some of the major asset classes around the world looked like. See chart below. I will acknowledge straight away that the numbers below are woefully outdated. Providing more up-to-date measurements for this letter seemed futile given that markets are shifting rapidly day by day, or more accurately, minute by minute. (For example, just this past Monday, April 7, the S&P 500 rallied 8.2% in 17 minutes). Do recognize, however, that the general direction has been down since the April 2 announcement of a more expansive – in terms of who, what, and how much – tariff list. The reaction to this list was swift and severe. In the first week of April, the US sell-off gained steam and approached bear market territory. Per the chart, non-U.S. markets entered April in decidedly better shape, but they, too, have sold off. International markets, as of this writing, are down a little over 1%, so they have still provided some diversification benefit.

Source: Standard & Poor’s, MSCI, FTSE, DJ Brookfield, Bloomberg, ICE BofA, HFRI. Any investment can result in total loss. Past performance is not necessarily indicative of future performance.

No matter the time frame, implementation of the full impact of the tariffs proposed by Trump has ignited fears of a global trade war, surging inflation, and a material growth slowdown. While the hard economic data has yet to emerge, higher levels of uncertainty have.

Tariffs are not the law of the land. They are Executive Orders, created with the stroke of a pen. They can be reversed just as easily by either the current or next president or by an act of Congress. Trump, himself, has already signaled that if he gets an attractive deal, tariffs could be amended or removed entirely. To the degree that they are being used as impermanent negotiation tools, open to revision or removal, no reasonable CEO is going to make long-term commitments. Put yourself in the shoes of an American company that imports its products or component parts from overseas. What manufacturer would reasonably spend millions or billions building an onshore facility if the rules of the game might change in the next 24 hours, 24 days, or 24 months? It’s just not logical. CEOs will invest in new plants only if they believe that the tariffs will endure for years and years. Who earnestly believes this?

I came across an interesting commentary this week from an investment strategy consultant:

In 1519, when the Spanish Captain, Hernan Cortes, landed on the shores of Mexico he famously ordered to “burn the boats” to prevent his men from turning around. To get manufacturing back to the US, the “boats” of globalization have to be burned – meaning the administration has to convince investors that they are permanent (which I am not quite sure is even possible). Otherwise, it’s best to declare victory and get back on the boat. – Dr. Claus te Wildt

World leaders, CEOs, investors, and economists are whispering into the administration’s ear. The markets are screaming it. There has to be a better way.

Our base case – as of today and certainly open to revision given the fluidity of unfolding events – is that the administration will eventually negotiate terms over the coming weeks – deal by deal – in return for valuable concessions. The president will get some wins – some of them deserved – and declare victory. Some tariffs will remain but likely in a more measured and targeted structure. In the meantime, volatility will continue.

[Note: Our investment team is also thinking through other scenarios. Our bear case includes prolonged uncertainty and escalated retaliation from all of our trading partners. A full trade war. And a recession would likely follow. Given the sheer level of uncertainty and dependence on the decisions of just a few powerful individuals, it is difficult to attach a probability to this scenario, but it is not our base case. In this scenario, it becomes more likely that the Fed would lower interest rates and fight the recession fight vs. the inflation one. There are other investment strategies we might consider employing such as extending the duration of our bond portfolios or leaning into more defensive sectors of the market.

Our bull case assumes tariff negotiations actually lead to trade liberalization. In other words, the credible threat of tariffs ultimately brings our trading partners to the bargaining table in earnest, eager to make meaningful concessions: reducing unfair trade practices, halting currency manipulation, and removing tariffs on our U.S. exports if we do the same, so-called “zero-for-zero” tariffs. There have already been rumors and rumblings of such agreements, but it is too early to say. In this more bullish outcome, stock markets would likely experience a rapid V-shaped recovery, credit spreads would rally, and risk assets, generally, would rise in anticipation of above-average economic growth.]

What NOT to do

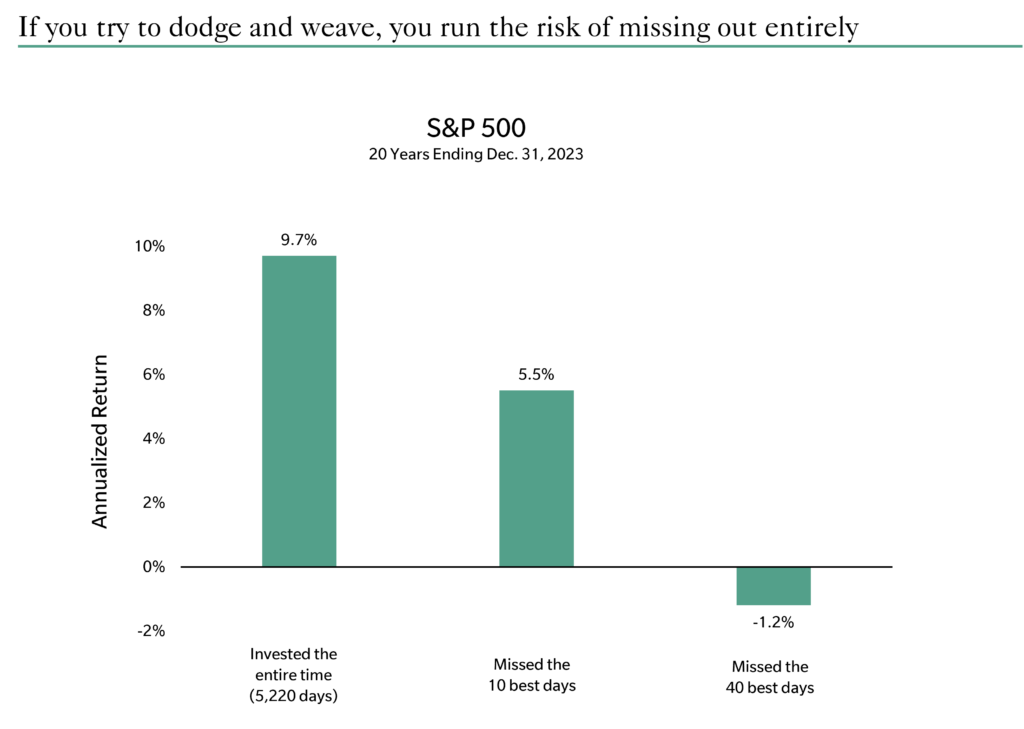

First, what NOT to do. Don’t attempt to dodge and weave by selling large chunks of equities and moving to cash. This advice is not borne out of an uncaringly stubborn or dogmatic view of what’s happening to your portfolios. Quite the opposite. It is borne out of humility and experience. We are highly skeptical of any investor’s ability to make two successful timing calls: when to get out and when to get back in. Investors playing this game run a much higher risk of missing out on the whole reason for investing in equities in the first place. See the analysis below. It shows the danger of missing out on just a few strong daily rallies. (P.S. this analysis does not even account for the huge taxes paid for jumping out of the markets). No, it is far more prudent to stay invested.

Source: JP Morgan Asset Management. Past performance is not necessarily indicative of future performance. All performance numbers are pre-tax, yet trading activity would likely have resulted in even lower after-tax returns.

Market volatility will continue to be painful…but, if this is of some comfort, not unusual. Over the past decade, the U.S. stock market has tripled your money. But nearly every year included painful double-digit intra-year corrections. The drawdowns we are all experiencing today are not the exception to the rule. They ARE the rule.

What to do

Keep calm and carry on. Our portfolios are intentionally resilient, designed not around one scenario but around many. That resilience stems from:

- Global equity diversification across sectors, regions, and factors. While U.S. equities are absorbing the brunt of the selloff, other parts of the world are holding up better.

- Diversification beyond equities, into real assets, alternatives, and private markets when appropriate.

- Fixed income buffers that offer ballast during periods of risk-off behavior.

Our playbook on what to do:

- Tax Loss Harvesting

For taxable investors, we will be looking to actively tax-loss harvest your portfolios. These “banked” losses can offset future gains, significantly reducing tax burdens.

- Continuing Dollar Cost Averaging (DCA)

For clients in a DCA program, we are sticking to the plan; in some cases, we’re even accelerating purchases, taking advantage of lower valuations.

- Rebalancing Opportunistically

Market volatility allows us to rebalance portfolios more tax-efficiently.

- Opportunistic Private Market Positioning

Many of our private equity and private credit strategies are resilient. And they are purpose-built for moments like this:

- Some provide mission-critical services to government, defense, and public safety agencies—demand that remains stable through cycles.

- Others are designed to invest in distressed or dislocated markets, where price volatility creates opportunity.

- Reminding Ourselves: Equities Can be Awful Short Term and Awesome Long Term.

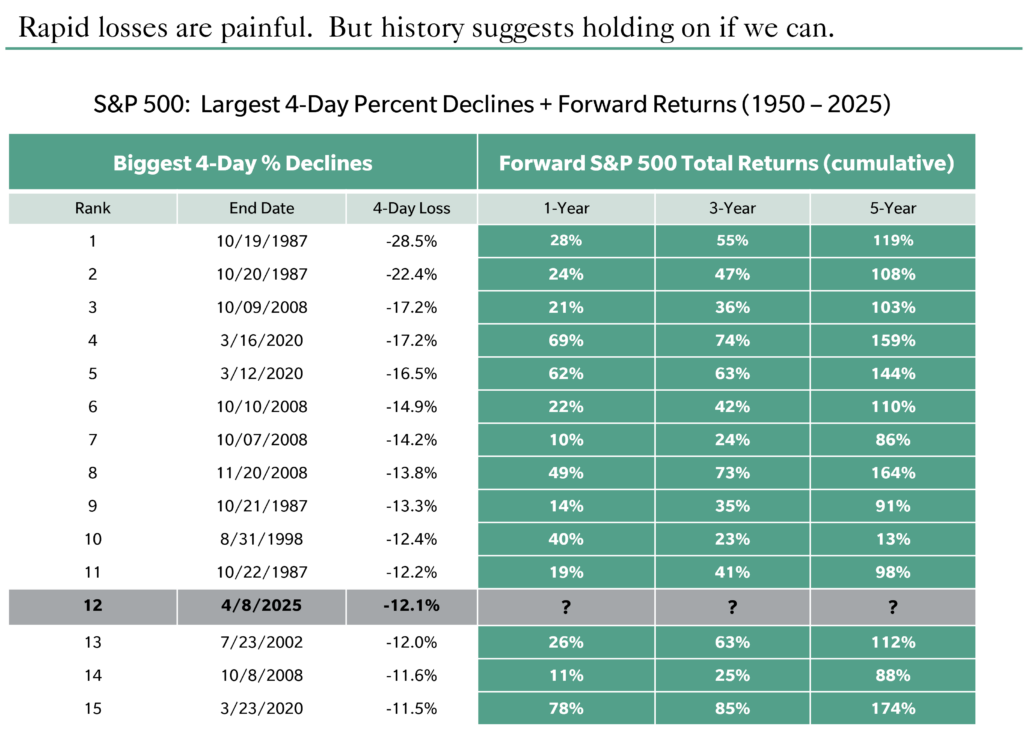

Equities can make your stomach turn in the short term. The key is holding on. We have seen terrifying headlines about the recent 4-day decline being one of the worst in modern memory.

Research, however, shows how important it is to hang on after these 4-day episodes, as markets tend to recover. See below.

Source: Creative Planning. @CharlieBilello

Closing thoughts

One of the greatest investors and innovators in the investment management industry was John Bogle, the founder of Vanguard. I often think of his advice, especially during frightening moments like we’re all experiencing today.

We are certainly not just “standing there.” There are many things we’re doing to take advantage of the market sell-off. But the spirit of his advice rings true: Don’t do anything large. Don’t do anything rash. Don’t sell because you’re nervous. These actions are both imprudent and ill-advised. This advice is true for all investors but particularly poignant and meaningful for taxable ones. Every trade. Every rebalance. Every tactical move. They can all trigger capital gains taxes that eat away at precious returns. Taxes are permanent impairments of capital. Market fluctuations are merely temporary.

As always, reach out to your advisory team if you have questions or would like to discuss positioning.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.