Last week, I thought for sure there would be headlines in the Wall Street Journal or on the cover of Barron’s. But nothing. I thought for sure that Jim Cramer, on his CNBC show, would be pushing his red House-of-Pain noise-making button. But nothing. I thought for sure that when I did a Google search, I’d find 14 million “hits” surrounding this fateful day in history. But still nothing.

What are we talking about? A lost decade for bonds, that’s what. Sure, there were a few headlines about bonds having a tough quarter, but nothing about the real story.

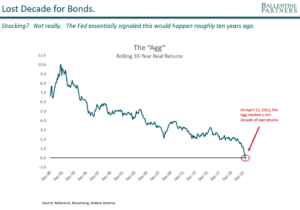

See chart below. On April 11, last week, the 10-year rolling real (inflation-adjusted) return for the Bloomberg U.S. Aggregate Bond index — the largest, best-known index representing U.S. investment grade bonds and commonly referred to as the “Agg” — turned negative1. While the 10-year annualized returns had been trending down for some time, the recent jump in bond yields (and the damage they inflicted) plus rising inflation finally pushed that number into the negative zone. So that chart is correct. We just recorded a lost decade for bonds. Yet nary a whisper in the news.

Further, when I ran up and down the hallway of our headquarters here in greater Boston, waving this chart, my colleagues were remarkably calm. As it turns out, they had rarely used the Agg in their client portfolios over this time frame. Why? First, and obviously, our clients are taxable investors. Municipal bonds had formed the “core” portion of clients’ bond portfolios, as muni bonds have offered much better tax-equivalent yields throughout most of this decade. Second, to their credit, the Ballentine team had been leaning into other exposures not even included in the Agg index like TIPs, floating rate, other types of credit, and other forms of alternative bond offerings, where and when appropriate. My colleagues weren’t surprised by this historic news because they had been steering clients away from the Agg for a long, long time.

Over the last decade, however, we have witnessed most investors doing the exact opposite. The Agg was all the rage. First, it is and remains the best-known bond index, bar none, sort of like the S&P 500 for bonds. Second, flows into the Agg (and its ilk) over the last decade have been substantial. Industry observers have pointed out that in recent years, more than 40% of all bond fund flows have gone into passive Agg funds and ETFs. Six of the ten largest bond funds in this country are actually passive replicas of the Agg. The U.S. Department of Labor has essentially endorsed the passive Agg for literally tens of millions of U.S. workers as the appropriate default bond investment in their employers’ 401(k). So, not only have millions upon millions of employees bought the Agg over the past ten years, but their employers, and even an arm of our own Federal government2, have been telling them to buy more as they approached retirement. Talk about buying high and selling low!

Now, were my colleagues here at Ballentine Partners brilliant? Maybe. They are all a bit modest here, so they would prefer to think of themselves as “prudent” rather than brilliant. More importantly, they would have pointed out that this lost decade had been foreshadowed.

How? Did they have a crystal ball? None required. To estimate what the expected real return of the Agg was going to be back in April of 2012, you only needed two items: first, the nominal yield on the Agg and second, a market expectation of inflation, 10 years forward. Anybody could have done this simple calculation. On April 11, 2012, the nominal yield on the Agg was hovering around 2.1%. Check. The 10-year breakeven inflation rate3, a readily available indicator of long-term inflation expectations, back on April 11, 2012, was 2.3%. Check. Subtract the inflation expectation from the nominal yield and you get the expected real rate of return for the Agg of -0.2%. On that day back in 2012, anybody who bought the Agg should have expected, ten years hence, a negative real rate of return, i.e., a lost decade. And that is exactly what happened.

The other reason why nobody should have been surprised is that the Chairman of the Federal Reserve at the time, Ben Bernanke, basically told us this was going to happen. It was not some smoke-filled back room deal amongst unsavory politicians. Nor was it some nefarious plan buried deep in arcane Fed meeting minutes and obfuscated by policy-wonk speak. It was in plain English, for all to see, written by Bernanke in an open editorial in The Washington Post on November 5, 2010. He told us exactly what he was going to do in the coming years. The strategy was relatively straightforward. He was going to make holding cash and traditional bonds so miserable (by driving down their yields) that investors would be forced to look elsewhere for any decent returns – credit, high yield, muni’s, alternative, other risky assets, etc. Ten years later, this lost decade should not be a surprise. Bernanke essentially told us it was coming.

Why are you bothering me with this bad news?

Look, there’s nothing you can do about the past decade. So why are we even talking about it? It’s water under the bridge, right? Well, yes and no. It matters because that simple math we did a minute ago still paints a similarly sober picture for the coming decade. Nominal yields on the Agg stand at 3.1% today. The Fed’s long-term inflation expectation metric stands at 2.9% (yes, we know inflation has been running significantly hotter recently, but it is expected to settle down over the coming decade). The expected real rate of return for bonds, then, is 0.2% – essentially nothing. And any surprise increases in inflation – like a worsening war in the Ukraine, longer-lasting supply chain issues, sustained higher oil prices, or any spiraling wage hikes – would only make the math worse. Another lost decade is not only possible, it’s actually quite probable.

Does this mean that you should sell your Agg and all your bonds?

Absolutely not! While bonds will likely deliver lower-than-average returns going forward, they can still play an essential role in your portfolio. They will still likely act as effective recession or depression “insurance.” Secondly, bonds are still providing income, key to many investors. Third, with yields rising recently (i.e., bond prices coming down), investors are indeed looking at better priced bonds today than they were 10 years ago. And finally, investment-grade bonds will always play an essential role in providing liquidity, especially when you need it the most. So, again, we are not recommending a complete elimination of bonds, as they play a vital role in your total portfolio.

Creative thinking is still needed.

Our advice on the Agg ten years ago was good advice: avoid it or look different from it. Today’s situation still calls for continued creative thinking and thoughtful portfolio construction. Markets will continue to be tricky to navigate, so we’d like to suggest strategies that we have been sharing with our own clients for some time now.

- Own less than a normal amount of bonds. The same risks always exist for bonds. The analysis, however, should always be: am I being compensated for taking on those risks? And today, you are most definitely not being compensated as well as you should be. So if you hold a “normal” amount of bonds today (like 40% in a normal 60/40 mix), it would be completely reasonable to consider shaving some portion of your bonds to look for a better risk-return tradeoff. The magnitude of the reduction will depend on your situation, liquidity needs, risk tolerance, outside holdings, and time horizon. We are not out of the woods.

- Shorten the duration of the bonds you do own. Another strategy which we have implemented for our clients and continue to do today is to shorten the duration of the bonds, as the same logic holds as above. With the yield curve so flat today – the yield on the 2-year Treasury is only slightly below the 10-year — it makes sense to shorten the duration of the portfolio. In other words, you’re getting paid roughly the same return with shorter bonds but with significantly less duration risk.

- Municipal Bonds. While a slightly different animal altogether, muni bonds and their tax-exempt income streams still have a better risk-return tradeoff today. The nominal yield on a 10-year muni index is over 2.5%. But for high tax-bracket investors, that translates into a tax-equivalent yield close to 4.1%, well above future inflation expectations from the Fed’s metric. If you live in a high-tax state like California or Massachusetts or New York, the math gets even better.

- Corporate Credit. Trading duration risk for credit risk is certainly worth consideration today, given the general good health of corporate balance sheets. Since the Great Financial Crisis of 2008, companies across the planet have taken advantage of historically low rates to get their balance sheets in order — that is, they have refinanced any existing debt at much lower rates, which is good for them and potentially good for you as a creditor. Secondly, in an inflationary environment, the bad news for bonds is balanced somewhat by the fact that these companies are enjoying higher inflated revenues: while their bond payments stay fixed in nominal terms, their cash flow is improving, thus reducing their risk of default. We are finding all sorts of opportunities in both public and private credit markets where we deem the risk-return tradeoff better than a traditional Agg.

- Floating rate bonds. Not all bonds have that “fixed dollar” payment structure. There are also bonds that have a floating interest rate, so that as rates go up, their payments to you as an investor also go up, thus reducing the duration risk of the bond. We should be clear that we are trading duration risk for more credit risk, so how much to own is unique to your situation. It’s important to work with an advisor on how to balance these trade-offs.

- Alternatives. If you can, this is also a time to consider an allocation to an Alternatives portfolio, which is what we are doing for our clients, where appropriate. Alternatives is a big umbrella, and it can encompass a number of different underlying strategies. For us, though, we are looking at unique types of credit risk that seem to have little to do with the general level of interest rates or are largely uncorrelated with the general economic cycle. These bonds tend to focus on more idiosyncratic money-making opportunities, such as infrastructure debt, litigation finance, and royalty finance. If these bonds sound a bit more esoteric, they are, but this is what we mean by needing to think out of the box at this challenging juncture in interest rate history.

As you can see, many of the above items are not “safe” U.S. Treasuries. But the lost decade for the Agg – 40% of which is composed of Treasuries — is a harsh reminder that these low interest rates, engineered by our Fed and central banks around the world, have rendered supposedly safe Treasuries quite unsafe in inflation-adjusted terms. That’s why Agg investors, even without Cramer’s House of Pain red buttons getting pushed, will likely be hurting some more.

1 On April 11, 2022, the Bloomberg Barclays Agg recorded a 10-year annualized return of 1.97% while CPI’s 10-year annualized rate was 2.05%.

2The U.S. Department of Labor has been a strong advocate for low-cost target-date funds as the default 401(k) choice for employees, which tend to use passive bond replicas of the Agg. Further, as an employee ages, he or she is almost always allocating more to these passive Agg funds.

3This number is available at the Federal Reserve web site: https://fred.stlouisfed.org/series/T10YIE

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.