A likely slowdown in bank loans after the Silicon Valley Bank collapse, easing wage pressure, and housing prices falling for the first time in 11 years all point to an inflation slowdown. But not enough to the Fed’s liking. Which means, ironically, that the pain of higher interest rates will continue until we can all breathe a little easier.

Silicon Valley Bank’s collapse was the second largest in U.S. history and is most likely going to lead to tighter credit conditions around the country. Inflation numbers, generally, were moving in the right direction, and many logically argued that the banking crisis could act as a further brake on the economy. This past week’s data also showed that housing prices fell (year over year) for the first time in 11 years. Core PCE, the Fed’s preferred method of measuring inflation, was lower than consensus estimates. So Chairman Powell had a choice: ease up on his ferocious and furious string of rate hikes and let the tough medicine work its way through the system or, as the meme above jokes, continue the beatings until morale improves. He chose the latter.

The Fed’s continued worries seem to focus on the labor markets. Pressures had been building all through the summer of 2021, which we wrote about last year. You name the metric — initial jobless claims, wage growth, jobs opening data, “quit rates”, and others, and they all pointed to a very good thing for American households: their work and labor were in high demand, their jobs were secure, and they were enjoying historic pay raises. Unemployment was and remains at 50-year lows, for goodness’ sake.

But this, yet again, was one of those counter-intuitive moments in capital markets history — and another shining example — when the market is not the economy. In any other normal period, a healthy job climate would have been good news. Rising wages mean more money in the pockets and purses of working Americans – whose consumption drives over two-thirds of the U.S. economy – buoyed spirits, confidence in the future, and hope for oneself and one’s family. What’s not to like, right?

Well, it doesn’t always work that way, as we all know. It’s been too much of a good thing. The Fed’s job over the past 15 years was acting as a gracious host, serving a punch bowl of cheap and easy money. Then last year started the less gracious, nay, painful act of removing it.

So yes, one of the main objectives of the past years’ rate hikes was to reverse every single one of those labor metrics. It’s uncomfortable to talk about in polite circles, but the Fed’s efforts, let’s be clear, were to drive the unemployment rate up. To increase layoffs. To destroy jobs. To inject some measured misery into the labor markets.

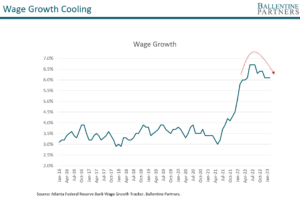

And it was starting to work. See below. The first chart shows average hourly earnings growth. Wages were growing and accelerating all through 2021 well into 2022. And then the rapid rise of interest rates started to have the desired effect. We’ve seen a decline in the rate of growth, exactly what the Fed was trying to engineer.

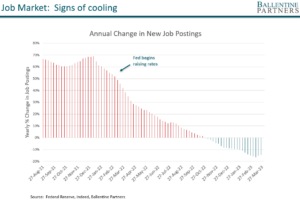

New job postings is another lens. While new job postings were growing at spectacular rates all through 2021 and 2022, we’ve seen a recent cooling trend. All through 2023, we’re witnessing negative growth from the prior year. See the chart below. Again, this was all a desired effect, for the greater good of price stability.

Is more pain necessary? It’s a debatable point about whether the Fed actually needs to continue applying pressure, as other signs of inflation are definitely encouraging: global supply chain pressures are now below COVID-19 levels (it’s as if COVID never happened), rent inflation pressure is easing around the country as more multi-family homes were built in 2022 than in the last 40 years (and the pipeline of new units is just as robust), and I just filled my gas tank this past weekend for $2.99 a gallon. But the Fed seems to know better.

What to do in the meantime? We’ve taken what cash holdings we had and gone out to the juiciest parts of the curve, the short end. Valuations on the U.S. stock market are within normal ranges, so frankly, when the medicine ahead does eventually do its job and wage pressures diminish further, there is a very good chance for a nice rally. We are also watching closely the movement of the U.S. dollar. At some point, it may make sense to lighten up slightly on our U.S. overweight, given the negative effects on U.S. multinationals of too strong a dollar (and the distinct possibility of a dollar decline given possible “peak dollar”).

Some have argued the pain should have been delivered earlier, while some still argue the pain needs to be pushed off further. We’ll leave the Monday-morning quarterbacking to others. All we know is where the Chairman stands today. A little bit more pain. A little bit longer pain. The beatings must continue until morale improves.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.