By Andrew Hacker, CFA, Research Manager

Executive Summary

Ballentine Partners heavily emphasizes tax-efficiency in selecting from the myriad of available public markets investment vehicles. As a result, exchange-traded funds (ETFs) have been a staple in our clients’ taxable portfolios. ETFs are extremely cost effective and minimize ongoing tax costs. Now, advancing technology and declining implementation costs (commission-free trading) have opened the door for even more tax advantageous strategies.

A strategy known as “direct indexing” provides a significant potential improvement upon ETFs for taxable investors. Direct indexing involves owning the individual stocks making up an index (or to replicate some other benchmark) rather than investing in index replicating vehicles (such as ETFs or mutual funds). This paper explores the potential benefits, risks, and suitability considerations of direct indexing, focusing primarily on customization and tax alpha generation through active rotation between stocks. We also explain how “direct indexing” has broader applicability beyond vanilla index tracking, including blended indices, factor-based approaches, and ESG/values-aligned portfolios. This is far from a passive strategy as it involves actively rotating between underlying stocks to generate after-tax excess return (“tax alpha”).

The unique characteristics of “direct indexing” and tax alpha necessitate thoughtful consideration of a client’s unique situation. Not all investors will capitalize on the potential tax benefits of these strategies. Investors most likely to do so have high tax rates, ongoing generation of realized capital gains, cash inflows to a portfolio and/or a desire for customization. Partnering with an advisor experienced with direct indexing can help extend and amplify the tax benefits while monitoring and potentially mitigating the risks. Here at Ballentine Partners we aim to do just that as we move towards using direct indexing as a core position in client equity portfolios.

Introduction

There are many ways to gain broad market exposure to public equities, including actively managed mutual funds or separate accounts, index-tracking exchange-traded funds and even derivatives such as futures, total return swaps and options. For taxable investors, however, there is another way that we find particularly intriguing. The industry term for it is “direct indexing.” The basic premise is this: instead of owning an ETF or mutual fund, which is a single security representing a basket of 500 stocks in the S&P 500 for example, an investor has a separately managed account which owns all 500 underlying names (or a representative sample). The separately managed account breaks apart the basket into its individual components. While the risk and return profile and economic exposure of such an approach is very similar to buying that S&P 500 mutual fund, ETF, or any of the other above-mentioned methods, owning the actual underlying stocks unlocks a host potential benefits for the investor.

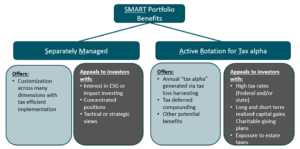

The term “direct indexing” does not fully describe the range of potential applications for the strategy. Firstly, this strategy is not limited to tracking a single index such as the S&P 500; it can also track blended indices, factor or quantitative based approaches, (such as a high-quality factor portfolio) and ESG/values-aligned portfolios (such as an S&P 500 ex-tobacco portfolio). Secondly, the word “index” implies a passive approach, with no opportunity for outperformance of the relevant index. However, we believe this strategy does, in fact, offer the potential for a portfolio to outperform its relevant index through active rotation of the underlying stocks to generate after-tax alpha (i.e., excess returns) over a truly passive S&P 500 ETF or mutual fund. Finally, the word “index” implies little to no trading activity; yet SMART portfolios, as discussed below, employ frequent but strategic trading to generate tax alpha. The key characteristics, then, of this strategy are:

- Separately Managed

- Active Rotation for Tax-alpha

Our shorthand, and preferred term, for this approach is SMART portfolios.

Introducing SMART Portfolios

Customization and tax benefits help SMART portfolios stand out from other public equity investment strategies. Direct ownership of the underlying securities opens up a multitude of customization options for investors. Investors can tailor SMART portfolios in a highly personalized manner which cannot be achieved via off-the-shelf financial products. Our interest in this strategy is based on the potential to generate tax alpha via tax loss harvesting of individual stock positions and substitution of other similar stocks, in a manner that complies with IRS rules regarding loss realizations. The substitution of similar stocks allows the portfolio to remain aligned with its benchmark target. We refer to this process as “active rotation.” Realized losses can either be used to offset realized gains in the same tax year, or carried forward for use in future years, helping to reduce the investor’s tax burden.1 The compounded effect of these tax savings is referred to as “tax alpha.”

Separately Managed

SMART portfolios are separately managed, providing the investor with full control, including the ability to customize the strategy to individual preferences. The use of separately managed accounts by high-net-worth investors is not a new concept. However, advances in technology and increased competition have reduced fees and lowered the minimum viable account size. The advent of commission-free stock trading is a boon for separately managed stock portfolios of all sizes, but especially for SMART portfolios which hold many small positions and trade frequently. Management fees have also declined due to new competition from financial giants which we expect to continue.

The extent to which customization is desired or beneficial will vary based on the investor’s financial situation, values, preferences and views. But the ability to better match SMART portfolios to the individual investor is, in our view, an advantage. Accounts can be actively tilted towards ESG factors or values to achieve a desired impact on the world. In contrast, undesired sectors, industries or values can be filtered out or reduced. Investors employed in a certain industry and receiving stock-based compensation can reduce their investment portfolio’s exposure to the industry or company in question which may better balance their overall exposures and risk/return profile.

Finally, SMART portfolios can express fundamental views for the purpose of seeking investment alpha. Style, sector or factor tilts can just as easily be expressed in separately managed accounts as with ETFs or other investment products. In fact, SMART portfolios can implement such allocation bets in a tax efficient manner by utilizing the same optimization technology which drives tax loss harvesting.

Active Rotation for Tax Alpha

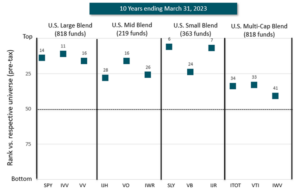

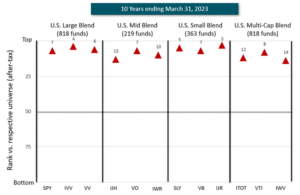

Amongst the menu of available options for exposure to public equities, exchange-traded funds (“ETFs”) stand out as strong solutions for taxable investors. ETFs are efficient at delivering a targeted index return with low fees and minimal ongoing tax costs. As shown by the following two charts, they consistently deliver pre- and post-tax returns which rank highly amongst their peer groups – a feat which very few active managers achieve. Finally, ETFs have demonstrated much stronger return persistence in their relative rankings through time.

Hypothetical pre-tax relative performance of ETFs vs. active managers

Source: Morningstar

Hypothetical after-tax relative performance of ETFs vs. active managers

Source: Morningstar

ETFs deliver strong results for investors, but they don’t offer the customization and tax alpha opportunities that are available with SMART portfolios.

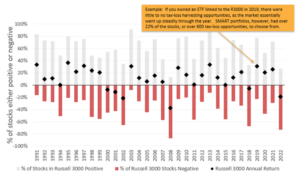

By breaking up an equity portfolio into its component pieces, SMART portfolios have the potential to capture tax losses even in positive years for the overall markets. As shown below, a sizeable portion of the market’s constituent pieces decline in value in each calendar year, including years with strongly positive returns.

In a year when ETFs can do essentially no tax-loss harvesting, SMART portfolios can still have hundreds of opportunities.2

However, the longer individual securities are held, the more limited the opportunity for tax loss harvesting is likely to become. This issue is discussed in more detail in this paper under the heading “Risks and implementation factors.”

SMART portfolios offer more opportunities to generate tax-loss harvesting trades

Source: Bloomberg, Ballentine Partners

Under the hood, SMART portfolio managers leverage semi-automated trading to capture tax losses from individual component stocks, swapping the proceeds into similar names. Quantitative models known as “optimizers” monitor exposures and suggest trades with tax benefits while minimizing the portfolio’s deviation from the targeted benchmark. Harvested tax losses can be used to offset current or future realized capital gains and reduce portfolio outflows for taxes. Again, tax loss harvesting is not a new concept nor is it unique to these strategies. But SMART portfolios engage in tax loss harvesting to a greater extent than is possible in a traditional portfolio of ETFs or mutual funds, and also to a greater extent than has historically been possible with portfolios of individual securities.

Technically, tax alpha generated in such a manner is a deferral of taxes into the future, rather than an outright savings. The act of capturing a tax loss creates a new position with a lower cost basis, which if sold at a future date will have a proportionally higher capital gain (and associated tax bill). Crucially, this assumes a future sale of the position or portfolio, which may not come to pass. Securities held until death receive a step-up in cost basis, thereby avoiding taxes on unrealized capital gains. Securities donated to charity also avoid taxation on unrealized gains. We like to think of tax loss harvesting as creating an interest-free loan from the government, with the proceeds invested in equities. Over long time periods, that investment can compound at positive real rates of return prior to being paid back. Alternatively, the loan itself can be “forgiven” either through charitable contributions or receipt of a step-up in cost basis if eligible. All else equal, the tax benefits of SMART portfolios are more powerful in accounts where those two outcomes are likely.

It is essential to work with an advisor to see if a SMART portfolio approach makes sense. It can be a powerful tool. But not for every situation.

Investor suitability criteria

There are so many potential variables that will determine the actual results realized by an investor that we cannot project the benefits of investing in a SMART portfolio with any certainty. Therefore, it is essential for potential investors to understand the underlying theory and processes before making an investment decision.

Our research and experience with these strategies has shown that suitable investors may earn 1% or more of annualized tax alpha over long time periods. With thoughtful implementation, an ideal portfolio fit and favorable market conditions tax alpha may be higher. Investor suitability characteristics such as tax rates, cash flows and asset location can have a dramatic impact on how much tax alpha may be achieved. For ideal candidates, however, potential tax alpha figures are meaningful – active managers spend entire careers striving to generate similar levels of annualized alpha, with very few succeeding. For investors who do not fit the ideal profile, the strategy should deliver enough tax alpha to make it worthy of consideration. There are, however, a few cases where this strategy might leave an investor worse off. For example, it would be disadvantageous for an investor to accumulate losses and then die without having offset the losses with realized capital gains. Accumulated losses cannot pass through an estate to be used by heirs.

Realizing the potential tax benefits of SMART portfolios require careful consideration of an investor’s characteristics. First and foremost, investors interested in SMART portfolios should have visibility into future realized capital gains. Without gains to offset, the value of tax loss harvesting diminishes significantly. While unused losses can be carried forward to future tax years (at the federal level and in most states) they are typically forfeited at an investor’s death.

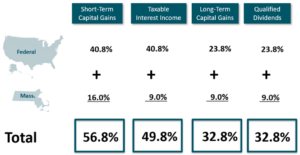

An investor’s effective capital gains tax rate also directly impacts the tax benefits of SMART portfolios. Tax loss harvesting strategies are more valuable when they offset more heavily taxed gains. In a simplified example, one dollar of losses used to offset capital gains taxed at 40% is worth about 40 cents. With a 20% tax rate the value drops to 20 cents. Another consideration is the impact of taxes at the state level. See table below for Massachusetts, for example. The short-term capital gains tax rate is one of the highest in the country. On a combined basis, high income investors are paying a short-term marginal capital gains tax rate approaching 57%.

Massachusetts combined highest marginal tax rates

Source: Internal Revenue Service & Commonwealth of Massachusetts. Rates shown are highest marginal tax rates.

As previously mentioned, investors who expect to pass the bulk of their investments to their estate or to charity are a better fit for SMART portfolios compared to those who expect to spend them. Investment horizon is also an important consideration – investors who expect to spend their assets far in the future may still benefit from SMART portfolios if they are a strong fit in other criteria.

Portfolio cash flows can be either a strong tailwind or difficult headwind for tax alpha generation in these strategies. Investors withdrawing from their portfolios for income or retirement may not see much benefit from SMART portfolios. Withdrawals both slow down the generation of tax alpha and may eventually trigger realized gains from selling securities to raise cash. In contrast, investors adding cash to a SMART portfolio may buoy and extend their tax loss harvesting opportunities. Using new cash to create fresh stock positions produce new “shots on goal” for tax alpha, even if the rest of the portfolio is highly appreciated. Charitable giving can have a similar positive impact on tax alpha generation. Gifting appreciated securities to charity from a SMART portfolio, then replacing those securities with cash equates to a cash deposit with the same aforementioned benefits.

Risks and implementation factors

The performance of any benchmark index can be replicated with reasonable accuracy by owning only a portion – often less than half – of the underlying stocks making up the specified benchmark. However, the replication will not be perfect; there will be some performance deviation between the portfolio and the benchmark. This is known as tracking error– which is present in many investment products, especially actively managed funds. In SMART portfolios, however, it is easily measured and managed. The manager employs quantitative models to ensure the portfolio’s fundamental exposures (such as sectors, industries, styles, and factors) remain close to target. Initial expected tracking error for typical SMART portfolio implementations is typically below 1% per year, but can be heavily influenced by the investor’s customization decisions and other factors. Tracking error does tend to rise over the life of a portfolio as the “rising tide” of upward trending markets bring more and more holdings into unrealized gains. Opportunities for rebalancing are reduced by their tax consequences. Potential investors should consider whether they are comfortable with 2% or more tracking error on this portion of their portfolio.

A notable challenge for SMART portfolios, and a focus of our ongoing research, is the tendency for available tax alpha to decline over time. Tax alpha generation requires stocks declining below their cost basis (effective purchase price). Markets drift higher over time – and an increasing portion of an account’s holdings will rise and remain above their cost basis. Actively rotating between stocks to capture tax alpha accelerates this process. For a portfolio funded with cash or securities with market value close to tax cost basis, the most abundant tax alpha opportunity lies in the first 1-5 years of a SMART portfolio’s life, naturally declining thereafter. Mitigating that decline, and ensuring sustainable tax alpha generation through time, may be achieved through positive cash flows, dividends, charitable giving and some customization options. SMART portfolios funded with highly appreciated securities will have less opportunity to generate tax alpha, unless the portfolio is augmented with periodic substantial cash in-flows.

Conclusion & Ballentine Partners’ Approach

SMART portfolios offer an evolutionary potential improvement for taxable investors’ equity portfolios. While ETFs are a strong solution, bespoke separately managed accounts with active tax alpha generation can add significant value for certain investors. Maximizing the potential tax benefits of the strategy requires thoughtful implementation with an eye towards estate planning, philanthropy, and portfolio context. Capturing consistent tax alpha via SMART portfolios is an enviable but achievable outcome in contrast to seeking fleeting investment alpha through active management. Bespoke customization options offer additional benefits for clients who wish to express their views, values, or make an impact. At Ballentine Partners, we are excited to recommend SMART portfolios as a core equity allocation for suitable clients, in combination with low-cost, efficient ETFs. Please ask your Ballentine Partners’ team if SMART portfolios are a good fit for your portfolio.

1 This paper discusses tax alpha only from the perspective of federal tax rules. The opportunity to offset capital gains with losses is limited by the tax codes of some states. For example, some states do not allow capital losses to be carried forward into the next tax year. Please consult your tax advisor for information about the application of this strategy in your state of tax residence.

2 Any individual account’s ability to capitalize on component security losses may vary significantly based on account’s age, strategy, and other factors. While SMART portfolios offer more opportunities to generate losses when compared to an ETF or mutual fund, the size and scope of the opportunities may vary.

About Andrew Hacker, CFA, Research Manager

Andrew is a Research Manager at the firm and is responsible for research coverage of global equity markets. He is responsible for portfolio construction and manager selection for publicly traded equities and digital assets. His research also contributes to our overall market outlook.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.