Investors of a certain age might remember Alan Greenspan’s infamous declaration of “irrational exuberance” when opining on the state of the asset prices in a December 1996 speech to the American Enterprise Institute. Greenspan was cautioning investors about high valuations after the S&P 500 posted a gain of 37.6% in 1995 and on its way to 23.0% gain in 1996. Had investors taken Greenspan’s advice to heart and sold their stocks, they would have missed additional gains of 33.4% in 1997, 28.6% in 1998, and 21.0% in 1999, before collapsing as the tech bubble burst in 2000-’02. Although he was way too early, his cautionary advice turned out to be right. Ultimately valuation and fundamentals do matter.

In those days, investors focused mostly on the broad US stock market when trying to gauge whether asset prices were too cheap or too expensive. Today, there are identifiable pockets of overvaluation in certain niche investments that are reminiscent of Greenspan’s famous phrase. Whether these investments reflect true fundamental long-term value or are harbingers of significant cracks just below the broader investment surface remains to be seen. We’ve identified at least four areas that have attracted enormous investor attention in recent months, and whose fundamental value as an investment opportunity we believe remains dubious at best. Most have experienced wild swings in prices this year, both up and down.

What accounts for the burst of interest in these highly speculative investments? A number of factors could be at play. Certainly, the amount of cash funneled to investors as a result of the fiscal stimulus during the pandemic has put extra cash in many people’s pockets and time on their hands during the lockdown to decide how to spend it. The spread of investment information through influencers on the internet as well as the emergence of Robinhood as a low-cost trading platform has drawn many younger investors into the game. And the strong momentum of traditional equity markets (the S&P 500 has nearly doubled since its nadir on March 23,2020) has rewarded the risk takers and encouraged even more speculation.

To be clear, our purpose is not to suggest that speculation in these assets is a precursor to a significant decline in broad equity markets. Fundamentals remain largely supportive of stock prices, and economic growth should remain above-trend for the foreseeable future, albeit with the usual caveats. In our view, traditional assets do not exhibit the excessive valuation characterized by the examples below.

Here is a brief rundown of the possible signposts of irrational exuberance:

1. Special Purpose Acquisition Corporations (SPACs) – A SPAC is essentially a shell company set up by investors in order to raise money through an IPO to eventually acquire or merge with another company. Usually a SPAC is created or sponsored by institutional investors, successful entrepreneurs, or other high-profile Wall Street types. Sometimes referred to as “blank check companies”, investors participating in the IPO do so without knowledge of the company the SPAC will eventually acquire. They rely on the business acumen of the sponsors to find an attractive acquisition within a predetermined period of time, usually two years.

SPACs are structured to provide substantial financial benefits to the sponsors, who typically contribute a small percentage of capital in the IPO but end up with 20% of the equity of the acquired company. Companies acquired through a SPAC can avoid the rigorous disclosure requirements required in an IPO, which creates additional uncertainty for the SPAC investor. As a result, typical SPAC acquisition targets are companies with lofty projections about future growth, but little in the way of actual revenues or profits. The only sure winners in a SPAC are the sponsors that can convince the investing public of their ability to find and build great companies over a long period of time.

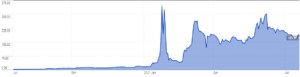

As evidenced in the graph below, some of the air has come out of the SPAC bubble, but issuance of new SPACs continues at a strong pace:

IPOX SPAC Index (1-year Performance as of 7/20/21)

Source: IPOX

2. Non-Fungible Tokens (NFTs) – An NFT is a digital representation of something that is unique, i.e. something that can’t be replaced with something else. In the non-virtual world, think of an NFT as a one-of-a-kind signed version of a baseball card. The current buzz for NFTs revolves around digital art, but NFTs can be applied to almost anything digital that has a unique identifying code, including video and sports highlights, designer sneakers, even someone’s Tweet. They are usually bought and sold with cryptocurrency. According to Pymnts.com a staggering $2.5 billion was spent on NFTs in the first six months of 2021, up from a total of $13.7 million in all of 2020.

NFTs are typically held on the Ethereum blockchain, although other blockchains can support them as well. Blockchain technologies afford artists and other content creators an efficient way to monetize their creations without having to rely on galleries or auction houses. Artists can program in royalties to their NFTs so they’ll receive a percentage of sales whenever their art is sold to a new owner.

Like other forms of art, the value of an NFT is based entirely on what someone else is willing to pay for it. As a result, the value of any particular NFT is highly unpredictable. Would you pay $2.9 million for a NFT of Twitter co-founder Jack Dorsey’s first-ever Tweet? Or how about Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, that recently sold for nearly $600,000. I didn’t think so.

As long as people are willing to pay, this is a positive development for artists, who can access large groups of potential buyers at low cost and with little interference from traditional middle-men. An explosion in creativity may result.

3. Dogecoin and other altcoins – Dogecoin is the most famous of a long list of cryptocurrency tokens (known as altcoins) that you probably have never heard of. Popularized by Elon Musk, Dogecoin was created by two software engineers as a joke, making fun of the wild speculation in cryptocurrencies at the time. Dogecoin can be viewed as the ultimate speculative investment, in that while other cryptocurrencies attempt to solve real-world problems, Dogecoin makes no similar claims. This has not stopped investors from bidding up the price of Dogecoin by more than 15,000% since the beginning of the year. Since the peak on May 7, Dogecoin has collapsed by 76% (as of July 20). Buyer beware.

4. Meme stocks – Meme stocks refer to a group of stocks that have enjoyed increased popularity as a result of heavy exposure on social media sites. The most popular of these platforms is Wall Street Bets on Reddit, which has more than 10 million readers. Popular meme stocks that have experienced wild rides include Gamestop (GME), AMC Entertainment (AMC), and Virgin Galactic (SPCE). GME rose almost 2,000% in the first few weeks of 2021, despite being in the rather mundane business of selling video games in brick-and-mortar retail locations. Although a recommendation from Wall Street Bets may be rooted in a legitimate analysis of a company’s future prospects, the hype created by the spread on social media often drives the stock price well ahead of the company’s fundamental value. As a means of teaching younger investors about the risks and rewards of the stock market (on steroids), the growing interest in meme stocks may ultimately be a good thing. At the same time, it may condition them to make outsized bets in hopes of a big hit at time when they should be building an investment portfolio for the long term.

Since its peak in late January, GME has fallen by about 50%, but is still up 885% this year.

Gamestop 1 Year Performance (as of 7/21/2021)

As noted above he purpose of this blog is not to predict impending doom in traditional financial markets, but rather to point out a few signs of excessive optimism (and/or speculation) in less well-traveled parts of the investment universe. The fiscal support provided during the pandemic has left many investors with excess cash and time on their hands to seek out non-traditional investment opportunities and dream of a world full of potential. It is possible that many of these ideas will fulfill expectations, providing some investors with exceptional rewards. Others, no doubt, will end in disappointment. As seasoned investors in traditional asset classes, we prefer allocating capital to places with identifiable valuation metrics, such as price/earnings ratios or bond yields. Nonetheless, we believe it is important to monitor these new trends so that we can be alert to the signs of irrational exuberance if it creeps into investor psychology writ large.

About Bruce D. Simon, CFA, CPWA®

Bruce is a Partner and the Director of Research at the firm. In addition to working directly with a number of family clients, Bruce serves on Ballentine’s Investment Management Committee, which is responsible for the oversight of all of the investment activities for the firm.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.