Much ink has been spilled in recent days over the upcoming deadline when the US Treasury will reach the limit on the amount of debt it can issue, potentially triggering a catastrophic default of the US government. For those who experienced the events of the summer of 2011, our current predicament has an eerily familiar ring. The script usually goes something like this: the beginning starts with histrionics, predictions of economic Armageddon, gallons of ink being spilt, red-faced talking heads flailing their arms on the Sunday morning shows, provocative Twitter tweets getting our dander up. Cooler heads patiently wait for the histrionics to die down and the news cycle to, well, cycle. Trial balloons from both camps are floated in the media, attempting to portray one side as reasonable and the other as extreme. Tension mounts as we approach the due date. And then it ends. A solution is found — typically imperfect but at least reasonable. And the whole kerfuffle quickly becomes a distant memory.

In 2011, we went right up to the edge before President Obama and Congressional leaders from both parties struck a compromise. Both sides got some of what they wanted: the debt ceiling was raised by $2.4 trillion in two phases, and the legislation included $900 billion in slowdowns in planned spending increases over a 10-year period and established a special committee to discuss additional spending cuts. But the damage was done: Standard & Poor’s lowered the credit rating on US government debt, concerned that this affair might not be the last.

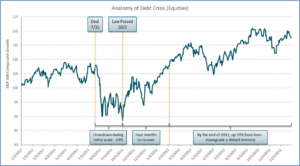

During this last brush with fiscal brinkmanship in 2011, financial markets reacted as investors handicapped the outcome. In the 6 months leading up to the final agreement on August 2, 2011, the S&P 500 gyrated between sharp gains and losses, only to drop as much as 19% in the two months after the crisis was resolved (likely owing to the debt downgrade).

Source: Morningstar

Somewhat perversely, the bellwether 10-year US treasury bond yield fell steadily (prices up) leading up to the crisis and rallied further after the S&P downgrade. The price action seems to reflect the US government debt’s unique role as the place to hide during periods of turmoil, even if US treasury-backed debt was the source of the turmoil!

Source: Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity.

We are confident that after the requisite sturm und drang, a similar outcome to 2011 is highly likely. Yes, there may be different faces in the halls of congress with different priorities (such as fawning media attention), but we fully anticipate that there will be a last-minute compromise. There may be as many as 25 congressmen who are willing to take us over the edge, but they alone do not have the power to prevail over the will of the majority. As a result, for clients holding treasury bills, we are highly confident that the government will honor these obligations, so no action is necessary.

As investors, what should we be planning for? Since S&P has already downgraded our debt, we may see even greater volatility in stocks leading up to the drop-dead date (sometime this summer, although there is disagreement as to exactly when). Confident in this outcome, we could take advantage of equity market volatility by tax loss harvesting, rebalancing, and adding to positions during short-term weakness caused by panicking investors. On the fixed income side, we could expect spread widening among some lower-rated issuers, as investors lower their risk posture. We will be prepared to exploit this development, should it occur.

We assign a near-zero probability of the worst-case outcome, but as risk managers we should consider all possibilities. The current batch of gimmicks being discussed (e.g., the minting of a $1 trillion dollar coin) are likely to be discarded. If a compromise is unable to be reached, we could expect, among other things: 1) sharp rise in US interest rates, leading to higher borrowing costs for consumers and businesses; 2) a dramatic decline in US GDP growth, exacerbating the likelihood of a global recession; 3) a crash in the value of the US dollar; and 4) the elimination or postponement of Social Security checks, Medicare reimbursements, and payments to state governments, suppliers, contractors, and federal employees. The political damage caused by such a scenario would be so destructive to the party deemed to be responsible that it should force negotiators to the table. Hugely damaging but highly unlikely.

Our strategy for dealing with this debt ceiling standoff is based upon our belief that any dislocations that occur in the marketplace are likely to be temporary. We remain confident in that prediction. After all, when have politicians not acted in the best interests of the country?

About Bruce D. Simon, CFA, CPWA®

Bruce is a Partner and the Director of Research at the firm. In addition to working directly with a number of family clients, Bruce serves on Ballentine’s Investment Management Committee, which is responsible for the oversight of all of the investment activities for the firm.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.