How fast can the market change its mind on interest rates? Head-spinningly fast, as it turns out!

When academics talk about “the market” or “market efficiency,” the underlying assumption is that the price of an asset reflects all known and publicly available information. So, when the price of any asset changes, it reflects the “market’s” assessment of a new fact. And as our famous economist John Maynard Keynes reminds us above, when the facts change, the market reserves the right to change its mind.

Another assumption, however, embedded in efficient market theory is that any new price reflects the collective wisdom and processing power of hundreds of thousands, more likely millions, of market participants: a wide and varied body of analysts, portfolio managers, institutions, computer models, and individuals, coolly and calmly assessing these new facts. The resulting price also reflects a series of market participants’ activities: they evaluate the reliability of that information and its source, they imagine a series of possible outcomes, they attach some classic Bayesian probabilities to these scenarios, they assess history, they put the new information in the context of other prices, they assess how this new fact deviates from what the market was already anticipating, and so on and so on and so on. And oh, by the way, they do this all in a matter of seconds.

Thinking fast, however, does not mean acting fast. While any one individual player may get nervous, jumpy, or excited, the collective mood of these millions of market participants should move more methodically, or so you’d think. [Ever try to get a million people to agree on anything? Who am I kidding, ever get a group of five friends to agree on which restaurant to choose or what movie to go to? Now that’s slow!] The point is that “the market” is full of players that may react differently to the same fact — the market, at any one instant, has bulls and bears, pessimists and optimists, the fearful and the greedy, rich and poor, contrarians and momentum traders, patient investors and high-frequency traders, and everything in between. And as the old adage goes, for every seller, there’s a buyer.

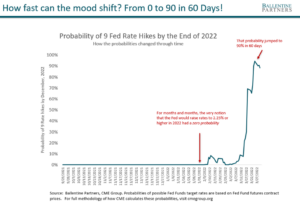

Which raises the question, as it relates to expectations of Fed Funds rate in 2022: What the heck just happened? See the chart below.

What you’re looking at is a calculation by the CME Group that measures the probability of where the Fed Funds rate will be in the future. It is a derived number driven by the pricing of futures contracts. But make no mistake, it is what “the market” thinks. Back around sixty days ago, on January 31, the market definitely believed that the Fed would be instituting rate hikes throughout 2022. The question was the quantity and the pace. Theoretically, there was a chance the Fed might get hawkish and engage in a series of draconian, Volkeresque-style rate hikes. But the market is also a student of history and knows that this Fed, led by Powell (and preceded by Yellen, Bernanke, and Greenspan), came from a long line of doves. The very idea that the Fed would all of a sudden get aggressive in its inflation fight was essentially absurd. The market, in other words, was attaching a 0% probability to the Fed getting religion.

Well, somebody threw the market a new fact, evidently. It was not the Ukraine war and its inflationary impact on oil, natural gas, and food prices or implications for additional supply chain gunk-ups. In late February, there was barely a blip when Russian tanks crossed the border. It wasn’t a surprise CPI “print” that was alarming, as the jaw-dropping December print of 7.0% and the even more damaging January print of 7.5% had already happened with nary a movement. Was it a powerful investment banking group like Goldman indicating that they’re getting spooked? Maybe.

I think the more reasonable answer was that it was not a single data point drip, but more a growing pool of facts that eventually burst the dam. And break it did, as the probability of a rapid-fire and aggressive series of rate hikes in 2022 just jumped from 0% to 90%.

To be clear, we’ve seen hot spikes like this before, only to have them cool down as other counter-facts emerge. A simple dovish aside comment from Powell or one of his colleagues on CNBC could cool this chart down. Still, this is something to monitor, as many market prognosticators believe that the 40-year decline in interest rates is on the verge of a regime change. A head-spinningly fast change in fact: and rare are those regime changes without a few getting their heads cut off.

About Pete Chiappinelli, CFA, CAIA, Deputy Chief Investment Officer

Pete is Deputy Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.