Executive Summary

Few investment ideas generate as much passionate debate as gold. Educated opinions range from the belief that it is one of the most important investments you can own to the view that it is inherently worthless. In this paper, we review the outstanding recent performance of gold, explore the reasons for gold’s attractiveness as an asset class, review the historical context for the use of gold as a currency, and identify the conditions in which gold is likely to perform well in the future. Because gold has woefully underperformed stocks and bonds and has even failed to keep up with inflation over long time periods, we do not believe gold deserves a permanent position in a diversified, growth-oriented portfolio. Gold has performed well under certain market conditions, so the decision to include it in a portfolio is largely based on the investor’s time horizon, withdrawal requirements, and ability to anticipate those conditions before they arise.

Nonetheless, recent performance of gold is leading investors to reconsider their stance on the precious metal. As the spread of the coronavirus took hold and severely impacted financial markets, gold held up as a safe-haven asset. In total for the first half of 2020, the price of gold increased 16.3% while the S&P 500 posted a -3.1% return.

Recent Performance

Gold began experiencing a run of outperformance even prior to the current market stress caused by the coronavirus and is now outperforming the S&P 500 over trailing 1- and 3-year periods ending June 30, 2020.

Investors purchase gold to provide diversification benefits during periods when equities may suffer. Factors such as financial market uncertainty, geopolitical turmoil, negative real interest rates, high realized or expected inflation, and shifting currency exchange rates are conditions that typically favor gold. Many of those conditions are now present, which explains gold’s recent run of strong performance.

There is a significant amount of negative-yielding debt being traded in the world1. Holders of this debt are essentially locking in a negative return on their investments in exchange for the safety they provide. In this environment, gold’s reputation as a safe-haven investment and its potential for positive returns may appear more attractive on a relative basis. Yet, each of these investments carries their own risks. Negative yielding debt, whether issued by a sovereign entity or corporation, has the potential to default, or to be severely impacted by inflation. Physical gold investments cannot default, but their value will be affected by supply and demand.

It is unclear what the long-term repercussions of immense monetary stimulus and a sky-high and ballooning national debt will be. Nonetheless, investor demand for safe-haven US treasuries seems to be limitless, despite interest rates near all-time lows. As the government formulates additional plans to support the economy during the coronavirus pandemic, we can expect the federal deficit to substantially increase. Longer term, the supply of money being pumped into the system may lead to inflation, causing the value of the US dollar to decline. As discussed below, the price of gold is inversely correlated to the value of the US dollar, so gold is viewed as an attractive hedge by market participants expecting a fall in the dollar.

Interestingly, among North American family office investors, the average portfolio allocation to gold and precious metals was only 0.1%2 in 2019, much lower than the global average of 0.8%. Gold’s recent strong performance, combined with the sense of uneasiness about central banks and global equity markets, may fuel a renewed interest among investors looking to diversify away from traditional equity and fixed income markets.

A Very Brief History of the Yellow Metal

Gold has been used for thousands of years as a means of exchange and a store of value, sitting atop pyramids in ancient Egypt, and later used in coin form as early as the 6th century BC. In the United States, the Gold Standard Act of 1900 established gold as the only metal for redeeming paper currency. Citizens could redeem dollars for gold and vice versa at banks across the country, at a fixed rate of $20.67 per ounce. During the Great Depression, people clamored to exchange the declining value of their paper assets (stocks and paper currency) for gold. President Roosevelt, worried that a run on banks would deplete the Federal government’s gold reserves, first put a moratorium on banks paying out in gold, and then made the private ownership of gold illegal, mandating that citizens turn over their gold to the government3. In 1944, the Bretton Woods Agreement allowed foreign governments to exchange US dollars for gold, with the USD effectively becoming the global reserve currency. In 1971, President Nixon abandoned the Bretton Woods system, allowing the price of gold to be determined by the market. Then in 1974, President Ford repealed Roosevelt’s Depression-era executive order, so that private ownership of gold was allowed again. The regulations around gold have been steady ever since.

Why is Gold Special?

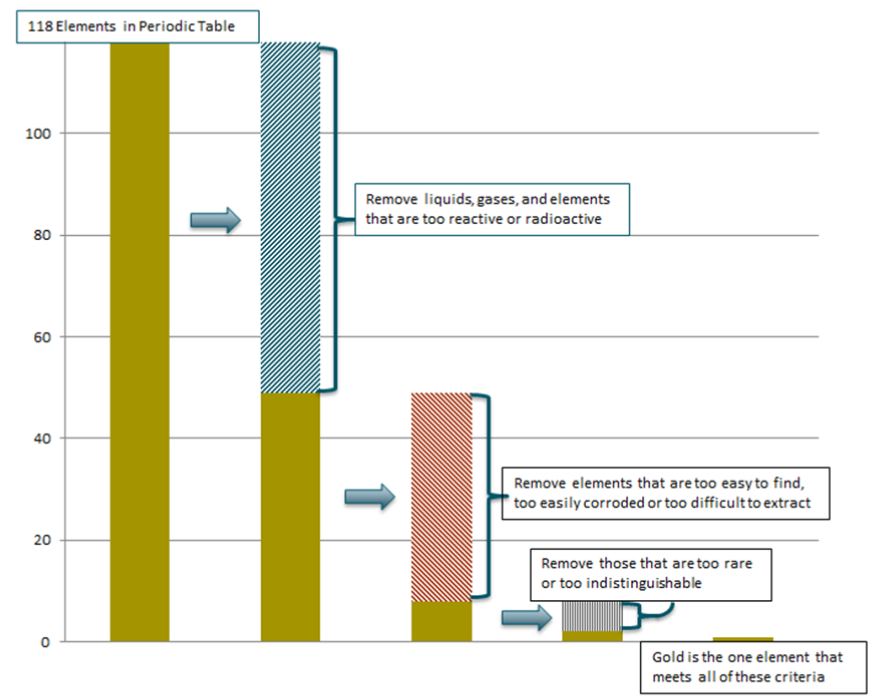

Investors often ask why gold has been the historical standard for storing value versus some other element or commodity. Out of all the 118 elements in the periodic table, gold has certain qualities that are unique4. After eliminating from consideration all of the elements that are either gases or liquids at room temperature, those that will disintegrate or explode when in contact with other common elements, those that are radioactive, and those that can only be created in a lab environment, we are left with 49 elements. Some of those remaining, such as copper and iron, are too prone to rust or too readily available. Others are extremely difficult to extract. That leaves 8 “noble metals” that do not react much with other elements and could be suitable candidates. These include gold, silver, platinum, and some other lesser known elements. These lesser known elements, and platinum to a degree, are all so rare that they would not be practical to use as a medium of exchange. Perhaps most importantly, 7 of those 8 elements have the same silvery color, which makes them hard to distinguish from one another. Gold’s color is attractive and unique, it doesn’t tarnish, and it is difficult, but not impossible, to mine.

Gold Has Its Downsides

The arguments against the use of gold as an investment are straightforward.

It doesn’t have a high functional value. Only approximately 14% of above-ground gold is being used for industrial and technological purposes. Jewelry accounts for 48%, and the rest of it is held by governments and investors5. About 50% of the annual demand for gold comes from jewelry6, mostly in China and India. The demand for gold jewelry could change over time, as consumer tastes change. Deteriorating economic conditions could also negatively impact demand for luxury items such as jewelry.

Gold doesn’t generate income. In fact, since an investor needs to pay a combination of transaction fees, storage fees, management fees, and insurance fees for the asset, gold generates negative cash flow, which detracts from its appeal for many investors. Because it doesn’t produce income, it is impossible to derive a fair value based upon traditional valuation measures. As Warren Buffett put it, “it doesn’t do anything but sit there and look at you.” Imagine buying a share of Apple. Apple has 137,000 innovative, intelligent employees working tirelessly to create and sell products that consumers want. As a shareholder, they are working for you, working to increase the value of your investment. Compare that to an investment in gold. Instead of a share of Apple stock, you buy an equivalent amount of gold, which would be about 1/5th of an ounce, roughly the weight of a U.S. quarter. You buy it, cross your fingers, and hope that in the future, you can sell it for more than you paid.

Long term performance is unimpressive and is very dependent on the time frame analyzed. During the high inflation period of the 1970s, gold performed very strongly, returning 31.0% annually, compared to the S&P 500’s annualized return of 5.8% over the decade. However, gold has not held up as a good long-term investment since then. In the 40-year period from 1/1/1980 through 12/31/2019, the price of gold has increased 2.7% annually, even below the 3.1% inflation rate in the U.S. This return pales in comparison to the S&P 500’s return of 11.8% and the 10 Yr Treasury’s return of 7.6% over the same period.

When does it Make Sense to Own Gold?

There are several economic scenarios which lend themselves to rising gold prices. The most common are 1) high inflation; 2) a falling US dollar, and 3) severe equity market volatility.

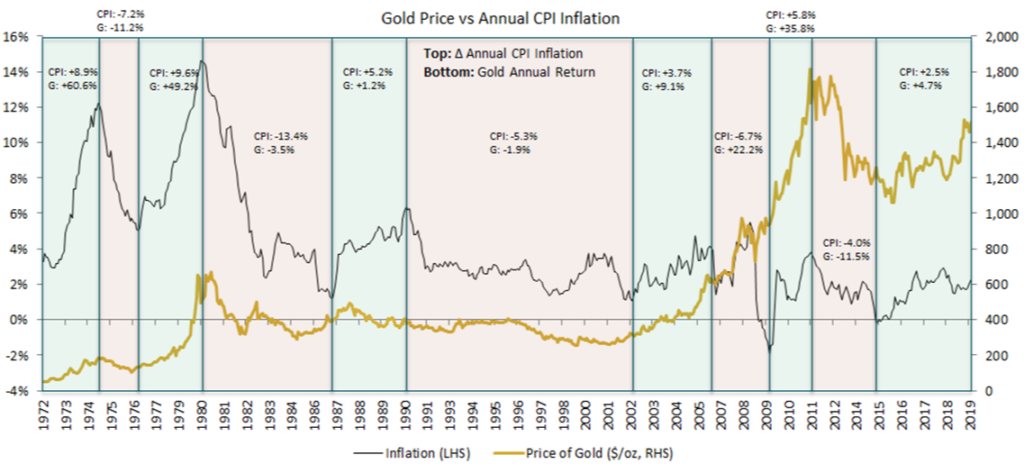

Protection against Rising Inflation

Despite underperforming inflation over the long run, gold has performed well during periods of sharply higher prices. Gold’s strong performance during the Stagflation era of the 1970s is the best example of this trait. The U.S. has not experienced a period of extremely high inflation since that time. Nonetheless, investors concerned about the purchasing power of their paper currency may choose to invest in gold as hedge against higher inflation.

Source: Inflation data from St. Louis Fed; Gold Price Data from Morningstar Direct

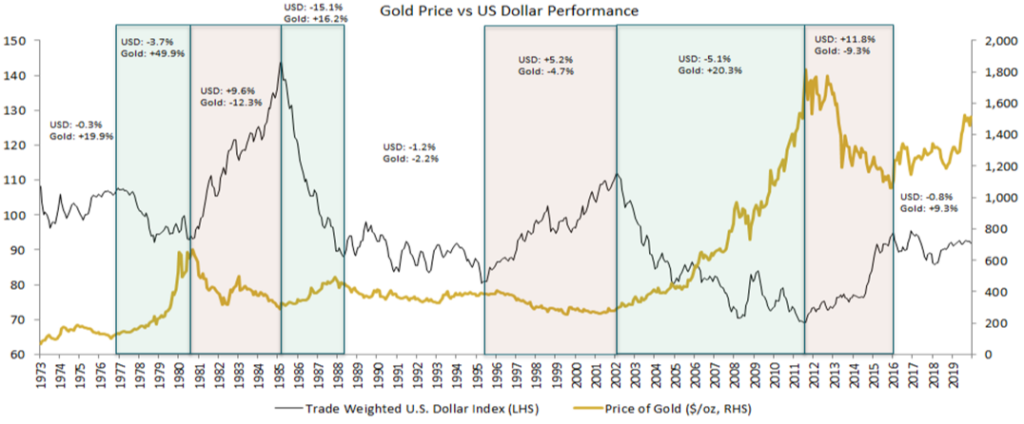

Protection against a Declining Dollar

Gold also protects investors concerned about the impact of a declining U.S. dollar. The price of gold has demonstrated a strong inverse relationship with the USD exchange rate. The USD is the benchmark pricing mechanism for gold around the world. When the dollar falls, it makes gold less expensive to investors transacting in foreign currencies, which increases demand and lifts prices. Conversely, when the dollar is rising, the price of gold tends to fall, since it is now more expensive to foreign buyers.

There are valid arguments to be made that the value of the USD will decline over the foreseeable future. Stronger growth in international and emerging markets, driven by population growth, may cause a decline in the USD relative to other currencies. Investors concerned about the potential for currency devaluation in the U.S. can hedge this risk by buying gold. The Trade Weighted USD Index has exhibited an inverse relationship with the price of gold over long time periods. Since common inception in 1973, the correlation between the two indexes has been -0.38.

Source: Trade-Weighted USD data from St. Louis Fed; Gold Price Data from Morningstar Direct

It is important to note that foreign equities can also provide a cushion against a declining dollar, and often provide income as well. We can look at the MSCI EAFE Index, which measures the performance of non-US international equities: since its inception in 1986, the correlation between the index and the USD has been -0.52. Over the same time period, the correlation between gold and the USD has been -0.37. Since that time, the MSCI EAFE Index has outperformed an investment in gold by 1.0% annually.

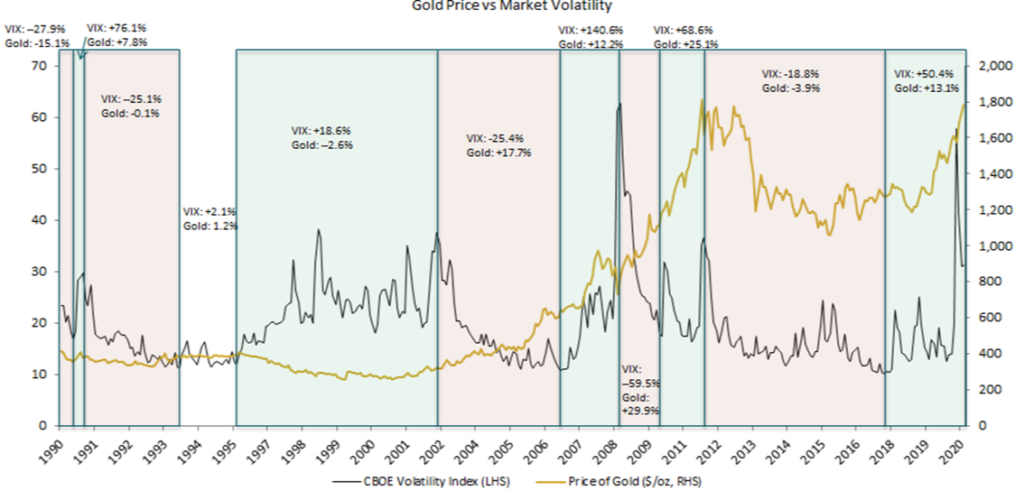

Protection against Market Volatility

Investors use gold as a portfolio diversifier to combat equity market volatility. In practice, the investment performance of gold hasn’t demonstrated a strong positive or negative relationship with equity market volatility as measured by the CBOE VIX. Additionally, periods of extreme volatility tend to be short lived and unpredictable.

Source: CBOE Volatility Index data from St. Louis Fed; Gold Price Data from Morningstar Direct

An Insurance Policy7

Gold should have a strong advantage over traditional investments during extreme, unpredictable conditions (so-called “black swan” events). Doomsday scenarios, such as the breakdown of the U.S. government, an economic depression, a global nuclear war, and/or the destruction of the modern electronic infrastructure that houses our financial assets and records, are highly improbable and impossible to predict. Investors with substantial financial resources may find it worthwhile to allocate a portion of their wealth to gold through a physical purchase or through a publicly traded fund. If society collapses, and technological infrastructure is destroyed, physical gold is a strong candidate to maintain value given its qualities discussed earlier. We think of an investment made on this basis as an insurance policy rather than a competitive long-term investment. For an investor that is purchasing gold as insurance for these types of black swan events, a portion of the gold should be in physical form and reasonably accessible.

While there is no certainty that gold would be used as currency in a future global event such as these, there is some precedent for it. For example, in various wars going back to World War II, U.S. and British soldiers, particularly pilots and paratroopers who may find themselves in danger behind enemy lines, have been given so-called “Life Barter Kits”. These kits contain gold coins and rings that were meant to be used as a currency of last resort. In war-torn countries, such as post-war Vietnam, gold was also the primary means of payment by refugees attempting to exit the country8. In each of these instances, gold stood out because its value was stable, globally recognized, and not dependent on the backing of any government. Furthermore, the ability of citizens to carry a large amount of value in their pockets was also a benefit in these extreme circumstances.

Additionally, in severe monetary collapses such as the hyperinflation experienced in Zimbabwe in the late 2000s or more recently in Venezuela, citizens began transacting in more stable currencies such as the US dollar, and in some cases, precious metals such as gold9. It stands to reason that if the U.S. dollar was experiencing the same type of hyperinflation, the reliance on gold and other scarce assets would increase.

It is worth noting that in these types of events, the global supply of gold jewelry and luxury goods would functionally convert into use for investment purposes. This would result in a large increase in supply, as 48% of gold is used for jewelry. The increase in demand would be driven by the severity of this hypothetical catastrophe. The demand for gold for investment and insurance purposes would increase while the demand for luxury purposes would collapse. For perspective on what the magnitude of an average person’s demand could be, we can start with context on how much gold there is in the world. The total amount of gold that has already been mined or is in known underground reserves is approximately 7.9 billion ounces. The most recent estimate of the global population is approximately 7.8 billion people. If evenly distributed, there would be about 1 ounce of gold available per person.

How to Invest in Gold

There are several ways to get exposure to gold in your investment portfolio. The most popular methods are listed below.

Exchange traded funds (ETFs) – ETFs are one of the most efficient ways to invest in gold. The most popular gold ETFs issue shares that are backed by physical gold that is stored in secured vaults around the world. The ownership of a share of the ETF represents a claim on that gold. The benefits of an ETF investment are that the fees are low, the complexity is low, and the value of the investment generally has extremely high correlation with the spot price of the underlying commodity. There are some downsides of ETF investments as well. Individual investors are generally unable to redeem their shares for physical gold so they must rely on functioning financial markets to properly value their investment. This is unlikely to be a problem in all but the most extreme black swan events.

Physical gold bullion purchases – investors can choose to purchase physical gold from a variety of brokers. Various governments issue gold bullion in coins and bars to authorized purchasers who act as dealers to individuals and other institutions. Investors can work through these intermediaries to purchase physical gold. The key benefit of physical gold ownership is that the link between the investor and the asset is as close as possible. Physical gold should be able to retain its value even in the face of the collapse of the broader financial system.

Gold Accounts – The safest form of physical gold ownership, this consists of storing gold in a vault owned and managed by a bullion dealer. The gold owner must pay for insurance and storage charges.

Structured Products – Structured products, such as exchange-traded notes are usually issued as unsecured debt of a corporation. Rather than pay a fixed or floating rate of interest on the debt, the company chooses to pay creditors a return based on the price of a reference asset, gold in this case. This is usually an inexpensive way to gain exposure to gold prices, but investors are exposed to the credit risk of the issuer – not a comforting proposition in the face of an economic catastrophe.

Does Gold Deserve a Place in Your Portfolio?

Investors who are very concerned about the state of the global economy, the purchasing power of the USD, or the potential for severe geopolitical turmoil may choose to purchase some gold for the long-term stability that it provides.

Investors considering an investment in gold purely for investment reasons should consider a few factors first. For investors with a short-medium time horizon and high withdrawal requirements, capital preservation is more important than long term growth. These portfolios don’t have the time to recover from a short-term market storm, so the addition of gold to these portfolios can mitigate unwanted stock market volatility.

We believe that investors with long-term horizons (most investors) should focus primarily on assets such as equity, fixed income, and cash-flow generating real estate that have shown the ability to increase in value through organic growth and reinvestment of income. We do not recommend an allocation to gold for these investors.

Learn more about David Hanson, CFA, CAIA, CFP®, Senior Research Analyst.

2 UBS 2019 GFO Report

3 Some exemptions were given for small amounts of gold, for industrial and artistic uses.

4 Data from https://www.bbc.com/news/magazine-25255957

5 World Gold Council (https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold)

6 World Gold Council (https://www.gold.org/about-gold/gold-demand/sectors-of-demand)

8 https://www.cia.gov/library/readingroom/docs/CIA-RDP80T00942A001200070001-3.pdf

9 https://www.miamiherald.com/news/nation-world/world/americas/venezuela/article232672327.html

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.