“You have got to expect the unexpected.”[1]

“Stuff happens.”[2]

How should a private investor respond to radical uncertainty? History, including very recent history, presents many examples of radical uncertainty that roiled investment markets. The collapse of the global financial system (2007 – 2009) and the world-wide pandemic caused by the novel coronavirus (2019 – ?), certainly qualify as examples.

What exactly do we mean by radical uncertainty? Mervyn King, the former governor of the Bank of England explained radical uncertainty this way:

“The fundamental point about radical uncertainty is that if we don’t know what the future will hold, we don’t know, and there is no point in pretending otherwise.”[3]

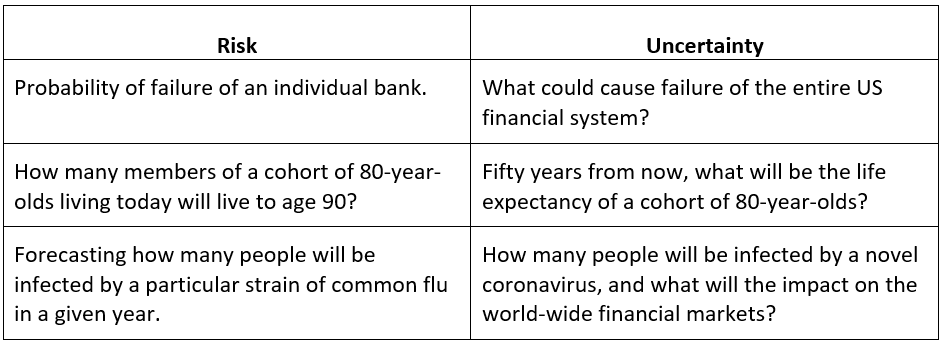

To understand radical uncertainty, it is important to understand the difference between risk and uncertainty. Risk concerns events, such as your house catching fire, where it is possible to define precisely the nature of the future event and to assign a probability based on past experience. Uncertainty concerns events that we cannot define or even imagine and to which probabilities cannot be assigned because we have no experience to guide us.

Here are some examples to illustrate the difference between risk and uncertainty:

The examples in the Risk column are all things we have seen before. We have a variety of tools allowing us to predict probabilities and we have some understanding of how those events will play out. But, for the events in the Uncertainty column, there is no scientific basis upon which to calculate probabilities. We simply do not know.

What mistake are we likely to make if we are unprepared for the unexpected? The mistake we are likely to make is a serious one – succumbing to our fears and abandoning an asset allocation that we know we must maintain to meet our long-term investment objectives. The decision to abandon our long-term strategy is likely to be taken with the worst possible timing, resulting in permanent impairment of our investment capital. Charles Ellis had a lot to say about this problem in his seminal book, “Winning The Loser’s Game:”

“For most investors, the hardest part is not figuring out the optimal investment policy; it is staying committed to sound investment policy through bull and bear markets and maintaining what Disraeli called “constancy to purpose.” Sustaining a long-term focus at market highs or market lows is notoriously difficult. At either kind of market extreme, emotions are strongest when current market action appears most demanding of change and the apparent “facts” seem most compelling.

“Holding onto a sound policy through thick and thin is both extraordinarily difficult and extraordinarily important work. This is why investors can benefit from developing and sticking with sound investment policies and practices. The cost of infidelity to your own commitments can be very high.”[4]

In the face of radical uncertainty, what does “smart” behavior look like? Smart investment behavior requires that we prepare for the unexpected by adopting coping strategies to guide our response to radical uncertainty. Coping is a completely rational response to uncertainty. Coping strategies consist of three elements:

- a categorization of problems into those that are amenable to optimizing behavior and those that are not;

- a set of rules of thumb, or heuristics, to cope with problems that represent radical uncertainty; and

- a narrative that integrates the most important pieces of information that we are able to understand and that allows us to make a quick decision. The narrative must be believable.

Let’s illustrate the development of a coping strategy for the COVID-19 situation. What should an individual private investor do in response to the COVID-19 situation to protect family wealth?

First, does the COVID-19 situation fall within the scope of problems that can be addressed by attempting to optimize a solution? Clearly not. The impact of COVID-19 on the wealth of any particular family cannot be addressed with any of the available portfolio optimization tools. At the onset of the pandemic there was considerable uncertainty about the scope and severity of its impact and expert opinions varied widely. In fact, even after many months of experience with COVID-19, expert opinions continued to vary widely. Who would have predicted the US stock market would have performed as well as it has?

Second, what heuristic (a fancy word for a rule of thumb) can be applied to aid in portfolio decision-making? For the COVID-19 situation and similar situations, a heuristic which is often useful is to adopt the advice of Charles Ellis by: (1) carefully working out an investment policy that is well-suited to your commitments and your tolerance for short-term volatility, and (2) stick with your policy through thick and thin. Keep in mind that a decision to deviate from a carefully conceived long-term strategy means that you are taking a temporary position that is inconsistent with your long term objectives. That is a serious decision that is more likely than not to result in permanent impairment of your capital. It is often better to position your capital so that you can ride out the storm.

Third, analyze the available data to develop a narrative in which you believe. At Ballentine Partners, the narrative we adopted was that even if the impact was severe, the world was not going to end. We believed the U.S. and other nations would throw considerable resources at the problem to find a cure or a vaccine, or both. We believed the impact would be relatively short – perhaps two or three years. We also believed the major economies of the world would respond with loose monetary policies to mitigate the economic damage caused by shutting down major segments of their economies to slow the spread of the virus. Our investment team subjected that narrative to weekly review and testing as the situation unfolded. Based on that narrative, we decided to urge our clients to stick with their long-term strategic asset allocations. So far, our coping strategy seems to be sound.

- Paul Lambert, manager of England’s Aston Villa soccer club, press conference, 2013.

- Ed Smith, an English author, journalist and former professional cricketer, explaining that luck plays a big part in sports and one’s personal life.

- King, Mervyn The End of Alchemy, W.W. Norton & Company, 2016.

- Ellis, Charles, Winning the Loser’s Game, McGraw-Hill, 2017.

To learn more about Roy C. Ballentine, ChFC, CFP®, click here.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.