Since their introduction in 1974 under the Employee Retirement Income Security Act of 1974, Individual Retirement Accounts (IRAs) have been widely used by investors as a tax-efficient way to prepare for retirement. Savers take a deduction on contributions during working years, investments grow tax-deferred, then income tax is assessed as the funds are distributed in retirement. Historically, if any assets remained in the IRA at the account owner’s death, the account could be left to a designated beneficiary who had the ability to “stretch” the distributions over their own life expectancy.

However, this all changed in 2020 with the implementation of the Setting Every Community Up for Retirement Enhancement (SECURE) Act. This Act severely limited the ability to utilize “stretch” IRAs, instead subjecting most non-spouse beneficiaries to a 10-year withdrawal period (spousal beneficiaries are not subject to these same restrictions). For affluent investors, this changes the calculus on the value of leaving IRA accounts to the next generation. In fact, I would urge that most wealthy families – especially those that are philanthropically inclined – consider leaving their IRA assets to charity, bypassing their children altogether.

Before any potential inheritors get upset, let me walk through the math behind this estate planning technique.

*Please keep in mind this advice applies to Traditional IRA accounts, which are subject to income tax upon distribution. For Roth IRAs, I would generally advise keeping those in the family as long as possible to continue their tax-free growth. *

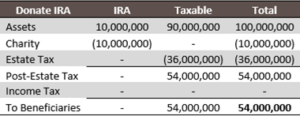

For simplicity, let’s say after many years of good planning, an investor has utilized their lifetime exemption and has $100 million remaining in their taxable estate, of which $10 million is held in an IRA and $90 million in a taxable investment account. We will assume both the investor and their beneficiary children live in a state without income or estate tax, such as Nevada or Florida. The investor’s estate will be subject to a federal estate tax of 40%. In addition, we will assume the children are also high-income individuals and subject to the highest marginal federal income tax rate of 37%.

As illustrated in the table above, all estate tax must be paid from the taxable assets. Estate tax cannot be paid from the IRA assets that contribute to the value of the taxable estate and the resulting tax. Additionally, the beneficiaries are responsible for paying income taxes on all distributions made from the IRA. After withdrawing assets from the IRA as required over a 10-year period, the beneficiaries will have received a total value from the estate of $56,300,000. How would that differ if the entire IRA was left to charity?

After getting a deduction against the estate tax for the charitable contribution of the $10 million IRA, the estate tax due is calculated on only the remaining $90M and the total value received by the beneficiaries is $54,000,000. By comparing these examples, we can see that in the first scenario (where the IRA was inherited by the children), they would have only benefitted from the IRA at a rate of 23 cents per dollar.

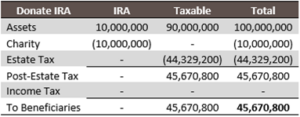

In these examples I made the generous assumption that neither the parent, nor the beneficiaries, lived in a state with income or estate tax. Let’s use this same example, except the family lives in my dear home state: The Commonwealth of Massachusetts. As a result, the parent’s estate will have a total combined effective estate tax rate of approximately 49.3% (vs. 40% previously). In addition, the children are subject to a marginal income tax rate of 46.0% (vs. 37% previously), thanks to the new “Millionaire’s tax” in Massachusetts.

As a result of these changes, you can see that the beneficiaries would only receive an extra $440,000 as the result of inheriting a $10 million IRA … just over four cents per dollar! If the IRA was instead left to charity, the children would have foregone just $440,000 AND the parents’ favorite charities would have benefited from a full $10 million of donations. Now that’s what I call leverage. For affluent families, there is no time like the present to reevaluate how retirement assets can satisfy charitable objectives.

Learn more about David J. Ferraro, Jr., CFP® here.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

This article from Ballentine Partners is intended for educational purposes only. Nothing herein should be construed as investment advice or a solicitation to invest in any security. Ballentine Partners is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. A copy of Ballentine Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.ballentinepartners.com.