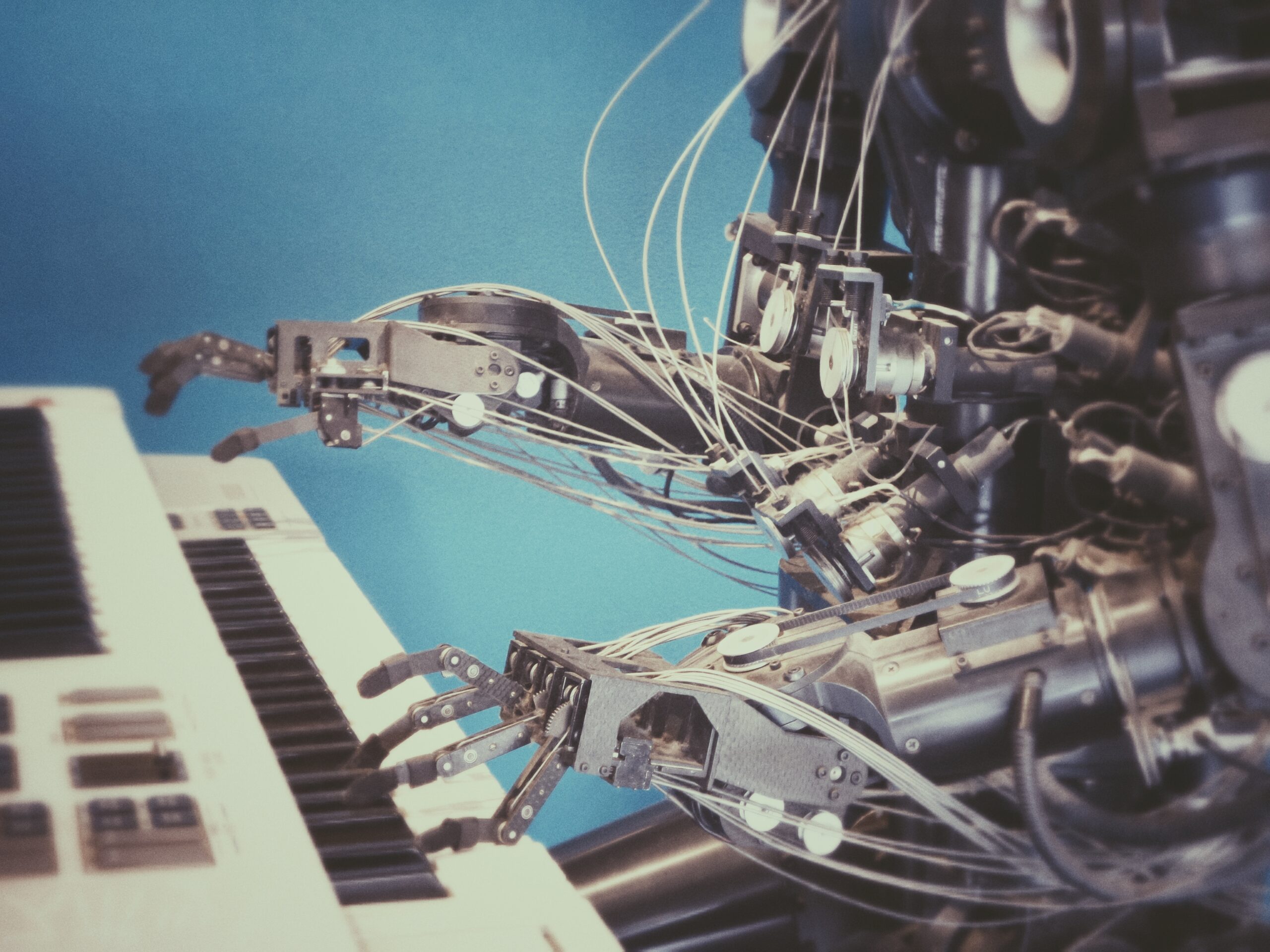

Without our really noticing it, artificial intelligence (AI) is creeping ever more closely into our daily lives. From the Amazon Echo to self-driving vehicles to currencies that you can’t touch, AI is gradually transforming developed societies in ways we have yet to fully grasp. As artificial intelligence gets more sophisticated and weaves further into the fabric of human existence, what are the implications for work and society as we know it? While the answers to these questions are beyond the scope of this article, our view is that a better understanding of the AI phenomenon is important to investors hoping to participate in an emerging trend that will shape the future for years to come.

Without our really noticing it, artificial intelligence (AI) is creeping ever more closely into our daily lives. From the Amazon Echo to self-driving vehicles to currencies that you can’t touch, AI is gradually transforming developed societies in ways we have yet to fully grasp. As artificial intelligence gets more sophisticated and weaves further into the fabric of human existence, what are the implications for work and society as we know it? While the answers to these questions are beyond the scope of this article, our view is that a better understanding of the AI phenomenon is important to investors hoping to participate in an emerging trend that will shape the future for years to come.

What Is AI?

In its most basic form, artificial intelligence (AI) is the simulation of human intelligence by machines. Unlike traditional software programs, AI systems can alter their behavior by discovering patterns and logic from experience, creating a kind of “self-learning”. At present, these systems are impacting nearly every industry from manufacturing to financial services, giving rise to new business models while making others obsolete. Although still in its infancy, AI is evolving rapidly, with significant implications for human interactions in the future.

AI is generally conceived of in three major steps, or Calibersi:

- Artificial Natural Intelligence (ANI) – also called weak AI, this is AI that can do one thing really real well, such as the computer that learned how to beat the world champion in chess by analyzing millions of prior games and strategies.

- Artificial General Intelligence (AGI) – also known as strong AI or human-level AI, this is a computer that is as smart as a human across a complete range of tasks; in other words, a machine that can perform any intellectual task that a human being can.

- Artificial Superintelligence (ASI) – the point at which a machine becomes smarter than the best human brains in every field, encompassing scientific creativity, general wisdom, and social skills. Some observers theorize that an ASI-powered machine could one day be a trillion times smarter than the human brain.

So where are we now? Somewhere in the late stage of Caliber 1 and beginning on Caliber 2. Scientists who worry about the evolution of AI are most concerned about Caliber 3, when the possibility of a Terminator-style machine can decide on the future of the human race. Something to ponder.

On a more mundane level, artificial intelligence is a buzzword in every corporate boardroom. According to JP Morganii, here are some of the activities that corporate managements are working on right now using ANI or AGI:

- Sales and customer engagement – recommendation systems, virtual assistants, chatbots, and AI-managed marketing platforms;

- Operational efficiencies – quality control, predictive maintenance, and improved legal/regulatory compliance;

- New insights and new business models – better data analysis allowing employees to spend less time in routines, more time engaging with and understanding customers at a higher level.

How Rapidly is AI Developing?

The notion of a computer that is thousands of times smarter than a human seems like a long way off, and it may well be. But it is important to acknowledge the rapid acceleration of technological advances as society has evolved. The famed futurist Ray Kurzweil calls this the Law of Accelerating Returns, and refers to the fact that advanced societies can progress at a much faster rate than earlier societies because they are more advanced. The availability of big data, cheap computing power, cloud storage, and advances in algorithms are combining to supercharge the growth in AI.

An easy way to visualize this acceleration is to think of the movie Back to the Future, which debuted in 1985. In the movie, Michael J. Fox traveled 30 years back in time to 1955 and was caught off-guard by the newness of TVs, the price of soda, and the lack of love for shrill electric guitar. It was, however, still a world that he could relate to. If that movie was made in 2015 and Fox traveled back in time to 1985, Marty McFly would be in a world that lacked personal computers, internet, or cell phones. It would be like being on another planet for him. The example is simple, but it illustrates the dramatic acceleration of innovation in just 60 years.

Kurzweil suggests that the progress of the entire 20th century would have been achieved in only 20 years at the rate of advancement in the year 2000—in other words, by 2000, the rate of progress was five times faster than the average rate of progress during the 20th century. He believes another 20th century’s worth of progress happened between 2000 and 2014 and that another 20th century’s worth of progress will happen by 2021, in only three years. A couple decades later, he believes a 20th century’s worth of progress will happen multiple times in the same year, and even later, in less than one month. All in all, because of the Law of Accelerating Returns, Kurzweil believes that the 21st century will achieve 1,000 times the progress of the 20th century.iii If Kurzweil is close to being right, one can see how the accelerating pace of innovation has the potential to change our lives in enormous ways.

The first level of AI, Artificial Natural Intelligence, is already well-entrenched in the daily lives among members of developed societies. A recent study revealed that 84% of Americans are currently using navigation apps, 72% are using video or music streaming services, and 20% are using smart home devices such as thermostats and lighting that are self-learning.iv All of these systems contain some element of Artificial Intelligence. The growth in AI has created enormous demand for people with the technical skills to contribute to AI development. The number of AI-related job postings in the US per million postings has nearly tripled since early 2015, along with a commensurate increase in compensation.v According to JP Morgan Research, AI-focused spending is expected to grow at a compound annual rate of 48% between 2017 and 2021, more than twice the rate of other high-growth technology sub-sectors such as big data and cloud storagevi.

Some Applications for Artificial Superintelligence (ASI)

As the human brain evolves over millennia while computers gain knowledge at an accelerating rate, it is only a matter of time before computers begin to outsmart humans. Kurzweil refers to this crossover point as the Singularity. Although there are many futurists who warn of a dark dystopian future, the Singularity and the evolution to Artificial Superintelligence is just as likely to create a wealth of positive benefits to society. Here is just a small sampling:

- Brain Computer Interface (BCI) involves the implantation of a small computer in our brains. Very basic versions of it are being used today to help paralyzed individuals move prosthetic limbs and help deaf people hear. More advanced versions may allow humans to think of a question and have the internet-enabled computer respond by transmitting the response directly to the user’s brain. Humans may be able to communicate simply by transmitting thoughts to one another.vii

- As knowledge is gathered from human experience and communication technology improves, the internet will become the repository for all of human knowledge and available to everyone on demand. Think of the progress that could be achieved in medical science if a robot could diagnose a problem with all the available knowledge amassed in human history.

- Perhaps more imminent is the evolution of autonomous vehicles. As the technology improves, the need for huge swaths of land dedicated to parking lots will diminish, the number of auto accidents and casualties will be nearly eliminated, and cars will be much more efficiently utilized. The impact on the environment, human health, insurance companies, and auto repair shops, among other industries, is incalculable.

Investing in the AI Wave

By now if you are convinced that AI is a trend that is still early in its evolution and you are contemplating the many changes to human interaction that AI has the potential to meaningfully change, you are probably wondering how to invest in it. Because the technology is so young, there are very few “pure play” public companies that are focused exclusively on AI. Most of the research is being conducted in small private companies, university environments, or as part of much larger companies with multiple lines of business. We see three primary ways to participate in the growth of AI:

- Mutual Funds or Exchange Traded Funds (ETFs) Focusing on AI Research and Development

- Private Investments in Individual AI-Focused Companies or Venture Capital Funds

- Public Companies with Large AI Research Efforts

Mutual funds and ETFs – There are a number of commingled vehicles that are focused on the AI space. Despite their forward sounding symbols (e.g. BOTZ, ROBO, and ARKQ), these vehicles generally own large multinational companies with a significant interest in AI. Generally, these ETFs are fairly small, have short performance histories, and carry relatively high fees. An analysis conducted by Ballentine found none that had beaten the Nasdaq 100 Technology Index (QQQ) over a long time period.

There are a number of technology-focused mutual funds, but we found none that had a specific focus on AI.

Private Investments – Perhaps the best way to participate in the AI revolution is to invest in early-stage companies with a great idea and a fabulous engineering staff. Depending on your level of knowledge, that can be done through a direct private investment in an individual company, or through a venture capital fund. Most people choose the latter route, since a VC fund comes with automatic diversification and the guidance of experts who understand the technology. But venture capital is highly speculative: even the great venture capitalists have many strikeouts along with the occasional big winner.

Public Companies with Large AI Research Efforts – For those investors looking for a more conservative way to participate in AI, the best choice would seem to be to construct a concentrated portfolio of securities that will either: 1) benefit directly through the adoption of AI technologies that they are creating and selling to other companies or consumers; or 2) benefit indirectly by adopting technologies that will improve their capabilities but are produced by another firm. In the former category, JP Morgan cites Amazon, Microsoft, Google, Alibaba, Baidu, IBM, and Oracle, among others. In the latter, companies engaged in the banking, securities, manufacturing, insurance, wholesale trade and transportation industries are among those that will likely be most dramatically altered by the growth in AI.

Summing Up

This paper was intended to provide an introduction to Artificial Intelligence, its potential evolution, some of its potential future mind-bending possibilities, and suggested ways to participate in its growth as interested investors. The topic is far too large, and its impact too significant, to address in a single report. Perhaps the most important takeaway is that AI’s impact across all industries could be so profound as to be a benefit to all those who can catch the wave.

i Urban, Tim: The AI Revolution: The Road to Superintelligence, Wait But Why, 2015.

ii An Investor’s Guide to Artificial Intelligence, JP Morgan Global Equity Research, November, 2017.

iii Kurzweil, Ray, The Singularity Is Near.

iv Northeastern University/Gallup Survey of 3,297 adults in the U.S., conducted Sept.-Oct. 2017.

v Wall Street Journal, Indeed Hiring Lab, McKinsey & Co.

vi An Investor’s Guide to Artificial Intelligence, JP Morgan Global Equity Research, November, 2017.

vii Yardeni, Ed: Alter Ego, Morning Briefing, May 10, 2018.

Learn more about Bruce D. Simon.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited.

The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available.

Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering.

The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.