*Spoiler Alert: I’ll be discussing the climactic ending of Succession. If you are still working your way through the series, I would suggest saving this article for later. If you’ve not yet watched the show, be forewarned that you’ll hear some of the most colorful and creative expletives in television history. *

Now that my Sundays at 9pm are free once again, I can’t help but reflect on HBO’s latest award-dominating series, Succession. For the uninitiated, the show revolves around Brian Cox’s character, Logan Roy, the founder of media empire Waystar Royco (a character not-so-loosely based on Rupert Murdoch). In life, and in death, Logan was a complex individual. A dissertation could be written about topics ranging from Roy family dynamics to negotiation tactics displayed throughout the series. However, I’m going to focus on a narrower topic not deeply covered on the show: Logan Roy’s estate settlement.

Over each of the show’s 4 seasons, Logan enticed three of his ill-equipped children into vying for the position of his successor. In the end, Kendall takes the lead, only to be usurped by brother-in-law, Tom Wambsgans, as Waystar Royco is sold to Nordic tech company GoJo. As Kendall meanders through Battery Park defeated, the sad reality is he probably never had a chance. Though the most difficult outcome for Kendall to accept, this was almost certainly the best financial outcome possible. Not because of the eldest boy’s lack of capability, or many indiscretions, but because there is a tremendously large estate tax bill that needs to be paid.

The tax bill

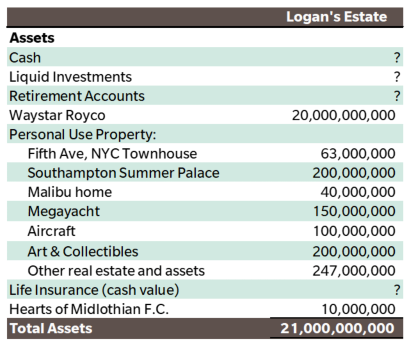

Logan’s stake in Waystar Royco was estimated by internet sleuths to be around $20 billion. Add to this a portfolio of impressive real estate, a mega yacht, aircraft, works of art and collectibles of an additional $1 billion, and you have a taxable estate of at least $21 billion. Using a mix of internet sleuthing and personal estimates, I put together a rudimentary balance sheet below. In the real world, it would likely be vastly more complex than what is displayed.

We can safely assume that Logan was a proactive planner and had already fully utilized his $12,920,000 lifetime exemption in prior wealth transfers to his children. With New York as his domicile, Logan’s estate would be subject to an effective estate tax rate of 49.6%, bringing the total tax bill just north of $10.4 billion (fun fact: this would need to be paid in 105 separate checks, as the IRS does not accept checks over $100 million). While we are unaware of Logan’s liquidity profile, he would have needed over $20 billion of liquid assets or life insurance proceeds inside his estate to satisfy the tax liability on $21 billion of illiquid assets (for a total estate of $41b). It is almost inconceivable that there would be enough cash available to pay the tax authorities without liquidating a significant portion of the company. What’s more is the estate tax bill is due just nine months following the date of death. This is a tight turnaround to scramble together an eleven-figure sum, particularly with the complexity of selling restricted shares of a closely held public company.

What could be done?

Though magnified for the Roys, the challenge of adequate estate liquidity is a familiar one among business-owning families. One tool the IRS permits is a Section 6166 election. Internal Revenue Code §6166 allows for the estate to defer payment of the federal estate tax for 4 years and pay in installments for an additional 10 years. To qualify for this election, the following requirements must be met:

- The decedent was a U.S. citizen or resident at the time of death.

- The closely held business was an active trade or business.

- The value of an interest in a closely held business exceeds 35 percent of the decedent’s adjusted gross estate.

- Notice of election is made on a timely-filed estate tax return.

So far, his estate seems to have passed the 4-part test, though you may be asking yourself, “what constitutes a closely held business?” For a C-corporation like Waystar, an interest in a closely held business is defined as:

Stock in a corporation with either 45 or fewer shareholders, or 20 percent or more of the voting stock is included in determining the decedent’s gross estate.

We don’t know exactly how much of Waystar Royco’s voting shares Logan owned. Season 2, episode 7 revealed that the Roy family controlled a combined 36 percent of the voting shares. Again, I will assume that Logan would not have ceded significant control of the enterprise to his children, thus retaining at least 20 percent of the voting shares. Having passed each of these tests, the estate gets the luxury of time to source the needed liquidity. This does, however, come at a cost. The IRS assesses a statutory interest rate on the deferred taxes which is likely preferable to selling the assets at unattractive values or abruptly relinquishing control.

Getting liquidity

How could the heirs use an illiquid estate to get their hands on desperately needed cash? Unfortunately for the Roys, unless the estate can find a generous lender, there is likely no getting around selling a significant portion of the estate’s Waystar position. Naturally, selling over $10 billion of a single stock position would likely take several years to accomplish. Firstly, it can take several months to go through the legal process of preparing the shares for sale in the public market. Further, it is advisable (and many brokers require) that no more than 10 percent of the stock’s daily volume of shares be sold on any given trading day to avoid influencing the market price.

This could be further complicated based on who is serving as trustee/manager of the entity that owns the shares. If Logan’s long-time confidant and Waystar Vice-Chairman, Frank Vernon (or any other company insider), is serving in this role, sales can only take place during open-window periods when he is not in possession of material non-public information. Frank could implement a Rule 10b5-1 Plan during an open window to make sales on a periodic basis, but those sales cannot begin for at least 90 days after execution of the plan, following the amendments adopted by the Securities and Exchange Commission this past December. Good thing we made that 6166 election!

Stay tuned …

Were Logan Roy a client of Ballentine Partners during his lifetime, we would have spent years devising and executing on strategies to reduce the tax burden upon his death, maximize liquidity & optionality, and reduce friction for the family. More to come in our next episode.

Learn more about David J. Ferraro, Jr., CFP® here.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

This article from Ballentine Partners is intended for educational purposes only. Nothing herein should be construed as investment advice or a solicitation to invest in any security. Ballentine Partners is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. A copy of Ballentine Partners’ current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.ballentinepartners.com.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.