Once used to describe a mythical creature, the term “unicorn” has been used recently to describe startups that have achieved a valuation greater than $1BN. With speculation of tax increases dominating recent headlines, there remain some equally rare provisions in the tax code that greatly benefit the founders, executives, and investors of these enterprises. Section 1202 of the Internal Revenue Code provides the opportunity for taxpayers to exclude up to the full capital gain realized from the sale of Qualified Small Business Stock (QSBS). Here, we will walk through what QSBS is and how investors can best maximize the benefits of this tax provision.

What is QSBS?

QSBS is a preferred tax treatment applied to investments that satisfy five general requirements:

- The shares must be issued by a C corporation.

- The shares must have been held for at least five years.

- The tax basis of the corporation’s gross assets must be less than $50M at the time of issuance. In addition, at least 80% of the value of the corporation’s assets must be used in the conduct of an active business.

- The shares must have been acquired at original issue (this can include founder’s shares, exercised options, or direct investment).

- The stock must be issued after August 10, 1993.

It is important to note that not all businesses are eligible for QSBS treatment, as the corporation must be a “qualified trade or business.” Per IRC §1202(e)(3), this excludes:

- Service businesses in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees

- Banking, insurance, financing, leasing, investing, or similar business

- Any farming business (including the business of raising or harvesting trees)

- Natural resource extraction (mining, oil, gas)

- Hotels, motels, restaurants, or similar businesses

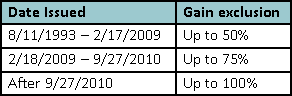

When all the above requirements have been met, the tax savings are significant. Investors selling their position can exclude up to 100% of the gain, depending on when the shares were issued.

This gain exclusion is limited to the greater of $10M, or 10 times the stock’s cost basis. As an example, let’s say a startup founder holds QSBS valued at $200M, with a cost basis of $500K. In this instance, they would receive the benefit of the $10M exemption, providing $2.38M in capital gains tax savings ($10M exemption * 23.8% capital gains tax rate). Conversely, if their cost basis were over $20M, the entire capital gain would be exempt from tax.

While President Biden’s current tax plan proposes no changes to the tax benefits of QSBS, there is a proposal by the House Ways and Means Committee which would eliminate the 75% and 100% exclusions for taxpayers earning over $400,000. These taxpayers would still benefit from a 50% exclusion. There is no proposal to change the $10M or 10x cost basis limitation. As a result, holders of highly concentrated positions of very low-basis shares would be relatively unaffected by this change. However, if our startup founder paid $20M for their $200M position, half of their gain ($90M) could be exposed to capital gains tax instead of being fully exempt, as is the case under current law.

Maximizing the Exemption

While the QSBS gain exemption offers generous savings, for investors holding highly appreciated stock, there can still be a substantial capital gains tax to pay. Multiple strategies can be employed which stand to significantly increase the after-tax outcome from a liquidity event.

Under the requirement that the corporation must have gross assets less than $50M at the time of issuance, it is important to recognize that this rule relates simply to assets on the balance sheet, not the company’s valuation. If a venture-backed company has a $1BN valuation based on the latest funding round but $40M of gross assets, the newly issued shares are still eligible for QSBS treatment. Further, if an executive of the company holds significant stock options, strategic timing of exercise can yield tremendous benefits. So long as options are exercised while the company has less than $50M of assets, those shares can also qualify as QSBS.

Additionally, QSBS treatment is applied per taxpayer. Investors can effectively multiply the gain exclusion by gifting stock to non-grantor trusts prior to sale. Each non-grantor trust that receives a gift of these shares will benefit from its own QSBS exemption. When consistent with wealth transfer goals, gifting QSBS to an irrevocable trust is a highly effective strategy. Typically, when highly appreciated assets are transferred to a non-grantor trust, the original cost basis carries with it. In the case of QSBS, the capital gains taxes are dramatically reduced or eliminated, leaving more assets to remain invested for long-term growth. Additionally, in some states, shares can be transferred to self-settled trusts for the benefit of the investor and their spouse, which is typically done for the primary purpose of asset protection.

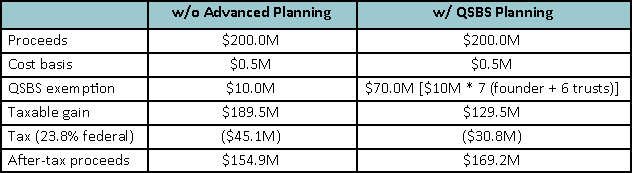

To illustrate the impact of this planning, let’s revisit our startup founder with $200M of QSBS. Through successful use of grantor retained annuity trusts (GRATs), the founder transferred $10M of the shares to non-grantor trusts for each of their three children. In addition, the founder and their spouse gifted $20M of company stock to a generation-skipping non-grantor trust for their descendants. Lastly, the founder and their spouse established self-settled asset protection trusts for their own benefit, which were funded with $10M each. As the following table shows, through careful planning, the founder and their family were able to retain an additional $14.3M of wealth! Should capital gains tax rates increase, as the Biden administration proposes, the savings will be all the greater.

Conclusion

Maximizing the benefit of this exemption requires coordination among skilled advisors well-versed in the intricacies of QSBS. This piece is not intended to be all-encompassing but rather a demonstration of the critical importance of careful planning and high-quality advice. Before any action is taken, it is vital to clearly define family goals and values. Reducing taxes is not an end but a means to align wealth with the future we desire for ourselves and the world around us.

Learn more about David J. Ferraro, Jr., CFP® here.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.