Market Recap

There are always odd times in investing when what’s happening in the economy is completely disconnected from what’s happening in the capital markets. This was not one of those times! For the first quarter of this year, good news in the economy actually translated to good news in the risk markets.

The U.S. economy is proving to be quite resilient. While that was a surprise to many professional economists throughout most of 2023, it is no longer. “Soft landing” – a laughable concept a year ago – became the consensus view. Consumer spending is healthy. Their mood is quantifiably on the rise. The Atlanta Fed GDP Nowcast, which gained credibility all throughout last year as it was one of the few models that signaled “all is well”, just posted a solid 2.8% call for the first quarter of 2024. Not only is the U.S. economy in solid shape in its own right, it remains the envy of the world.

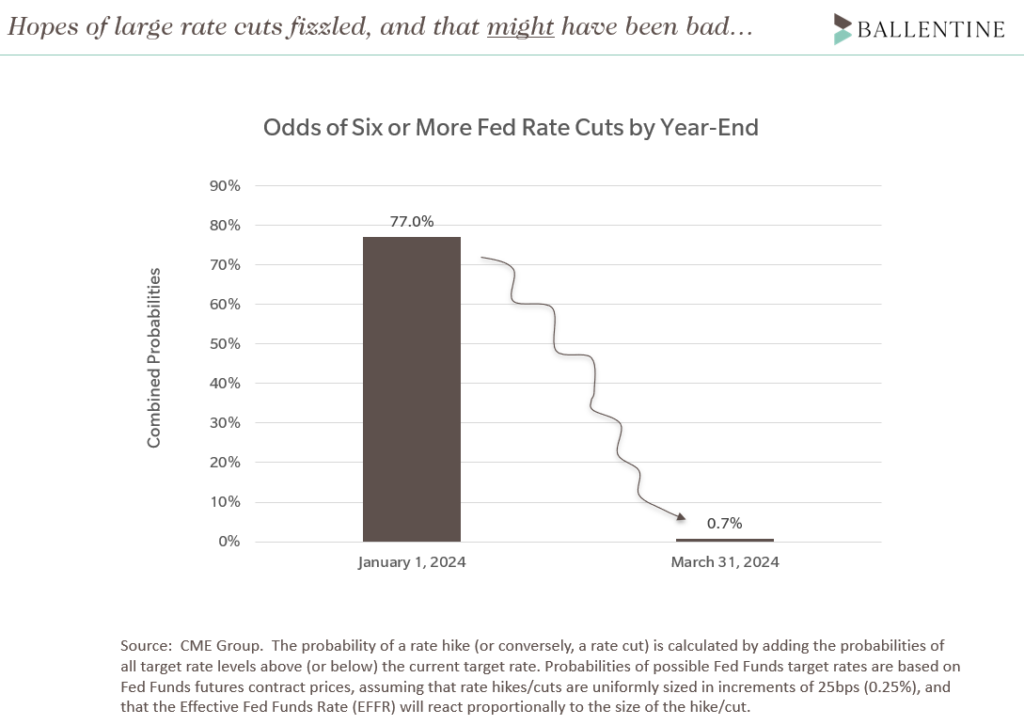

Now, all this good economic news could have been bad news for stocks. A strong economy meant that the much-anticipated Fed rate cuts might not occur at the pace expected by the markets. Much of the 2023 runup was predicated upon the Fed aggressively cutting rates in 2024. See chart below. On January 1, markets were pricing in six or more rate cuts for 2024; by quarter’s end, those hopes had been dashed. This could have been bad news for equity markets.

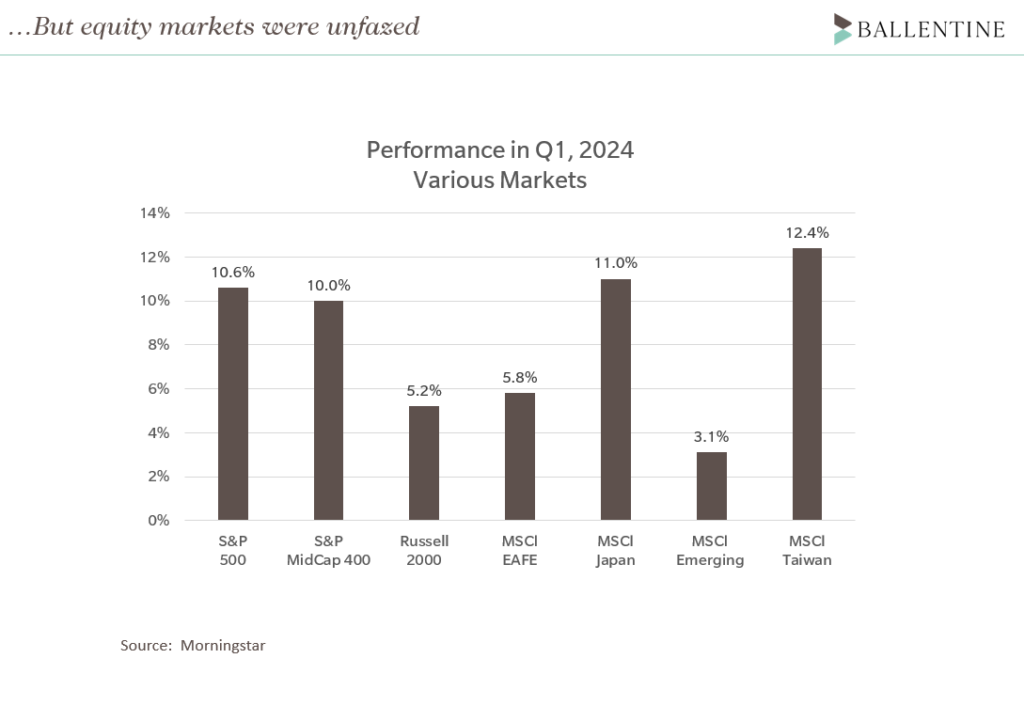

Instead, economic good news meant…well…stock market good news.

Markets rallied strongly in the first quarter. The S&P 500 ended March 31 up 10.6%. The Artificial Intelligence (AI) revolution sparked rally after rally (Nvidia posted stellar results and its stock was up 86% on the quarter). While there has been handwringing about the narrowness of markets, the first quarter offered some encouraging signs of broadening, as the S&P Mid Cap 400 index also rallied, up 10%. The MSCI EAFE index was up an encouraging 5.8% (excluding the effects of the strong dollar, EAFE was up over 10%). Japan, in particular, had a strong quarter. We wrote about an interesting development in Japanese equity markets breaking out of their multi-decade doldrums and we remain encouraged. See research piece here. MSCI Emerging Markets was up 3.1% (yet again, in local terms it was up over 5.4%). Taiwan, in particular, rallied strongly.

Ten-year Treasury bond yields rose from 3.88% on January 1 to end the quarter at 4.26%, resulting in paper losses for most bond portfolios. But it was a mixed bag. The Barclays Aggregate bond index lost 1.2% on the quarter while municipal bond losses were more modest, around -0.2%. And the high-yield muni index was actually positive on the quarter as credit spreads tightened due to rosier economic expectations.

Outlook and Strategy

We remain confident in the U.S. economy, given our repeated thesis: the U.S. consumer, despite headlines to the contrary, is in good shape. For a few reasons: first, unemployment remains low. Jobs are aplenty, despite media rumblings about layoffs in technology and finance. Second, real wages are rising. Yes, rising prices for groceries and rents put everybody in a bad mood, but the reality is that for the vast majority of American households, their take-home wages are not only keeping up with inflation but exceeding it. Third, despite concerns about rising mortgage interest rates, the vast majority of American households locked in low mortgage rates within the past ten years; they remain largely shielded from today’s higher mortgage rates. In addition, 40% of U.S. households have paid off their mortgage, so rising rates are essentially irrelevant as long as they don’t plan to move. In summary, jobs are secure, wages are rising above inflation, and the biggest interest expense in most U.S. households remains fixed and low.

We do, however, have to balance this enthusiasm with some uncomfortable realities. If interest rates remain higher for too long, it could eventually dampen spending at the margin, especially for lower-income households. While jobs remain plentiful, the “quit rate” – a measure of employee confidence – has been falling. Gasoline prices, which briefly dipped below $3 per gallon last year, are now trending upwards, further pinching household budgets.

From a valuation perspective, some caution is warranted. U.S. large-cap stocks are on the very upper end of reasonable ranges. We take some comfort that a large chunk of the US market — the Magnificent 7 – are healthy companies delivering real earnings and sustained growth. Still, we like the modest small and mid-cap tilt in our portfolios, given that these areas are trading at significant discounts to their larger counterparts and their own history. We are in the midst of a research project exploring whether and when to allocate even more to this “cheap” asset class; by many metrics, small and mid-cap stocks are the cheapest they’ve been in over 20 years.

Another worry for us remains the state of commercial real estate (which includes office buildings, multi-family housing, and retail) and the overhang it poses for regional banks. We will continue to monitor this closely.

Finally, geopolitical clouds have darkened measurably. Hot wars in Ukraine and Gaza, along with seemingly ever-present tension between the U.S. and China, are a sobering backdrop to otherwise good economic news.

From a positioning standpoint, we maintain a notable overweight to US stocks, a large underweight to developed international equities, and a neutral allocation to emerging markets. As noted above, our U.S. equity allocation also reflects a tilt toward small-cap stocks, which lagged in this quarter’s rally but appear quite inexpensive in relative terms. In real assets, we have a bias toward infrastructure stocks and an underweight in real estate. We trimmed our High Yield overweight in late 2023, mostly as a defensive move in the event our base case proved wrong. We maintain this position; credit spreads are paying investors a premium and the economy seems sound, but spreads are by no means robust at these levels.

About Pete Chiappinelli, CFA, CAIA, Chief Investment Officer

Pete is a Partner and Chief Investment Officer at the firm. He is focused primarily on Asset Allocation in setting strategic direction for client portfolios.

This report is the confidential work product of Ballentine Partners. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.

Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.